|

|

|

|

|||||

|

|

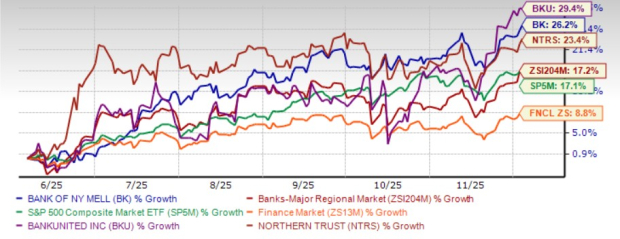

The Bank of New York Mellon Corporation’s BK shares touched a new 52-week high of $114.43 in Thursday’s trading session. Over the past six months, BK stock has gained 26.2%, outperforming the industry, the Zacks Finance Sector and the S&P 500 index. Also, the company’s shares have fared better than its close peer, Northern Trust Corp. NTRS, but have underperformed BankUnited Inc. BKU.

Six-Month Price Performance

Does BK stock have more upside left despite hitting a 52-week high? Let us try to decipher that.

Relatively Higher Rates to Aid Revenues: Though the Federal Reserve has reduced interest rates by 50 basis points (bps) this year and 100 bps in 2024, they are still relatively higher than the near-zero levels in 2020 and 2021. This will support BK’s net interest income (NII) and net interest margin (NIM), driven by stabilizing funding costs.

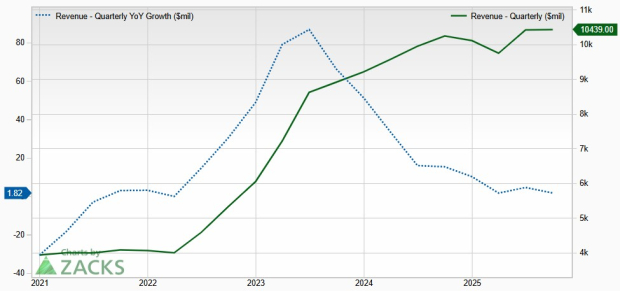

BNY Mellon’s NII indicated a compound annual growth rate (CAGR) of 6.2% over the five years ended 2024. Similarly, NIM improved to 1.32% in 2024 from 1.26% in 2023, 0.97% in 2022, 0.68% in 2021 and 0.84% in 2020. Also, total revenues and loans witnessed a CAGR of 2.5% and 5.4%, respectively, over the same period. The uptrend for all these metrics continued during the first nine months of 2025 on a year-over-year basis.

Quarterly Revenue Trend

Further, BNY Mellon’s diverse product offerings and strategic collaborations, alongside improving trade clarity, are expected to drive revenue growth. Last month, the company launched a Stablecoin reserves fund to support institutional adoption of digital assets in the liquidity space. This will further aid fee revenues.

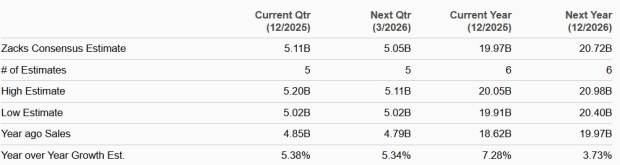

Sales Estimates

Additionally, BNY platform’s operating model is likely to drive the top line by leveraging technology and boosting fee revenues. This will enable the company to achieve higher operating leverage over time.

Strategic Buyouts & Expansion Efforts: BNY Mellon has been trying to expand its presence in international markets through several growth initiatives, including launching new services, digitizing operations and making strategic buyouts.

In 2024, the company acquired Archer and announced plans to launch Alts Bridge. In 2021, the company, through its subsidiary, Pershing, acquired Optimal Asset Management. Given the huge growth potential of overseas securities markets and a rise in complex new securities, the long-term growth prospects of the industry are encouraging. In the first nine months of 2025, non-U.S. revenues constituted 35% of total revenues.

The company’s international revenues are expected to continue to improve as demand for personalized services rises globally.

Solid Balance Sheet Position: As of Sept. 30, 2025, BK’s total cash and cash equivalents (consisting of cash and due from banks and interest-earning deposits) were $122.5 billion. Total debt was $55.9 billion.

Additionally, the company maintains a stable outlook and investment-grade long-term senior debt ratings of Aa3, A and AA- from Moody’s, S&P Ratings and Fitch Ratings, respectively. This renders the company favorable access to the debt market. Thus, given its decent earnings strength and a solid liquidity position, BNY Mellon will likely be able to address debt obligations in the near term, even if the economic situation worsens.

Moreover, as of Sept. 30, 2025, BK’s common equity tier 1 ratio and the total capital ratio of 11.7% and 15.3%, respectively, were well above the regulatory requirements.

BNY Mellon’s focus on maintaining a strong capital and balance sheet position supports its capital distribution activities. After the clearance of the 2025 stress test, the company hiked its quarterly cash dividend by 12.8% to 53 cents per share. Further, the company has been consistently raising its quarterly cash dividends. The bank hiked dividends five times during the last five years, with a dividend payout ratio of 30%.

Dividend Yield

Similarly, BankUnited increased its dividend four times over the past five years, while Northern Trust raised its dividend only twice over the same time frame.

Also, BK has a share repurchase plan. In April 2024, the company announced a new share repurchase program worth $6 billion. As of Sept. 30, 2025, roughly $2.8 billion worth of shares remained available for repurchase under the authorization. Management expects to return 100% or more of its earnings to shareholders in 2025, having returned 102% last year and 123% in 2023.

Over the past month, the Zacks Consensus Estimate for earnings of $7.36 and $8.10 per share for 2025 and 2026, respectively, moved marginally upward.

Estimate Revision Trend

The projected figures imply growth of 22.1% and 10% for 2025 and 2026, respectively.

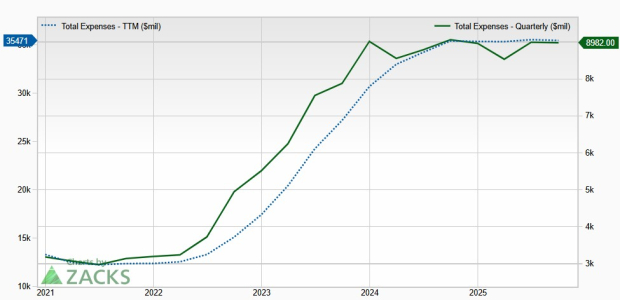

Rising Operating Expenses: While BNY Mellon’s cost-saving initiatives helped it lower expenses over the past several years, the same has been increasing of late. The company’s total non-interest expenses recorded a CAGR of 3.1% over the last five years ended 2024, with the uptrend persisting in the first nine months of 2025.

Expense Growth Trend

The company’s multi-year transformation program is expected to result in higher expenses in the quarters ahead. Moreover, given the inflationary pressure and the company’s efforts to upgrade operations with updated technology and automation, overall costs are expected to remain elevated.

Fee Income Concentration: BNY Mellon’s largest source of revenues is fee income, which constituted 71,7% of total revenues in the first nine months of 2025. The metric witnessed a five-year (2019-2024) CAGR of just 0.6%. This was mainly due to significant volatility in capital markets, which is worrisome and casts doubt on the sustainability of robust growth in the future.

Also, concentration risk from higher dependence on fee-based revenues could significantly hurt the company’s financial position if there is any change in individual investment preferences, regulatory amendments or a slowdown in capital markets activities.

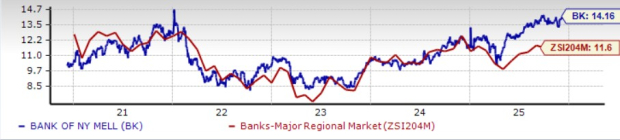

From a valuation perspective, BK stock is currently trading at a forward 12-month price/earnings (P/E) of 14.16X. This is above the industry’s 11.60X.

Forward 12-Month P/E

On the other hand, BankUnited and Northern Trust have a forward P/E of 12.86X and 14.30X, respectively. This reflects that BNY Mellon is expensive compared to BankUnited, while relatively cheaper than Northern Trust.

Relatively high interest rates, strategic expansion efforts and a solid balance sheet are likely to support BNY Mellon’s financials. Moreover, improving trade clarity will further complement the bank’s growth initiatives to boost its top line.

However, rising expenses and concentrated exposure to fee revenues remain a concern. Also, stretched valuation is another headwind.

Nonetheless, the company’s new operating model and product expansion efforts will continue to bolster its earnings. This is reflected in bullish analyst sentiments. Thus, BK stock remains a lucrative bet for investors now.

BK currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite