|

|

|

|

|||||

|

|

Synchrony Financial SYF recently extended its longstanding ties with North America’s largest furniture store brand, Ashley. The companies joined forces in 2010, and since then, Synchrony has played a pivotal role in helping millions of Ashley customers finance their purchases through SYF’s Ashley Advantage Credit Card for nearly 15 years.

Under the extended agreement, Synchrony will maintain its role as the exclusive financing provider, offering a wide variety of promotional terms to Ashley customers. These include deferred interest plans, equal payment options with no interest, reduced interest offers and fixed monthly payment solutions with repayment periods ranging from six to 72 months. The renewed deal extends to more than 750 independent Ashley licensee locations that participate in Synchrony’s financing program.

Synchrony’s extended partnership with Ashley brings several compelling advantages that are poised to fuel continued growth and enhance the customer experience. Through the use of advanced data and analytics of SYF, Ashley’s corporate and licensee operations will gain deeper insights into consumer behavior, promotional effectiveness and the overall program performance.

Additionally, Synchrony will continue investing in technology to deliver a frictionless and convenient credit application experience, whether shopping at Ashley stores or digital platforms. Furthermore, the partnership ensures continued access to flexible credit solutions tailored to meet evolving consumer needs. Leveraging Synchrony’s sophisticated credit decisioning systems, risk management tools and a diverse suite of financing options, Ashley will empower customers with the financial flexibility to make meaningful home purchases more attainable. Also, the availability of flexible financing solutions infuses greater peace of mind as it alleviates the strain on the finances of a consumer.

This partnership renewal reinforces both companies’ shared commitment to foster continued innovation in the home furnishings space. For Synchrony, such partnership renewals are likely to cement solid customer relationships, which in turn, may lead to bolstered credit lines, higher repeat sales and a greater customer lifetime value. Attractive benefits linked with Synchrony’s Ashley Advantage Credit Card are expected to attract newer customers as well as retain existing ones.

Increased utilization of the credit card may bring growth in interest and fees on loans from SYF’s Home & Auto sales platform. Interest and fees on loans remain the most significant contributor to Synchrony’s top line. Apart from Ashley, other partners forming part of the abovementioned platform are Floor & Decor, Lowe's and Mattress Firm. Home & Auto made up 27% of SYF’s total interest and fees on loans for 2024.

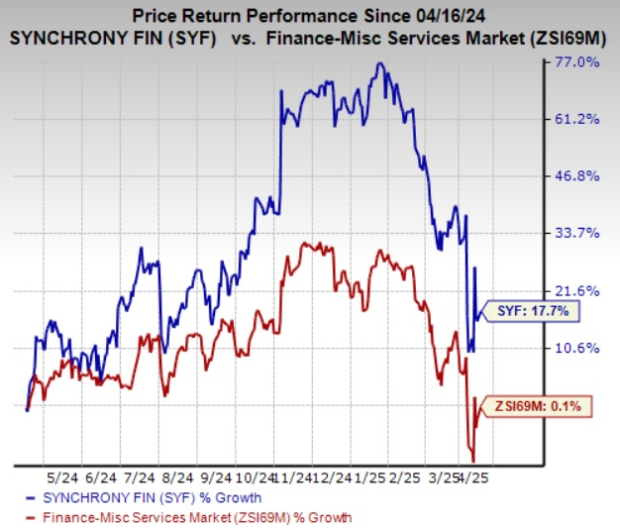

Shares of Synchrony Financial have gained 17.7% in the past year compared with the industry’s 0.1% growth. SYF currently carries a Zacks Rank #3 (Hold).

Somebetter-ranked stocks in the Finance space are FB Financial Corporation FBK, Business First Bancshares, Inc. BFST and InvenTrust Properties Corp. IVT. While FB Financial currently sports a Zacks Rank #1 (Strong Buy), Business First Bancshares and InvenTrust Properties carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of FB Financial outpaced estimates in three of the last four quarters and matched the mark once, the average surprise being 4.15%. The Zacks Consensus Estimate for FBK’s 2025 earnings indicates an improvement of 13.8%, while the consensus mark for revenues implies growth of 31.2% from the respective year-ago reported figures. The consensus mark for FBK’s 2025 earnings has moved 3.8% north in the past 30 days.

Business First Bancshares’ earnings outpaced estimates in three of the trailing four quarters and missed the mark once, the average surprise being 19.00%. The Zacks Consensus Estimate for BFST’s 2025 earnings indicates an improvement of 11.7%, while the consensus mark for revenues implies growth of 17.1% from the respective year-ago reported figures. The consensus mark for BFST’s 2025 earnings has moved 2.2% north in the past 30 days.

The bottom line of InvenTrust Properties outpaced estimates in two of the last four quarters and matched the mark twice, the average surprise being 1.80%. The Zacks Consensus Estimate for IVT’s 2025 earnings indicates an improvement of 6.4% while the consensus mark for revenues implies growth of 10.8% from the respective year-ago reported figures. The consensus mark for IVT’s 2025 earnings has moved 1.1% north in the past 60 days.

Shares of FB Financial, Business First Bancshares and InvenTrust Properties have gained 12.6%, 11.3% and 12.1%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-07 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite