|

|

|

|

|||||

|

|

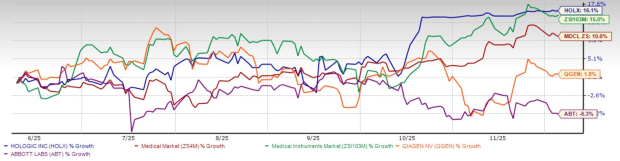

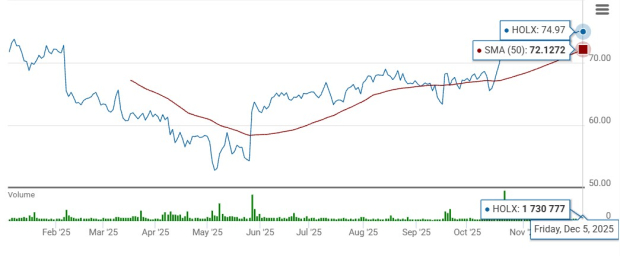

Hologic HOLX has seen steady gains over the last six months. Shares of this Massachusetts, MA-based medtech firm rose 16.1%, outpacing the industry’s 15% growth and the broader Zacks Medical sector’s 10% gains. The stock has also surpassed top competitors like Abbott ABT, which slid 6.3% and QIAGEN N.V. QGEN, which rose 1.8%. Further, Hologic’s last close of $74.97 is just 6.6% below the 52-week high of $80.31, reached nearly a year ago.

Hologic is currently moving through a take-private process by private equity firms, Blackstone and TPG. The transaction, pending Hologic stockholders’ approval, offers $76 per share in cash plus a Contingent Value Right (CVR) of up to $3 per share based on certain revenue targets. With the deal expected to close in the first half of 2026, let’s assess some of the factors that help evaluate if the short-term hold still makes sense.

On the technical front, HOLX shares are trading above the 50-day simple moving average.

With AI continuing to gain traction in mammography, several studies indicate Hologic’s ability to help radiologists work more efficiently without compromising quality. At RSNA 2025 in Chicago, the company presented new findings from more than 160,000 screening mammography exams. The retrospective study compared cancer detection rates before and after the adoption of Hologic’s 3DQuorum imaging technology, which uses AI to reduce the number of 3D imaging “slices” radiologists must review while maintaining image quality, sensitivity and accuracy. The study found no significant difference in cancer detection rates after implementation. Another study showed Hologic’s Genius AIDetection solution performing on par with 108 radiologists from the U.K. and the United States who reviewed 75 challenging breast cancer cases with the AI tool.

Further, Hologic and Biotheranostics will present 11 studies featuring the Breast Cancer Index(BCI) at SABCS 2025, which support more nuanced endocrine therapy decision-making and potential expanded utility in premenopausal women. BCI remains the only guideline-recognized and most extensively validated test for patients with early-stage, HR+ breast cancer.

A key component in the Diagnostics division, Hologic offers a broad menu of assays sold across its primary markets, all of which can be performed on the base Panther system or the combined Panther Fusion system. In fiscal 2025, the business saw higher sales volumes of BV/CV/TV, with more laboratory customers adopting the assays. Hologic is strongly acting on its vast U.S. vaginitis market opportunity by driving awareness and securing reimbursement for this high-throughput test.

Panther Fusion adoption is also on the rise, with its Open Access functionality giving labs the flexibility to run their own lab-developed tests on the Fusion platform. In October 2025, Hologic secured the FDA’s 510(k) clearance and CE marking in the European Union for the Panther Fusion Gastrointestinal (GI) Bacterial and Expanded Bacterial Assays. These diagnostic innovations are poised to further cement Hologic as an indispensable presence in the molecular lab. Also, the Biotheranostics oncology business continues to deliver accretive growth.

While Hologic has not explicitly detailed the goals tied to CVR for its Breast Health business in fiscal years 2026 and 2027, the division reflects renewed strength thanks to the strong execution of new leadership. The team built on the bifurcated sales structure and tighter processes established in fiscal 2025, and introduced a new strategy to upgrade older end-of-life gantries. Additionally, products from the 2024 acquisition of Endomagnetics further diversify Hologic’s interventional breast health portfolio, adding wire-free breast surgery localization and lymphatic tracing solutions.

On the innovation front, Hologic is set to commercially launch the Envision Mammography Platform this year, offering patients a high-speed 3D mammogram with an industry-leading 2.5-second scan time. The company’s Genius AI Detection PRO offers enhanced accuracy and efficiency in cancer screening compared with its predecessor, helping to reduce false positives.

Hologic shares trade at a forward three-year Price-to-Sales (P/S) of 3.87X, lower than its own median and its industry average. In contrast, QGEN and ABT have a three-year P/S of 4.76X and 4.55X, respectively.

Outside the United States, the Diagnostics business has been constrained by the geopolitical turmoil, including the USAID funding challenges in Africa and a difficult operating environment in China. Hologic also expects to incur approximately $10 million to $14 million in quarterly costs in fiscal 2026, creating a headwind for gross margin. The company continues to evaluate the status of the evolving tariffs and the various measures it has taken or plans to take to mitigate the impact.

Hologic’s impressive six-month rally is supported by solid divisional strength, new clinical evidence for its technologies and optimism surrounding its innovations. The proposed go-private strategy sets a clear valuation floor and minimises downside risk, but with shares trading close to the $76 cash offer, the short-term gains remain modest. Given its attractive valuation relative to its industry and peers, existing holders may want to retain this Zacks Rank #3 (Hold) stock in the portfolio through the end of its public run.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite