|

|

|

|

|||||

|

|

Amtech Systems (ASYS) is scheduled to report its fourth-quarter fiscal 2025 results on Dec. 10, 2025.

Amtech Systems anticipates revenues of approximately $19.8 million for the fourth quarter of fiscal 2025, indicating a year-over-year decline of 17.9%.

For the third quarter of fiscal 2025, the Zacks Consensus Estimate for the bottom line is pegged at a loss per share of 3 cents, unchanged over the past 60 days. The company had reported break-even earnings in the year-ago quarter.

Amtech Systems’ earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the negative average surprise being 51.25%.

Amtech Systems, Inc. price-eps-surprise | Amtech Systems, Inc. Quote

Our proven model does not conclusively predict an earnings beat for Amtech Systems this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Amtech Systems has an Earnings ESP of 0.00% and carries a Zacks Rank #3 at present. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Amtech Systems has identified advanced packaging as a significant growth opportunity, particularly within artificial intelligence (AI) infrastructure. In the third quarter of fiscal 2025, the company observed a strengthening demand for its equipment used in advanced packaging applications, particularly within AI infrastructure. The trend is likely to have continued and aided fourth-quarter performance.

In the third quarter of fiscal 2025, sales of equipment used in AI infrastructure were five times higher than a year ago and made up about 25% of Thermal Processing Solutions’ revenues. This shows how quickly AI demand is becoming an important part of Amtech Systems’ business. Moreover, per management, bookings in the fiscal third quarter suggest that AI-related demand should remain strong going forward. This uptick in demand is expected to have served a key growth catalyst in the to-be-reported quarter.

Amtech Systems has made substantial progress in restructuring its operations to improve cost efficiency and better align with evolving market demands. These efforts are already yielding tangible results. Over the last year and a half, it has reduced its factory footprint by reducing its manufacturing factories from seven sites to four sites, while shifting some production to partners.

A core element of this transformation is the adoption of a semi-fabless manufacturing model, which has effectively reduced fixed costs and improved operational leverage. In the third quarter of fiscal 2025, these steps have resulted in $13 million of annual savings. Amtech Systems’ cost reduction initiatives are likely to have positively aided margins in the to-be-reported quarter.

Moreover, Amtech Systems is working to improve profitability through a stronger mix of AI-related equipment and recurring revenues from consumables and service. ASYS continues to manage its pricing strategy with a focus on sustaining robust margins and ensuring long-term profitability in a dynamic market landscape, which is expected to contribute positively in third-quarter results.

However, Amtech Systems continues to face weak demand in its mature node semiconductor business, which remains a major headwind. In the third quarter of fiscal 2025, ASYS' revenues were affected by persistent weakness in the mature node semiconductor market. This, in turn, resulted in lower sales of wafer cleaning equipment, diffusion systems and high-temperature furnaces, all of which are used in chip production mainly in industrial and automotive applications. Continued weakness in mature node demand is likely to have more than offset the benefits of the abovementioned factors in the fourth quarter.

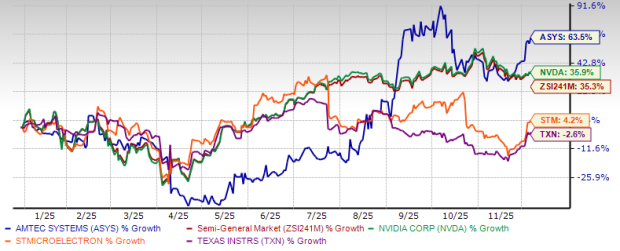

Year to date, Amtech Systems shares have surged 63.5%, outperforming the Zacks Semiconductor - General industry’s growth of 35.3%. The stock also outperformed its industry peers, including NVIDIA (NVDA), STMicroelectronics (STM) and Texas Instruments (TXN). Year to date, shares of NVIDIA and STMicroelectronics have gained 35.9% and 4.2%, respectively, while shares of Texas Instruments have lost 2.6%.

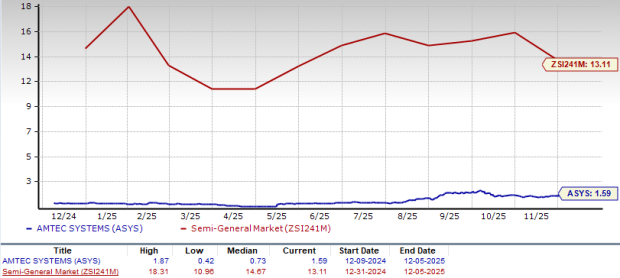

Amtech Systems is currently trading at a lower price-to-sales (P/S) multiple compared with the industry. ASYS’ forward 12-month P/S ratio sits at 1.59X, significantly lower than the industry’s forward 12-month P/S ratio of 13.11X.

Amtech Systems’ stock also trades at a lower P/S multiple compared with other industry peers, including NVIDIA, STMicroelectronics and Texas Instruments. At present, NVIDIA, STMicroelectronics and Texas Instruments have P/S multiples of 15.57X, 1.83X and 8.83X, respectively.

The long-term prospects for the advanced semiconductor packaging industry remain strong, with growing momentum in the sector serving as a tailwind for capital equipment demand. According to a Mordor Intelligence report, the advanced packaging market is estimated to reach $89.89 billion by 2030 from the projection of $51.62 billion for 2025, seeing a CAGR of 11.73%.

This bodes well for Amtech Systems’ prospects, which has identified advanced packaging as a significant growth opportunity. Furthermore, in the third quarter of fiscal 2025, the company observed a strengthening demand for its equipment used in advanced packaging applications, particularly within AI infrastructure, which shows how quickly AI demand is becoming an important part of Amtech Systems’ business. These trends are likely to contribute positively to ASYS’ to-be-reported quarter’s results.

However, the company’s reliance on mature node segments makes its performance more exposed to cyclical downturns. Furthermore, continued weakness in the mature node semiconductor market is hurting the company's overall growth.

ASYS is well-positioned for growth, driven by rising demand for advanced packaging and capital equipment. However, persistent weakness in the mature node semiconductor market continues to be a drag on the overall top-line performance.

Nevertheless, Amtech Systems’ strong fundamentals, discounted valuation and a favorable industry outlook support its long-term potential, making it an attractive long-term hold.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 45 min | |

| 50 min | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite