|

|

|

|

|||||

|

|

Credo Technology Group Holding Ltd CRDO delivered another record-setting quarter in the second quarter of fiscal 2026, showcasing not only powerful top-line momentum but also notable margin expansion. The company reported a non-GAAP gross margin of 67.7%, coming in above guidance and improving 11 basis points (bps) sequentially, with product gross margin rising to 66.8%, up 469 bps year over year.

This margin strength was driven by robust demand across its Active Electrical Cable (AEC) and Integrated Circuit (IC) businesses, disciplined operating expense management and substantial operating leverage as revenues surged 20% sequentially in the second quarter and 272.1% year over year. Operating profitability also moved sharply higher. Credo generated a non-GAAP operating margin of 46.3%, expanding 319 basis points from the first quarter due to top-line acceleration far outpacing growth in operating expenses. Non-GAAP net margins in the second quarter reached 47.7%, reflecting the company’s ability to scale efficiently even as it invests in optical and system-level product categories.

Credo continues to build a diversified, multi-pillar growth engine. It operates across five high-growth connectivity pillars: AECs, IC solutions such as retimers and optical DSPs, zero-flap optics, Active LED Cables (ALCs), and OmniConnect gearbox portfolio. Together, these pillars position Credo to target a total addressable market that is expected to surpass $10 billion in the coming years.

CRDO noted that AECs, now scaling to 100-gig per lane and transitioning to 200-gig per lane architectures, have become the “de facto” standard for inter-rack connectivity, replacing optical connections up to seven meters. Also, CRDO expects significant growth in optical DSP deployments during the current fiscal year, especially across 50-gig and 100-gig per lane designs, with longer-term upside tied to 200-gig per lane architectures.

For third-quarter fiscal 2026, management expects healthy revenue growth of roughly 27% sequentially at the midpoint, while gross margins are projected to moderate to a 64–66% range. Even with this normalization, the guided range remains near the upper end of the company’s long-term gross margin framework of 63–65%. For fiscal 2026, the company anticipates mid-single-digit sequential revenue growth, resulting in roughly 170% year-over-year growth. Non-GAAP net margin is projected to be around 45%, resulting in net income more than quadrupling from last year.

However, increasing market competition and macroeconomic uncertainties amid tariff troubles may impact CRDO’s growth trajectory. Credo competes with semiconductor giants like Broadcom AVGO and Marvell Technology MRVL.

Broadcom is experiencing strong momentum fueled by growth in AI semiconductors and continued success with its VMware integration. Strong demand for its networking products and custom AI accelerators (XPUs) has been noteworthy. Its AI segment benefits from custom accelerators and advanced networking technology that support large-scale AI deployments with improved performance and efficiency. In the third quarter fiscal 2025, the non-GAAP gross margin was 78%, up 100 bps year over year, while non-GAAP operating margin expanded 470 bps year over year to 65.5%. For the fourth quarter, Broadcom expects revenues of $17.4 billion, indicating 24% year-over-year growth. Gross margin is expected to decline 70 bps sequentially. The adjusted EBITDA margin is expected to be 67% for the fourth quarter of fiscal 2025.

Marvell is benefiting from the strong demand environment across the data center end market. Its data center end-market revenues jumped 39% year over year in the third quarter of fiscal 2026, propelled by strong growth across AI-driven demand for custom XPU silicon and electro-optics interconnect products. The completion of inventory digestions is likely to aid growth across the enterprise networking and carrier infrastructure end markets. In the third quarter of fiscal 2026, Marvell Technology's non-GAAP gross profit of $1.24 billion increased 35% year over year, with a non-GAAP gross margin of 59.7%, expanding 30 bps sequentially but contracting 80 bps year over year. Marvell Technology issued strong revenue guidance for the fourth quarter. It expects revenues to be $2.20 billion (+/- 5%). The non-GAAP gross margin is projected to be in the 58.5-59.5% range.

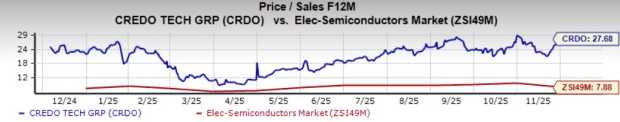

In terms of the forward 12-month Price/Sales ratio, CRDO is trading at 27.68, higher than the Electronic-Semiconductors sector’s multiple of 7.9.

Shares of CRDO have gained 22.6% in the past three months compared with the Electronics-Semiconductors industry’s growth of 15.9%.

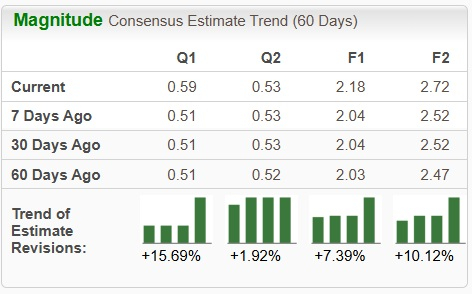

The Zacks Consensus Estimate for CRDO’s earnings for fiscal 2026 has been revised upward over the past 60 days.

CRDO currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| 10 hours | |

| 12 hours | |

| 13 hours | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite