|

|

|

|

|||||

|

|

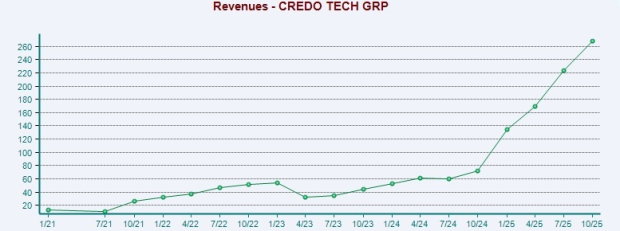

Credo Technology Group Holding Ltd (CRDO) delivered one of the strongest quarters, triggering a sharp post-earnings rally. The stock has gained 10.6% after the company reported results for the second quarter of fiscal 2026 on Dec 1. It hit a new 52-week high of $213.80 on Dec. 2.

The company’s second quarter fiscal 2026 showcased solid revenue acceleration, expanding hyperscaler base and three new multi-billion-dollar product pillars that significantly broaden its long-term total addressable market.

Over the past month, CRDO (up 8.6%) has also outpaced the Electronic-Semiconductors and the broader Computer and Technology sector’s growth of 3.9% and 0.8%, respectively. The gains are also higher than some of its competitors. Broadcom (AVGO) and Marvell Technology (MRVL) have gained 5.7% and 7.2%, respectively, over the same time frame, while Astera Labs (ALAB) has declined 16.5%.

After the strong post-earnings rally, Investors now have a crucial question: should they continue riding this momentum or lock in profits?

Let’s unpack the company's recent results and long-term prospects and ascertain whether staying invested is wise.

CRDO’s revenues surged 20% sequentially and a staggering 272% year over year to $268 million as hyperscalers and data center operators aggressively invest in AI infrastructure. The number far exceeded management’s revenue guidance of $230 million to $240 million.

Non-GAAP gross profit was $181.4 million in the second quarter compared with $45.8 million in the same period last year. Non-GAAP gross margin expanded 410 basis points (bps) to 67.7% during the quarter under review, coming in above the high end of the company’s guidance and improving 11 bps sequentially.

Total non-GAAP operating expenses increased 52.4% year over year to $57.3 million.

Non-GAAP operating income was $124.1 million compared with $8.3 million reported in the prior-year period.

The company generated cash flow from operating activities of $61.7 million, up $7.5 million sequentially, while free cash flow totaled $38.5 million. As of Nov. 1, 2025, CRDO had $813.6 million of cash and cash equivalents and short-term investments compared with $479.6 million as of Aug. 2, 2025.

As AI clusters scale into the hundreds of thousands of GPUs and push toward million-GPU configurations, reliability, signal integrity, latency, power efficiency and total cost of ownership have become “mission-critical”. Credo’s architecture (purpose-built SerDes technology, sound IC design and a system-level development approach) is tailored to meet these demands.

CRDO’s leadership in the AEC space is one of its biggest catalysts. AEC business remains its fastest-growing segment. CRDO noted that AECs, now scaling to 100-gig per lane and transitioning to 200-gig per lane architectures, have become the “de facto” standard for inter-rack connectivity. These are now replacing optical rack-to-rack connections up to 7 meters. The explosive adoption of zero-flap AECs is mainly due to these cables offering up to 1,000 times more reliability with 50% lower power consumption than optical solutions, added CRDO.

Credo’s hyperscaler traction sits at the center of its second-quarter strength. Four hyperscalers each contributed more than 10% of total revenues, reflecting strong adoption of Credo’s high-reliability AEC solutions. Management noted that the fourth hyperscaler is in full volume, but the more important development in the fiscal second quarter was the emergence of a fifth hyperscaler, which has begun contributing initial revenues. The company also highlighted that customer forecasts have strengthened across the board in recent months. This marks a major inflection point.

CRDO expects each of its top four customers to grow significantly year over year in the current fiscal year. The growing hyperscaler base reduces the risks associated with customer concentration and enhances the stability of top-line growth.

Beyond AECs, Credo’s IC portfolio — which includes retimers and optical DSPs — continued to show healthy performance. CRDO expects significant growth in optical DSP deployments during the current fiscal year, especially across 50-gig and 100-gig per lane designs, with longer-term upside tied to 200-gig per lane architectures.

Credo Technology Group Holding Ltd. price-consensus-eps-surprise-chart | Credo Technology Group Holding Ltd. Quote

Management noted that the Bluebird optical DSP (demonstrated fiscal first quarter) is receiving strong interest and positive customer feedback. Ethernet retimers also remain a critical piece of AI server and switching fabrics, particularly where MACsec encryption, gearbox capabilities and software programmability matter. Credo’s PCIe retimer program remains on track for design wins in fiscal 2026 and revenue contributions in the next fiscal year.

Given these, Credo expects revenues between $335 million and $345 million, implying 27% sequential growth at the midpoint for the fiscal third quarter. The company anticipates more than 170% year-over-year growth in fiscal 2026 and net income to more than quadruple.

One of the most important developments in the fiscal second quarter was Credo’s introduction of three entirely new growth pillars, each representing a multibillion-dollar opportunity. These include Zero-Flap (“ZF”) optics, active LED cables (ALCs) and OmniConnect gearboxes (Weaver).

ZF optics is a laser-based connectivity solution delivering AEC-level reliability through a custom optical DSP tightly integrated with Credo’s software stack. The optics are already in live data-center trials, with sampling to a second U.S. hyperscaler expected later in fiscal 2026. ALCs utilize micro-LEDs, delivering AEC-level reliability and power efficiency and support up to 30-meter connections for row-scale data center networks. Sampling is planned for fiscal 2027 with revenues in fiscal 2028 and Credo expects the ALC market to grow to more than twice the size of the AEC market. OmniConnect gearboxes are designed to optimize XDU connectivity.

Credo now has five main high-growth pillars — AECs, IC solutions (retimers and optical DSPs), Zero-Flap optics, ALCs and OmniConnect gearboxes. Collectively, these present a total market opportunity likely to surpass $10 billion, more than tripling Credo’s market reach just 18 months ago.

Even with exceptional performance, several company-specific risks warrant a balanced view. While hyperscaler demand is a growth driver, it also poses risks. With just three to four hyperscalers making up the bulk of revenues, a change in spending or in-house solution from one of these customers could materially affect revenue numbers.

The new connectivity pillars — ZF optics, ALCs, OmniConnect — are not expected to generate meaningful revenues until fiscal 2027-2028. Execution delays could shift these timelines further.

The company expects non-GAAP operating expenses to rise approximately 50% year over year in fiscal 2026. This could pressure margins if revenue growth slows.

Moreover, CRDO’s bullish narrative hinges on AI investment. While these segments are currently experiencing high growth, they are also cyclically dependent on AI capex spending, which could decelerate after initial buildouts.

Increasing market competition from the likes of Broadcom, Marvell Technology and newer entrants like Astera Labs and macroeconomic uncertainties may impact CRDO’s growth trajectory.

In terms of the forward 12-month Price/Sales ratio, CRDO is trading at 28.97, higher than the Electronic-Semiconductors sector’s multiple of 7.92. It seems that the current price has already factored in much of the anticipated AI-driven upside.

In comparison, Broadcom trades at a forward 12-month P/S multiple of 20.49, while Astera Labs and Marvell are trading at a multiple of 22.62 and 9.43, respectively.

In a market increasingly driven by AI tailwinds, CRDO stands out as a pure-play beneficiary with differentiated products, strong financials and increasing demand. However, premium valuation, competitive pressures and macro uncertainties limit near-term upside potential.

With a Zacks Rank #3 (Hold), CRDO seems to be treading in the middle of the road. Investors looking to invest are better off waiting for a favorable entry point, while investors already having a position can retain the stock given the compelling long-term fundamentals.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 12 hours | |

| 12 hours | |

| 15 hours | |

| 15 hours | |

| 16 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite