|

|

|

|

|||||

|

|

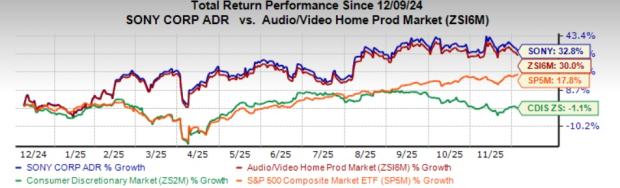

Sony Group Corporation SONY stock has surged 32.8% in the past year, outperforming the Zacks Electronics - Miscellaneous Products industry and the S&P 500 composite’s growth of 30% and 17.8%, respectively. The company also outperformed the Zacks Consumer Discretionary sector, which declined 1.1%. The stock has risen 5.5% in the past six months.

Sony is benefiting from a strategic focus on entertainment-driven businesses and buyout synergies. The company’s fiscal second-quarter results gained from strength in the Game & Network Services (G&NS), Music and Imaging & Sensing Solutions (I&SS) units amid softness in the Pictures and ET&S. Also, the company raised its fiscal 2025 view, driven by momentum in G&NS & Music.

Let us evaluate the pros and cons of SONY and decide the best course of action for your portfolio.

Strategic shift toward an entertainment-focused business has been Sony’s key growth driver over the years. In recent years, it has increasingly relied on expanding its content offerings across games, music, film and TV. The company has also prioritized the growth of its intellectual property across various business areas, made strategic investments in content, music catalogs and emerging sectors such as anime and advanced the development and use of innovative technologies to support content creation. Going forward, Sony’s corporate strategy will center on the momentum achieved so far, with a clear and focused effort to realize its long-term Creative Entertainment Vision, unveiled last year.

The G&NS segment is on a steady track, driven by the continued growth of PlayStation 5 in both active users and user spending. PlayStation’s monthly active users rose 3% year over year in September to 119 million, and total play time for the quarter also grew 1%. For fiscal 2025, the sales forecast has been revised upward by 3% from the previous view, led by favorable forex movements and solid hardware sales. Game software and network services sales are steadily increasing, and it expects this to continue in the second half, driven by more users moving to higher service tiers and stronger first-party game releases. Sony plans to build on this momentum to support long-term, profitable growth and invest in shaping the future of play. The company expects steady growth in revenues and profit from network services as the PS5 user base expands. Key goals include increasing revenues from PlayStation Plus and maximizing PlayStation Store earnings through personalization and pricing optimization.

Sony plans to grow the Music business by expanding into emerging markets (Latin America, India and parts of Europe), where streaming is gaining popularity, by growing organically and through acquisition synergies. It is exploring strategic investments in key areas and music catalogs to grow revenues and increase asset value, with a focus on discovering talent and strengthening ties with local independent labels and artists. Additionally, Sony Music Group strengthened its ties with digital platforms. It signed new licensing deals with Spotify this quarter, along with other labels, and agreed to back Spotify’s efforts to ensure AI is used in ways that support artists and songwriters. For fiscal 2025, the sales forecast has been revised upward by 6% from the previous projection on the back of higher revenues in Visual Media & Platform and foreign exchange tailwinds.

Sony Corporation price-consensus-chart | Sony Corporation Quote

Moreover, the company has been strengthening its business segments through accretive acquisitions and joint ventures. In its growth-focused sports business, Sony closed the acquisition of STATSports in October 2025.

Sony has updated its outlook for the fiscal year ending March 31, 2026. The company expects sales of ¥12,000 billion, up from the previous guidance of ¥11,700 billion. The top-line performance is likely to be driven by strengthening momentum in the G&NS and Music segments.

For G&NS, revenues are now expected to be ¥4,470 billion compared with the earlier projection of ¥4,320 billion, while for Music, net sales are estimated at ¥1,980 billion compared with ¥1,870 billion predicted earlier. For I&SS, revenues are expected at ¥1,990 billion compared with the earlier forecast of ¥1,960 billion. For ET&S, revenues are now estimated at ¥2,300 billion compared with the earlier forecast of ¥2,280 billion.

Operating income guidance has been raised to ¥1,430 billion from ¥1,330 billion. Net income is estimated to be ¥1,050 billion compared with the prior view of ¥970 billion.

Business volatility and intense competition, along with a slowdown in the imaging market, remain a worry. Additional U.S. tariffs are still expected to reduce fiscal 2025 operating income by about ¥50 billion, affecting multiple segments. For the second half of the fiscal year, Sony projects the uncertain environment to persist and expects to operate cautiously, with only modest progress likely.

The stock trades at a forward 12-month price-to-earnings (P/E) ratio of 21.75, below the industry’s average of 21.94.

With a VGM Score of B, the stock delivered an earnings surprise of 36.9%, on average, in the trailing four quarters. The company has an average brokerage recommendation (ABR) of 1.21 on a scale of 1 to 5 (Strong Buy to Strong Sell). ABR is the calculated average of actual recommendations made by brokerage firms and portends the future potential of the stock.

Backed by strong fundamentals and valuation, this Zacks Rank #2 (Buy) stock appears primed for further appreciation.

Some other top-ranked stocks from the broader technology space are Alto Ingredients, Inc. ALTO, Reynolds Consumer Products Inc. REYN and Teradyne, Inc. TER. ALTO sports a Zacks Rank #1 (Strong Buy), REYN and TER carry a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ALTO’s earnings beat the Zacks Consensus Estimate in two of the trailing four quarters while missing in two, with the average surprise being 81.67%. In the last reported quarter, Alto delivered an earnings surprise of 416.67%. Its shares have surged 68.4% in the past year.

REYN’s earnings beat the consensus estimate in two of the trailing four quarters while in line in two, with the average surprise being 2.58%. In the last reported quarter, Reynolds Consumer delivered an earnings surprise of 7.69%. Its shares have decreased 10.1% in the past year.

Teradyne earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 10.76%. In the last reported quarter, TER delivered an earnings surprise of 8.97%. Its shares have jumped 68.6% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-07 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite