|

|

|

|

|||||

|

|

Pacira BioSciences PCRX announced results from a pilot study evaluating the unique therapeutic approach of its iovera system compared to radiofrequency ablation (RFA) for chronic low back pain (CLBP).

The iovera system is a groundbreaking, FDA-approved, drug-free treatment that alleviates pain through cryoneurolysis. This technique uses targeted cold therapy to temporarily disrupt a nerve's ability to transmit pain signals. Patients usually experience immediate pain relief after treatment, with effects lasting for several months as the nerve naturally regenerates. Please note that this hand-held medical device was added to Pacira BioSciences’ portfolio following the acquisition of MyoScience.

Pacira BioSciences’ pilot study enrolled 30 patients with facet-mediated CLBP and randomized them to receive either iovera cryoneurolysis or RFA. Baseline measures, including pain scores, BMI, pain duration, and disability, were comparable across the two groups.

Per the data readout from the pilot study, CLBP patients treated with iovera showed notably stronger and more durable outcomes than those receiving RFA. Pain scores in the iovera group were significantly lower at both 180 days (3.1 compared to 5.4) and 360 days (3.0 compared to 6.1). Pacira BioSciences also reported that Functional disability improved more substantially with iovera than RFA therapy, with Oswestry Disability Index scores significantly lower at 360 days (10.1 compared to 20.6).

Additionally, fewer patients in the iovera arm required additional spine injections after 180 days (45.5% compared with 75% for RFA), and no treatment-related adverse events were reported in either cohort through 12 months.

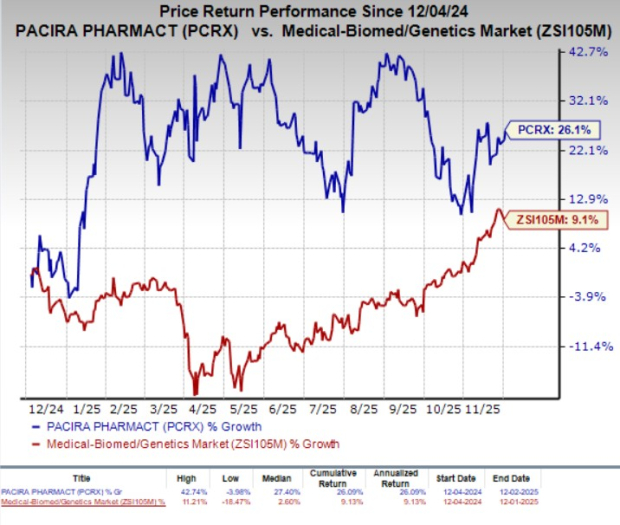

In the past year, PCRX shares have gained 26.1% compared with the industry’s 9.1% growth.

Pacira BioSciences believes that the results underscore the potential of iovera to deliver sustained pain relief without the disadvantages associated with RFA. The encouraging findings from the pilot study also support Pacira BioSciences’ ongoing spine tip development program for iovera to treat spine-related pain.

We remind the investors that in early 2025, PCRX received FDA clearance of a new SmartTip designed to enable deeper nerve access for lumbar procedures.

Per Pacira BioSciences, CLBP is the top cause of disability in the United States and a major contributor to opioid use, with facet-mediated pain accounting for up to 45% of cases. While RFA is a standard treatment, its heat-based approach can harm surrounding tissue, highlighting the need for tissue-sparing alternatives such as cryoneurolysis.

Apart from the iovera system, Pacira BioSciences’ marketed portfolio of products comprises two drugs — Exparel and Zilretta.

Exparel is PCRX’s flagship pain-management product, which was initially launched in 2012. The drug is indicated for postsurgical local analgesia in patients aged six years and older. It is also indicated for regional analgesia in adults via an interscalene brachial plexus nerve block, sciatic nerve block in the popliteal fossa and femoral nerve block in the adductor canal.

Zilretta, on the other hand, is approved as an extended-release intra-articular therapy providing relief to osteoarthritis (OA) patients with knee pain.

Pacira BioSciences is also currently looking to expand Zilretta’s indication to include treatment for OA pain in the shoulder. It initiated a phase III study in 2024 to evaluate the efficacy of Zilretta in shoulder OA. Based on the success of the study, the company plans to seek label expansion of the drug for this indication.

Pacira BioSciences, Inc. price-consensus-chart | Pacira BioSciences, Inc. Quote

Pacira BioSciences currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector include CorMedix CRMD, Arcutis Biotherapeutics ARQT and ADMA Biologics ADMA. While CRMD sports a Zacks Rank #1 (Strong Buy), ARQT and ADMA carry a Zacks Rank #2 (Buy) each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for CorMedix’s 2025 earnings per share (EPS) have increased from $1.83 to $2.87. EPS estimates for 2026 have moved up from $2.48 to $2.88 during the same period. CRMD stock has gained 1% in the past year.

CorMedix’s earnings beat estimates in each of the trailing four quarters, with an average surprise of 27.04%.

In the past 60 days, estimates for Arcutis Biotherapeutics’ loss per share have narrowed from 44 cents to 24 cents for 2025. During the same time, EPS estimates for 2026 have increased from 9 cents to 41 cents. In the past year, shares of ARQT have rallied 133.4%.

Arcutis Biotherapeutics’ earnings beat estimates in each of the trailing four quarters, the average surprise being 64.80%.

In the past 60 days, estimates for ADMA Biologics’ EPS have increased from 57 cents to 58 cents for 2025. During the same time, EPS estimates for 2026 have improved from 88 cents to 90 cents. In the past year, shares of ADMA have lost 3.5%.

ADMA Biologics’ earnings beat estimates in one of the trailing four quarters, matched once and missed the same on the remaining two occasions, with the average negative surprise being 3.01%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 | |

| Mar-04 | |

| Mar-03 | |

| Mar-03 | |

| Mar-03 | |

| Mar-02 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite