|

|

|

|

|||||

|

|

Ondas Holdings (ONDS) closed the third quarter of 2025 with a robust balance sheet. As of Sept. 30, 2025, Ondas had $433.4 million in cash, cash equivalents and restricted cash, and has raised $855 million since June to support its aggressive expansion plans. After adjusting for $407 million in net proceeds from an Oct. 7 equity raise and cash used for operations and M&A, ONDS’ pro forma cash balance reached $840.4 million, with stockholders' equity rising to $894 million.

This level of cash pile is nearly unmatched for a company of Ondas’ size and positions it strongly as it expands the defense and autonomous systems operations. The autonomous and unmanned systems, defense and security markets, according to management, are now at an “inflection point,” shifting from technology development to widespread platform adoption. Management noted that access to “low-cost capital” allows ONDS to “move decisively, scale efficiently and lead confidently” across these fast-growing verticals.

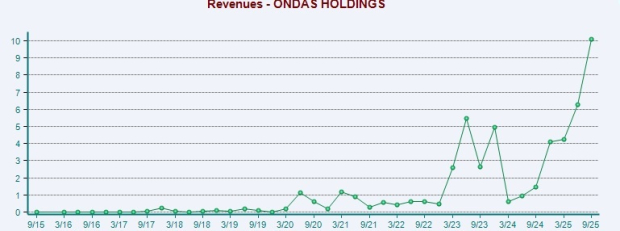

ONDS is deploying significant funds to boost the performance of the Ondas Autonomous Systems (“OAS”) unit, its fastest-growing business unit, which delivered $10 million of revenues in the third quarter, up from just $1 million in the year-ago quarter. The OAS had a backlog of $22.2 million at the end of the third quarter, driven by strong demand trends for Optimus and Iron Drone systems. Consolidated backlog stood at $23.3 million, and it reached $40 million, including acquisitions. ONDS noted that the customer pipeline remains strong and expects to end 2025 with further backlog expansion.

With ample cash, ONDS has resorted to aggressive M&A that expands its multi-domain capabilities like unmanned ground systems, robotics and fiber optic communications, subsurface intelligence and demining robotics. In the past few months, it has acquired Sentrycs, Apeiro Motion, Zickel, among others and recently announced an agreement to buy Roboteam, which specializes in multi-mission tactical ground robotics.

Another major initiative funded through this capital is Ondas Capital, launched in September. This new business division is solely focused on boosting the deployment of unmanned/autonomous systems to Allied defense and security markets.

However, challenges remain. Increasingly crowded drone space and ballooning operating expenses as it builds leadership teams and infrastructure to support growth pose concerns for ONDS. The challenge ahead will be converting this financial strength into operational performance and profitability expansion.

Draganfly (DPRO) is a Canada-based drone solutions and systems developer. It has 5-plus drone systems that are all NDAA-compliant. As the United States and NATO aggressively eliminate non-compliant Chinese systems from critical infrastructure, this compliance advantage becomes a moat. The company’s cash balance at the end of the third quarter of 2025 was C$69.9 million with minimal debt. Total assets also jumped to C$77 million due to higher cash.

On the earnings call, management noted that it was “burning about $1.5 million a month” and there was no “acute” requirement to raise cash. It is focused on acquisitions, but not necessarily around technology/products, but more focused on the people, added DPRO.

Unusual Machines (UMAC) is well-positioned within the evolving drone industry through its focus on manufacturing and selling (through B2B sales and a curated retail channel) small drones and essential components. The FPV segment is UMAC’s core operational area within the drone industry. At the end of the third quarter of 2025, UMAC had a cash balance of $64.3 million, which included a $48.5 million equity raise in July. It again raised an additional $72 million in gross proceeds from the ATM at $15.46/share and cash in hand swelled to $130 million.

UMAC held $16.8 million in short-term investments as of Sept. 30. Management noted that though the company had a profitable quarter, it was not cash flow positive. UMAC targets to sustain positive cash flow, and expects $30 million in annual revenues to reach there, which it expects in the latter half of 2026.

Shares of ONDS have jumped 55.4% in the past three months against the Communication-Network software industry’s decline of 8.4%.

In terms of the forward 12-month price/sales ratio, ONDS’ shares are trading at 29.26X, higher than the industry’s 2.04X.

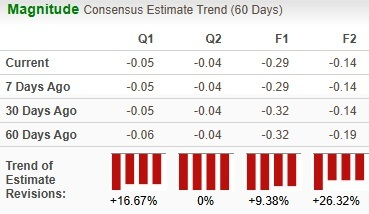

The Zacks Consensus Estimate for ONDS earnings for 2025 has been revised 9.4% upwards over the past 60 days.

ONDS currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 8 min | |

| 3 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite