|

|

|

|

|||||

|

|

As banks compete to differentiate themselves in an evolving banking landscape, First Horizon Corporation FHN and BOK Financial Corporation BOKF emerge as two institutions worth examining side by side. While both banks operate across multiple regions and offer comprehensive financial services, their approaches to growth, risk management, and customer engagement reveal distinct identities. Let us delve deeper and examine the key drivers for FHN and BOKF to determine which stock has stronger upside potential.

First Horizon has continued to demonstrate solid performance, marked by consistent growth in both loans and deposits over the past several years. This upward trajectory reflects the strength of its business model and the stability of its core markets. Management anticipates this momentum to persist, supported by sustained growth in the commercial and industrial (C&I) portfolio, steady mortgage-warehouse activity, and healthy consumer lending demand. Recent quarterly results reinforce this view, with loans expanding across key categories and deposits showing renewed strength as promotional offerings and improved customer engagement draw in and retain clients. Deposit balances, in particular, are expected to improve further as noninterest-bearing deposits rise and customer retention remains strong.

Further, the company has been witnessing improvement in net interest income (NII) over the past few years. The Federal Reserve has reduced rates twice this year, and a further rate cut is expected this month, given weakening job data. With relatively lower rates, FHN’s NII will improve further as loan demand increases and funding/deposit costs stabilize

From a liquidity standpoint, FHN remains well-positioned. As of Sept. 30, 2025, the company held $2.1 billion in cash and interest-bearing deposits. Further, its short-term borrowings were $4.3 billion, while term borrowings stood at $1.3 billion.

BOK Financial presents a fundamentally balanced outlook supported by a diversified operating model, consistent loan and deposit expansion and favorable margin trends. The company has been focused on diversifying its loan portfolio to energy, healthcare, and service lending. Management is targeting a year-over-year loan growth of 5–7% for 2025.

BOKF continues to record steady improvement in NII, supported by easing deposit costs and healthier asset yields. NII has maintained an upward trend through 2025, and management expects it to reach $1.33–$1.35 billion for the year, up from $1.2 billion in 2024.

Strategic market expansion is also enhancing BOKF’s long-term growth profile. In June 2024, Bank of Texas expanded into the San Antonio market, strengthening its statewide reach. In July 2023, BOK Financial Securities opened an office in Memphis, increasing the company’s presence in the Southeastern United States. These targeted expansions deepen the bank’s footprint and support growth across its fee-based and client-facing businesses.

However, BOKF's debt level seems unmanageable. As of Sept. 30, 2025, the company had total debt (comprising funds purchased and repurchase agreements and other borrowings) of $4.2 billion, whereas cash and due from banks, as well as interest-bearing cash and cash equivalents, aggregated to $1.4 billion.

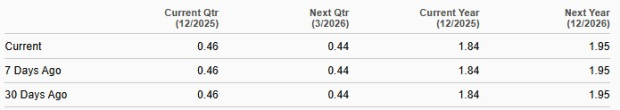

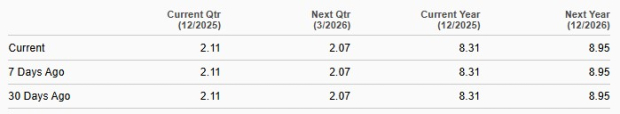

The Zacks Consensus Estimate for FHN’s 2025 and 2026 revenue implies year-over-year growth of 5.6% and 3.2%, respectively. Further, the consensus estimate for earnings indicates an 18.7% and 6.1% rise for 2025 and 2026, respectively. Earnings estimates for both years have remained unchanged over the past month.

The consensus mark for BOKF’s 2025 and 2026 sales suggests year-over-year increases of 6.9% and 5.5%, respectively. Also, the consensus estimate for earnings indicates a 0.8% and 7.7% rise for 2025 and 2026, respectively. Earnings estimates for both years have also remained unchanged over the past 30 days.

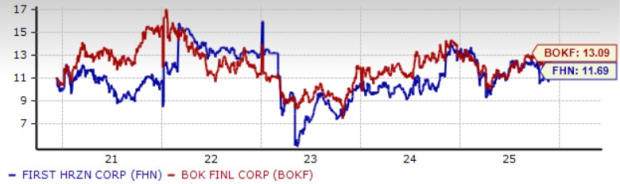

Over the past year, shares of BOK Financial have lost 1.1%, while First Horizon stock gained 10.3%. Both have fared better than the industry, which lost 5.4% in the same time frame.

From a valuation standpoint, BOKF is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 13.09X, while FHN is currently trading at a forward 12-month P/E multiple of 11.69X. FHN is lower than the industry average of 12.70X, while BOKF stock is trading at a premium.

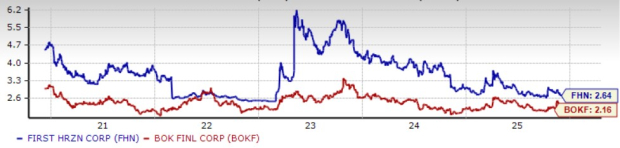

Meanwhile, both BOK Financial and First Horizon reward their shareholders handsomely. BOKF has raised its dividend five times in the last five years. In October 2024, the company raised its quarterly dividend by 3.6% to 57 cents per share. It has a dividend yield of 2.16%. Comparatively, FHN raised its quarterly dividend by 7% to 15 cents per share in January 2020 and has maintained the same since then. It has a dividend yield of 2.64%. Here, FHN holds an edge over BOKF.

While both First Horizon and BOK Financial offer appealing attributes, FHN ultimately presents the more favorable upside profile at this stage. Its steadier loan momentum, improving deposit stability and clearer runway for NII expansion, supported by a declining rate environment, position the bank for healthier earnings growth in the near term. Additionally, FHN’s lower forward P/E multiple and stronger stock performance over the past year suggest that investors are not fully pricing in its improving fundamentals.

BOKF remains a solid, well-diversified institution, but its higher valuation, slower earnings growth outlook, and comparatively heavier debt load limit its relative appeal. Meanwhile, FHN’s combination of improving balance-sheet trends, disciplined execution, and more attractive valuation creates a more compelling risk-reward setup for now.

At present, FHN and BOKF carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-11 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-06 | |

| Feb-04 | |

| Feb-02 | |

| Feb-02 | |

| Jan-30 | |

| Jan-30 | |

| Jan-30 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite