|

|

|

|

|||||

|

|

Vertiv Holdings, a Zacks Rank #1 (Strong Buy), has seen its shares surge this year as the company benefits from an accelerating transformation driven by AI and data center demand. Vertiv is a global designer and manufacturer of critical digital infrastructure technologies for communication networks and data centers in both commercial and industrial environments.

The stock broke out to an all-time high in 2025 on increasing volume. Shares continue to display relative strength as buying pressure accumulates in this market leader.

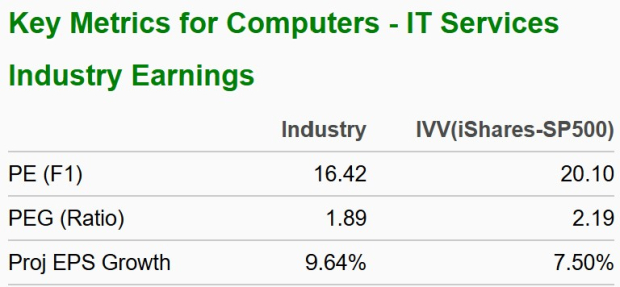

The company is part of the Zacks Computers – IT Services industry group, which currently ranks in the top 35% out of approximately 250 Zacks Ranked Industries. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform over the next 3 to 6 months.

Take note of the favorable characteristics for this group below. Stocks in this industry are relatively undervalued based on traditional valuation metrics. They are also projected to experience above-average earnings growth, which signifies a powerful combination that should lead to higher prices in the future.

Historical research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1.

It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Vertiv boasts an extensive product portfolio spanning thermal systems, liquid cooling, switchgear, busbar, and modular solutions. These are power management solutions, and as hyperscalers and enterprises increasingly scale AI deployments to support high-performance data centers, Vertiv’s product portfolio is gaining traction.

The AI infrastructure provider partners with leading chipmaker Nvidia in a high-density reference design that handles extreme power and thermal requirements of Nvidia’s 72-GPU rack-scale systems through the use of liquid and air cooling. Apart from Nvidia, Vertiv boasts a rich partner base that includes the likes of Ballard Power Systems, Compass Datacenters, and Intel. The company is also powering the iGenius Colosseum sovereign AI factory, which is Europe’s first sovereign AI supercomputer.

But Vertiv’s services extend beyond just data centers. Its products and systems for monitoring and controlling digital infrastructure are integral to technologies used for various applications including e-commerce, online banking, file sharing, and online gaming. The company also provides lifecycle management services, predictive analytics, and maintenance services.

Vertiv VRT has established a healthy track record of beating earnings estimates. The company surpassed the EPS mark in each of the past four quarters. Vertiv most recently reported third-quarter earnings back in October of $1.24 per share, beating the Zacks Consensus Estimate of $1.00/share by 24%. The bottom line grew 63% versus the same period in the prior year.

One of the leading AI stocks since this bull market began, Vertiv delivered a trailing four-quarter average earnings surprise of 14.9%. Consistently beating earnings estimates is a recipe for success.

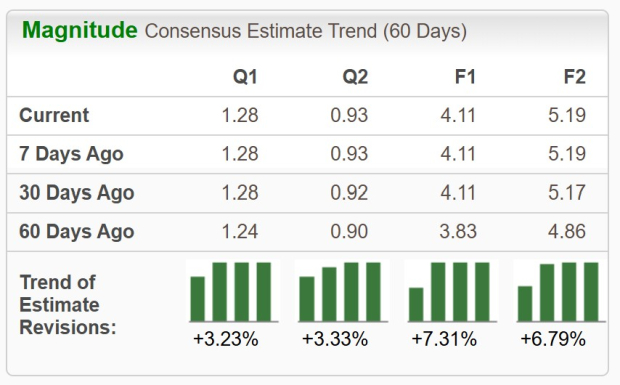

The Ohio-based company has witnessed improving earnings estimate revisions as of late. Looking into the current quarter, analysts have raised their Q4 EPS estimates by 3.23% in the past 60 days. The Zacks Consensus Estimate now stands at $1.28 per share, reflecting nearly 30% growth relative to the year-ago period. Revenues in the fourth quarter are projected to climb more than 22% to $2.86 billion.

VRT shares have advanced nearly 200% off the April bottom. Only stocks that are in extremely powerful uptrends are able to make this type of price move and widely outperform the market. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Notice how shares remain above upward-sloping 50-day (blue line) and 200-day (red line) moving averages. A recent pullback presents a unique buying opportunity. With both strong fundamentals and technicals, VRT is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, Vertiv has recently witnessed positive revisions. As long as this trend remains intact (and VRT continues to deliver earnings beats), the stock will likely continue its bullish run through the remainder of this year and beyond.

Solid institutional buying should continue to provide a tailwind for the stock price. Vertiv has vastly outperformed its tech peers, and increasing volume at recent breakout levels adds to the bullish sentiment.

Robust fundamentals combined with a strong technical trend certainly justify adding shares to the mix. Backed by a leading industry group and robust history of earnings beats, it’s not difficult to see why this company is a compelling investment.

Recent positive earnings estimate revisions should also serve to create a ‘floor’ in terms of any sudden or unexpected downside moves. If you haven’t already done so, be sure to put VRT on your watchlist.

Disclosure: Vertiv (VRT) is a current holding in the Zacks Headline Trader portfolio.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite