|

|

|

|

|||||

|

|

Omnicell’s OMCL strength in its SaaS and Expert Services offerings should help sustain growth in the upcoming quarters. Efforts to expand into overseas markets instill optimism. Additionally, a stable solvency looks encouraging. However, fierce rival pressure could hurt Omnicell’s performance.

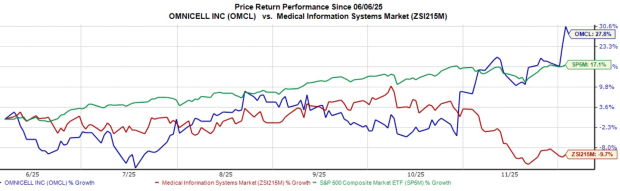

Omnicell, carrying a Zacks Rank #2 (Buy) at present, has gained 27.8% against the industry's 9.7% decline over the past year. The S&P 500 composite has increased 17.1% in the said time frame.

The renowned healthcare technology company has a market capitalization of $1.82 billion. Omnicell’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 38.7%.

Robust Pipeline for SaaS and Expert Services Portfolio: Omnicell’s suite of SaaS and Expert Services includes a combination of robotics, smart devices, intelligent software and expert services. These subscription-based offerings are a key part of the company’s medication management infrastructure to help drive improved clinical, operational and financial outcomes across all care settings.

In late 2024, Omnicell announced OmniSphere, a next-generation, cloud native, software workflow engine and data platform that is intended to seamlessly integrate enterprise-wide robotics and smart devices to support more secure, data-driven, medication management across the continuum of care. OmniSphere recently became HITRUST CSF (Common Security Framework) i1 certified. Additionally, the company introduced Central Med Automation Service, a subscription-based solution designed to help health systems establish and continuously optimize centralized medication management for consolidated pharmacy services centers and similar operations.

Omnicell also offers 340B solutions, which are related to the federal 340B Drug Pricing Program, requiring pharmaceutical manufacturers participating in Medicaid to sell covered outpatient drugs at discounted prices to specified healthcare organizations (called 340B covered entities).

Planned Geographic Expansion Another Upside: Outside the United States, healthcare providers are becoming increasingly aware of the benefits of automation. Many government and private entities are aware of the progress made over the last several years in the United States and are investing significantly in information technology and automation.

The company’s international operations include its sales efforts centered in Canada, Europe, the Middle East, and the Asia-Pacific regions and supply-chain efforts in Asia. Given the fact that the international market is less than 1% penetrated with very few hospitals adopting medication control systems, Omnicell intends to expand into new markets, which it views as strategic.

Image Source: Zacks Investment Research

Strong Liquidity and Capital Structure: Omnicell exited the third quarter of 2025 with cash and cash equivalents of $180 million, higher than its $167 million total debt on the balance sheet. This is indicative of a sound solvency position. The total debt to capital ratio was 12.1x in the third quarter, down from 21.3x in the previous quarter.

Competitive Landscape: Omnicell faces intense competition in the medication management and supply-chain solutions market. Even though the company continues to gain market share from other traditional providers of medication management and supply-chain solutions, major players pose threats as they spearhead several expansion programs. This increased competition could result in pricing pressure and a reduced margin, negatively affecting the company’s performance.

The Zacks Consensus Estimate for 2025 earnings per share has moved north 8.3% to $1.70 in the past 30 days.

The consensus mark for 2025 revenues is pegged at $1.19 billion, indicating a 6.5% rise from the year-ago reported number.

Some other top-ranked stocks in the broader medical space are BrightSpring Health Services, Inc. BTSG, Phibro Animal Health PAHC and Cardinal Health CAH.

BrightSpring Health Services has an estimated earnings growth rate of 100% for fiscal 2026 compared with the S&P 500 composite’s 16.7%. Shares of the company have rallied 101.1% compared with the industry’s 3% growth. BTSG’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 45.1%.

BTSG carries a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Phibro, currently carrying a Zacks Rank #1, has an estimated long-term earnings growth rate of 12.8% compared with the industry’s 13.3%. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 20.8%. PAHC’s shares have rallied 18.9% against the industry’s 15.4% decline in the past year.

Cardinal Health, currently carrying a Zacks Rank #2, has an earnings yield of 4.9% compared with the industry’s 5.9%. Shares of the company have surged 76.5% compared with the industry’s 3.4% growth. CAH’s earnings beat estimates in each of the trailing four quarters, with the average surprise being 9.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Stock Market Leaders, Top-Performing IPOs Tend To Share This Common Trait

BTSG

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite