|

|

|

|

|||||

|

|

Affirm Holdings, Inc. AFRM is priced like a winner long before the win is secured. Its valuation stands well above the rest of the industry peers, while analysts still project further upside from here. That disconnect forces investors to choose a side: is the market early in recognizing Affirm’s growth power, or already overpaying for a story that hasn’t fully materialized?

Affirm currently trades at a forward 12-month price-to-earnings (P/E) multiple of 54.61X, more than fifty percent above the broader industry average of 34.17X. The gap is even more pronounced when compared with rival BNPL platforms. PayPal Holdings, Inc. PYPL trades at 10.67X, while Block, Inc. XYZ trades at 33.60X. From a pure valuation standpoint, Affirm is priced aggressively, reflected in its Value Score of D.

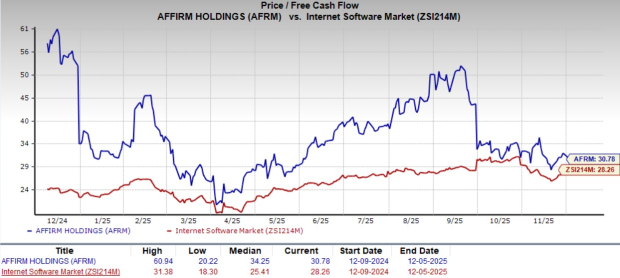

Free cash flow analysis reflects a similar dynamic. Affirm’s free cash flow rose 27.8% over the past year to $769 million, a healthy result and a key positive for a company still scaling its ecosystem. However, its price-to-free cash flow (P/FCF) of 30.78X remains at a premium to the industry average of 28.26X. Investors are clearly impressed with Affirm’s growth potential, and are paying up for it.

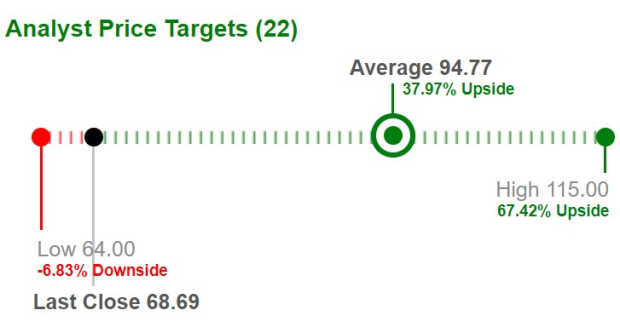

Despite these premium multiples, Affirm trades well below the average analyst price target of $94.77, implying nearly 38% upside. The spread between the high target of $115 and the low target of $64 reflects differing views on merchant retention, global expansion, and underwriting scalability. However, the consensus direction remains positive, suggesting that the market expects Affirm to convert its user base into durable earnings growth.

The question becomes whether the fundamentals are strong enough to justify the valuation gap, especially in a category facing rising competition and merchant churn.

Affirm exited its most recent fiscal quarter with $1.4 billion in cash and cash equivalents, up 5.5% from fiscal 2025 levels. At the same time, funding debt increased to $1.8 billion, pushing the long-term debt-to-capital ratio to a steep 70.62% compared with the industry average of just 13.38%. Leverage is clearly elevated, and a sharp contrast to the asset-light positioning of peers. However, Affirm’s growing cash generation provides some safety, allowing continued investment into technology, underwriting, and product expansion.

Despite recent pullbacks triggered by intensifying competitive pressure, Affirm shares have posted an 11.6% gain so far this year, beating the industry’s 10.2% average. The company has outperformed PayPal and Block during the period but still trails the broader S&P 500 Index.

Competition remains the sharpest risk for Affirm. Deep-pocketed rivals, including PayPal and Block, are pushing aggressively into BNPL, supported by their existing merchant networks and embedded payment ecosystems. Traditional financial institutions are also expanding installment-based payment offerings.

A major hit came when Walmart replaced Affirm with Klarna Group plc KLAR for its installment options. Klarna has moved fast, even launching KlarnaUSD, a USD-backed stablecoin, an example of how quickly competitive innovation is reshaping the payments landscape.

On the cost side, operating expenses have been rising: 25.9% in fiscal 2023, 5.4% in fiscal 2024, 12.7% in fiscal 2025 and 4.6% in the first quarter of fiscal 2026. While accelerating investments support scale, margin pressure will force tighter cost discipline over the medium term.

Despite the risks, Affirm’s growth story remains compelling. The company is not merely onboarding new users; it is building repeat usage that increases lifetime value. Short-term offerings drive transaction frequency, and the payoff shows: 96% of fiscal first-quarter 2026 transactions came from repeat customers.

Affirm is also extending its presence into everyday spending categories such as grocery, fuel, travel and subscription services. Transactions surged 52.2% year over year to 41.4 million in the most recent quarter.

Beyond BNPL, the Affirm Card represents a major growth vector. The company added 500,000 cardmembers in the last reported quarter, with Affirm Card GMV rising 135% to $1.4 billion, supported by its early success with the cash-flow underwriting method. It is investing in debit solutions and B2B tools, enhancing its product ecosystem. With its differentiated technology and underwriting, customer relationships are expected to deepen.

The international roadmap is expanding as well, with the Shopify partnership entering France, Germany, and the Netherlands. With 420,000 merchant partners and 24.1 million active consumers, Affirm’s network effect gives it a meaningful runway.

The Zacks Consensus Estimate for Affirm’s fiscal 2026 earnings suggests a nearly 567% year-over-year increase to $1 per share, while fiscal 2026 earnings are expected to increase to $1.56. Revenue projections are also strong, with fiscal 2026 and 2027 expected to grow 26% and 22.8%, respectively.

The company anticipates fiscal 2026 Gross Merchandise Value to be more than $47.5 billion. Affirm has also crushed estimates in each of the past four quarters, with an average surprise of 129.3%.

Affirm Holdings, Inc. price-consensus-eps-surprise-chart | Affirm Holdings, Inc. Quote

Affirm presents a classic growth-versus-valuation dilemma. Its expanding user base, strong repeat engagement, rising GMV, and new product momentum support a long runway, while the Shopify expansion adds international optionality. However, the stock’s premium multiples, elevated leverage, and intensifying competition temper the bullish narrative. Analyst targets imply upside, but execution must remain strong to justify the valuation gap.

With fundamentals improving yet risks clearly visible, the risk-reward profile appears balanced at current levels. Affirm’s growth story remains intact, but investors may want more margin sustainability signs before committing further. Affirm currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 36 min | |

| 50 min | |

| 51 min | |

| 56 min | |

| 59 min | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 2 hours | |

| 2 hours |

Heard on the Street: Credit Fears Are Spreading to Consumer Lending

AFRM -7.91%

The Wall Street Journal

|

| 2 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite