|

|

|

|

|||||

|

|

Credo Technology Group Holding Ltd.’s (CRDO) second-quarter fiscal 2026 results highlighted a strong acceleration, driven largely by the rapid expansion of its Active Electrical Cable (“AEC”) business and deepening traction across major hyperscale customers. CRDO’s efforts to diversify the customer base are expected to boost its revenue trajectory.

In the fiscal second quarter, Credo reported revenues of $268 million, up 20% sequentially and an impressive 272% rise year over year. The company’s AEC business remains its fastest-growing segment.

Four hyperscalers each contributed more than 10% of total revenues, reflecting strong adoption of Credo’s high-reliability AEC solutions. Management noted that the fourth hyperscaler is in full volume, but the more important development in the fiscal second quarter was the emergence of a fifth hyperscaler, which has begun contributing initial revenues. Management also highlighted that customer forecasts have strengthened across the board in recent months. This marks a major inflection point.

CRDO noted that AECs have become the “de facto” standard for inter-rack connectivity and these are now replacing optical rack-to-rack connections up to 7 meters. The explosive adoption of AECs is mainly as these cables offer up to 1,000 times more reliability with 50% lower power consumption than optical solutions, added CRDO.

Credo Technology Group Holding Ltd. price-consensus-eps-surprise-chart | Credo Technology Group Holding Ltd. Quote

As AI clusters scale into the hundreds of thousands of GPUs and push toward million-GPU configurations, reliability, signal integrity, latency, power efficiency and total cost of ownership have become “mission-critical”. Credo’s architecture (purpose-built SerDes technology, sound IC design and a system-level development approach) is tailored to meet these demands.

With fiscal third-quarter revenues expected to jump 27% sequentially (at the midpoint) and fiscal 2026 revenues projected to grow more than 170% year over year, the expanding hyperscaler base validates Credo’s position in the fast-growing AI connectivity solutions market. CRDO expects each of its top four customers to grow significantly year over year in the current fiscal year.

If the hyperscaler momentum continues at the current pace, then it is likely to serve as an important catalyst in sustaining Credo’s growth well into fiscal 2026 and 2027, and beyond. The growing hyperscaler base reduces the risks associated with customer concentration and enhances the stability of top-line growth.

Broadcom (AVGO) sees massive opportunities in the AI space as its three hyperscaler customers have started to develop their own XPUs. These hyperscalers are significantly ramping up investment in their next-generation frontier models, which do require high-performance accelerators and AI data centers with larger clusters. Management highlighted that the company has secured more than $10 billion of orders for AI racks based on its XPUs. As a result, it now expects AI semiconductor revenues to increase 66% year over year to $6.2 billion for the fourth quarter of fiscal 2025.

Broadcom is also well-placed to gain from the traction seen in Tomahawk 5 and 6 switches and Jericho 4 Ethernet fabric router, which are at the center of hyperscale AI cluster deployments.

Marvell Technology (MRVL) recently reported strong third-quarter fiscal 2026 results with revenues increasing 37% year over year to $2.075 billion, buoyed by a strong demand environment across the data center end market. MRVL announced the acquisition (expected to close in the first quarter of fiscal 2027) of Celestial AI, which specializes in the Photonic Fabric technology platform. This platform is purpose-built for scale-up optical interconnect.

Management highlighted that Celestial AI is “deeply engaged” with several hyperscalers and ecosystem partners. Celestial AI has already won a major contract with one of the biggest hyperscalers. This hyperscaler intends to use the photonic fabric chiplets in its next-generation scale-up architecture. Hyperscalers are also central to the company’s other product lines. Marvell is pushing boundaries with 400G per lane PAM technology, enabling 3.2T optical interconnects and future-proofing hyperscaler infrastructure.

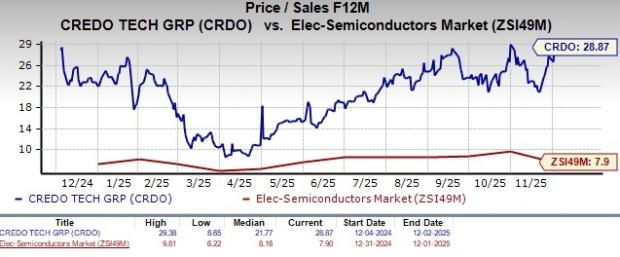

In terms of the forward 12-month Price/Sales ratio, CRDO is trading at 28.87, higher than the Electronic-Semiconductors sector’s multiple of 7.9.

Shares of CRDO have gained 40.6% in the past month compared with the Electronics-Semiconductors industry’s growth of 25.4%.

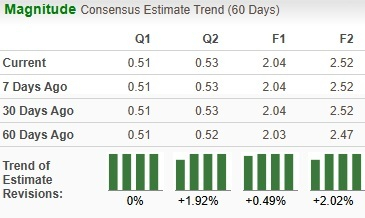

The Zacks Consensus Estimate for CRDO’s earnings for fiscal 2026 has been marginally revised upwards over the past 60 days.

CRDO currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 13 hours | |

| 13 hours | |

| 16 hours | |

| 17 hours | |

| 17 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite