|

|

|

|

|||||

|

|

GE HealthCare GEHC and Mayo Clinic have recently launched GEMINI-RT, a new research initiative aimed at reshaping personalized radiation therapy by combining advanced imaging, AI and patient monitoring across the full cancer care pathway. The collaboration builds on their long-standing research partnership and is focused on developing smarter, data-driven tools that can improve precision from diagnosis through follow-up.

Per management, GEMINI-RT is likely to accelerate innovation in key areas such as automation, predictive oncology, multi-modal treatment strategies and connected patient care. By pairing Mayo Clinic’s deep clinical expertise with GEHC’s engineering and AI capabilities, the initiative is expected to enhance clinical workflows, support better outcomes and reduce burnout for care teams.

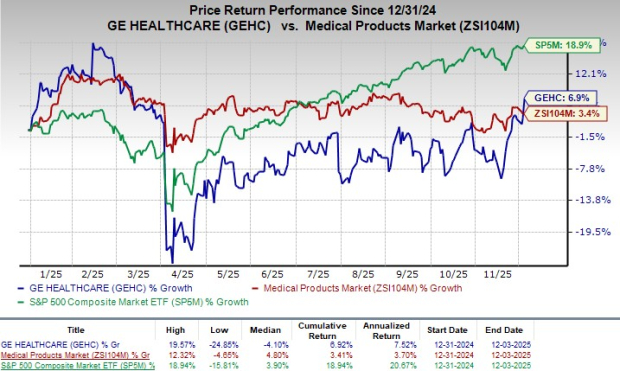

Following the announcement, the company's shares traded flat at yesterday’s closing. In the year-to-date period, shares have gained 6.9% compared with the industry’s 3.4% growth. The S&P 500 has gained 18.9% in the same time frame.

In the long run, GEMINI-RT is likely to strengthen GEHC’s competitive position in oncology by anchoring its technology directly into next-generation clinical workflows developed with one of the world’s leading cancer centers. The collaboration deepens GEHC’s pipeline in AI, imaging and radiation therapy planning, expands its role in multi-modal oncology care, and accelerates innovation that can translate into future commercial products. By shaping emerging standards in personalized radiation therapy and connected care, GEHC stands to grow its influence, strengthen customer loyalty and capture a larger share of a rapidly expanding global cancer-care market.

GEHC currently has a market capitalization of $36.44 billion.

GEMINI-RT represents a significant deepening of GE HealthCare’s collaboration with Mayo Clinic, building on their 2023 radiology research alliance and extending it into the core of radiation oncology. The initiative aims to modernize and personalize radiation therapy by integrating imaging, AI, dosimetry and patient-monitoring tools across every stage of care. By partnering directly with Mayo Clinic’s world-class clinical and research teams, GEHC gains access to unique patient insights, real-world workflows and outcomes data that can meaningfully shape product development and accelerate translational innovation.

The collaboration is centered around four strategic areas—automation, predictive oncology, multi-modal therapies and connected care. Automation efforts will focus on reducing repetitive planning tasks with AI-driven tools, while predictive oncology uses clinical data to tailor treatment decisions with greater accuracy.

Multi-modal therapy research will explore ways to combine radiation with emerging targeted treatments, and connected care initiatives aim to extend monitoring beyond the clinic, using sensors and AI to predict side effects earlier and support at-home management. Together, these pillars create a comprehensive framework for improving patient outcomes and easing clinician workload.

For GEHC, the long-term strategic upside is substantial. Working alongside Mayo Clinic provides a powerful validation pathway for next-generation oncology technologies and helps GEHC embed its solutions into future standards of care.

As global cancer incidence continues to rise, the demand for more personalized, efficient and scalable radiation therapy will expand. By co-developing the tools that could define this new model, GEHC is positioned to strengthen its oncology portfolio, deepen customer adoption and capture sustained growth opportunities in one of the fastest-evolving areas of healthcare.

Currently, GEHC carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Medpace Holdings MEDP, Intuitive Surgical ISRG and Boston Scientific BSX.

Medpace, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 earnings per share (EPS) of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company beat earnings estimates in each of the trailing four quarters, the average surprise being 14.28%.

Intuitive Surgical, sporting a Zacks Rank #1 at present, posted a third-quarter 2025 adjusted EPS of $2.40, exceeding the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion outperformed the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 7 hours | |

| 10 hours | |

| 11 hours | |

| 14 hours | |

| 15 hours | |

| 15 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite