|

|

|

|

|||||

|

|

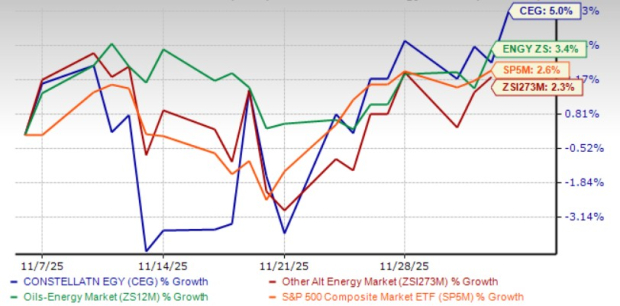

Shares of Constellation Energy Corporation CEG have gained 5% in the past month compared with the Zacks Alternative Energy – Other industry’s growth of 2.3%. CEG’s shares have also outperformed the Zacks S&P 500 composite and the Zacks Oil-Energy sector in the same time period.

CEG continues to add clean energy to the grid through its efficient operation of nuclear plants and benefits from the government support for the production of a large volume of clean energy.

Another company, Duke Energy Corporation DUK, is also actively pursuing nuclear energy expansion as part of its long-term clean energy strategy, particularly in the Carolinas. Duke Energy has lost 4.9% in the past month, underperforming its industry.

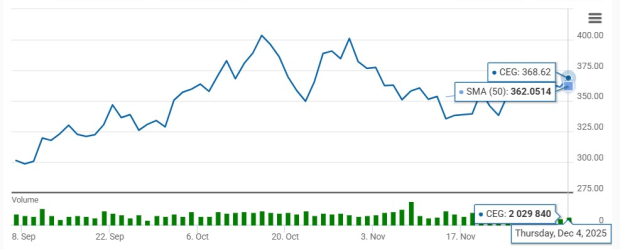

Constellation Energy is currently trading above its 50-day simple moving averages (SMAs), signaling a bullish trend.

The 50-day SMA is a key indicator for traders and analysts to identify support and resistance levels. It is considered particularly important as this is the first marker of an uptrend or downtrend of stocks.

Should investors consider adding CEG to their portfolios based solely on its recent share-price momentum? To find out, it is important to dive deeper into the fundamentals and evaluate the key factors that can reveal whether now is an opportune moment to view CEG as a potential portfolio addition.

Constellation Energy is benefiting from rising clean-energy demand, supported by a diversified portfolio anchored by its large nuclear fleet. By prioritizing zero-carbon generation, the company reinforces its position in both reliability and sustainability. Its nuclear assets continue to stand out, delivering a remarkable 96.8% capacity factor in the third quarter of 2025.

Constellation Energy’s earnings momentum is driven by strategic capital deployment and its ongoing expansion of renewable assets. The company expects to invest about $3 billion in 2025 and $3.5 billion in 2026, with nearly 35% directed toward securing nuclear fuel supporting the reliability and cleanliness of its power generation portfolio.

Nearly 90% of Constellation Energy’s annual power production is already carbon-free. The company is targeting 95% by 2030 and a full 100% by 2040. This transition supports lower operating costs through modern, efficient assets, while its expanding suite of clean-energy products and services creates new avenues for revenue growth.

The Calpine acquisition would broaden Constellation Energy’s generation mix, strengthen reliability and expand its market presence. By adding flexible natural-gas and geothermal assets, the deal enhances balance, creates cost and trading efficiencies, and supports earnings growth, reinforcing Constellation Energy’s position as a leading low-carbon power provider.

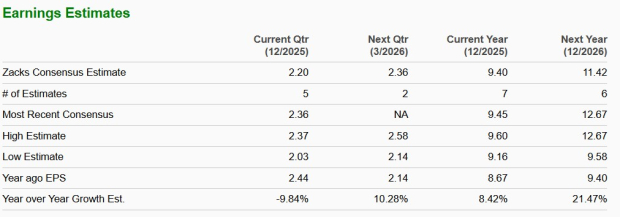

The Zacks Consensus Estimate for Constellation Energy’s 2025 and 2026 earnings per share indicates year-over-year growth of 8.42% and 21.47%, respectively.

NextEra Energy NEE also produces a large volume of clean energy and has initiatives to add more clean energy sources to its generation portfolio. The company’s unit Energy Resources has 29.6 GW in the backlog of signed contracts, which provides clear visibility into the ongoing expansion of clean power generation. The Zacks Consensus Estimate for NextEra Energy’s 2025 and 2026 earnings per share implies year-over-year growth of 7.29% and 7.84%, respectively.

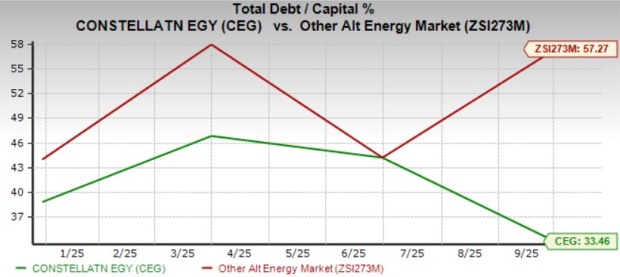

The debt-to-capital ratio of Constellation Energy is 33.46 compared with its industry’s 57.27. The ratio indicates CEG is utilizing much lower debts compared with its peers to run operations. The declining interest rate will be beneficial for the company, as it will further reduce long-term interest expenses.

Times Interest Earned ratio of the company at the end of the third quarter is 8.5, which indicates that it has enough financial strength to meet interest obligations.

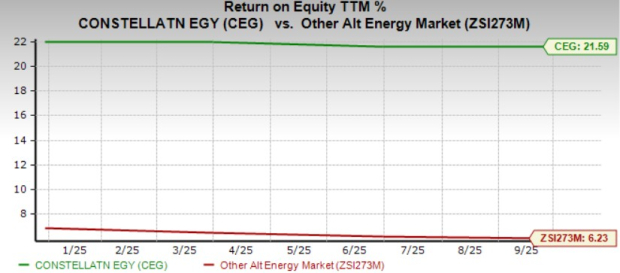

Return on equity (“ROE”), a profitability measure, reflects how effectively a company utilizes its shareholders’ funds to generate income.

Constellation Energy’s trailing 12-month ROE of 21.59% is better than the industry average of 6.23%.

Since 2023, CEG’s board of directors has authorized the repurchase of up to $3 billion of its outstanding common stock. As of Sept. 30, 2025, there was approximately $593 million of remaining authority to repurchase shares of the company's outstanding common stock.

CEG aims to increase its dividend by 10% annually, subject to the board's approval. Its quarterly dividend is 38.78 cents per share at present, resulting in an annualized dividend of $1.55. Check CEG’s dividend history here.

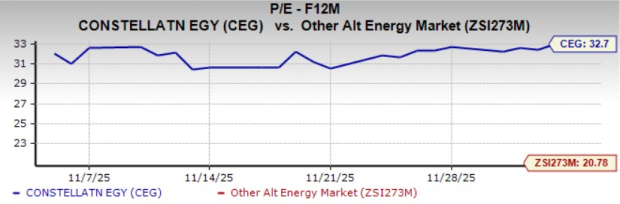

Constellation Energy is currently trading at 32.7X, a premium compared with its industry’s 20.78X on a forward 12-month P/E basis.

Constellation Energy is well-positioned to benefit from rising clean-energy demand across its service areas, backed by strategic investments and an expanding renewable portfolio. Its robust generation assets enable the company to meet this growing need effectively.

For now, existing shareholders may continue holding this Zacks Rank #3 (Hold) stock and take advantage of its steady dividends and solid ROE. However, given CEG’s elevated valuation, prospective investors may find it prudent to wait for a more attractive entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Nuclear Stock Briefly Flashes Buy Signal On Earnings Beat After Cathie Wood Sells

CEG +6.41%

Investor's Business Daily

|

| Feb-24 |

Nuclear Stock Flashes Buy Signal On Earnings Beat As Cathie Wood Sells

CEG +6.41%

Investor's Business Daily

|

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite