|

|

|

|

|||||

|

|

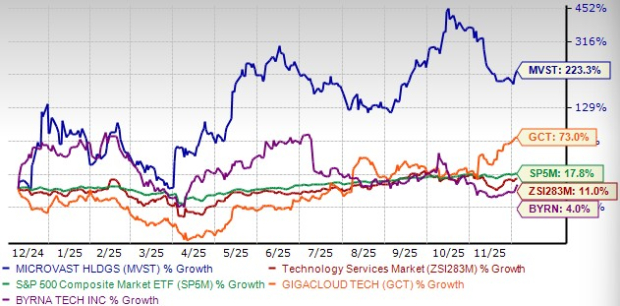

Microvast Holdings MVST shares have experienced remarkable growth over the past year. It has surged 223.3% during the period, outperforming the 11% rise of its industry and 17.8% growth of the Zacks S&P 500 Composite.

MVST has outperformed its competitors, with GigaCloud Technology GCT and Byrna Technologies BYRN gaining 73% and 4%, respectively.

However, the recent performance paints a different picture, with Microvast shares dipping 24.7% in the past month. Microvast has underperformed its industry peers, GigaCloud Technology and Byrna Technologies, over the past month. GigaCloud Technology and Byrna Technologies have rallied 18.7% and 7.8%, respectively.

Let us analyze further to find out whether investors should ride the rally or square off their position to book profits.

MVST’s APAC-centric Huzhou Phase 3.2 expansion is vital to expanding its production capacity. This project is expected to add 2 GWh in annual production capacity in the first quarter of 2026. The key priority of this plan is to cater to the strong customer demand, cementing Microvast’s path to capture a higher market share.

This expansion is supported by MVST’s prudent CapEx trend. In the third quarter of 2025, the company logged $17.4 million in CapEx, out of which $15.5 million was apportioned to the expansion plan. The company managed to shoulder $30.6 million in CapEx in the year-ago quarter, highlighting its focus on high-return capacity expansions rather than asset base building.

Despite this optimistic trajectory, Microvast may find itself amid operational execution risks. Supply-chain disruption may hinder equipment installation and commissioning for expansion by the year-end, deteriorating the scalability of capacity.

A net loss of $1.5 million in the third quarter of 2025 from the year-ago quarter’s net profit of $13.2 million signals instability in core profitability, raising red flags for investors. In the recently reported quarter, Microvast’s inability to generate profit despite registering 21.6% year-over-year growth in its revenues and a 440-basis-point expansion in the gross margin raises serious questions about the business model.

This fiasco is particularly due to a $12.6-million non-cash loss from changes in the fair value of warrant liability and convertible loan. It provokes questions on how a solid operational performance does not guarantee profitability due to unpredictable accounting adjustments of debt and equity.

Return on equity (ROE) is a profitability metric that assesses how effectively a company utilizes shareholders' equity to generate earnings. By the end of the third quarter of 2025, Microvast reported a ROE of 12.1%, below the industry’s 15.5%.

Return on invested capital (ROIC) reveals a company’s efficacy in deploying total capital to generate operating profits. In the case of MVST, it stands at 6.3%, which is lower than the industry’s 7.7%.

Lagging the industry in capital generation efficiency weakens MVST’s competitive advantage due to subpar profit generation from its equity and capital base compared with its peers.

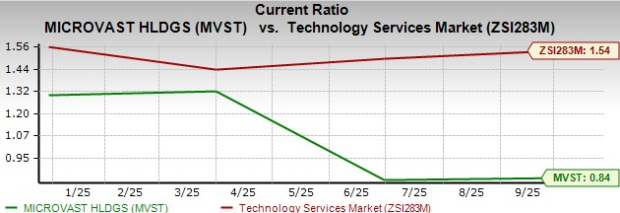

As of Sept. 9, 2025, Microvast held $143 million in cash and equivalents compared with a significantly higher $335 million current debt. It hints at liquidity risks and financial distress, further confirmed by its current ratio of 0.8 in the third quarter of 2025, which, aside from being below 1, also underperforms the industry’s 1.5. Taking everything into account, it appears that MVST may face challenges in settling its short-term obligations.

Neither MVST declared dividends nor disclosed any plans to do so in the near future. Therefore, the only way to achieve a return on investment in the company’s stock is share price appreciation, which is not guaranteed, evidenced by a 24.7% decline in its share price in the past month. Hence, dividend-seeking investors may find Microvast shares unappealing.

Despite a substantial decrease in the share price over the past month, Microvast has shown a massive upside of 233.3% in a year. Investors who have held on to this stock for the long run may consider selling their shares to book profits now, as we are highly skeptical regarding Microvast’s investment prospects.

Despite the company’s well-managed plan for Huzhou Phase 3.2 expansion, operational risks linger. The recent detriment in terms of net loss compared with a considerably profitable year-ago quarter raises red flags. Alongside this distress, MVST falls behind its industry in terms of capital return, affecting investors’ morale.

We have reservations about the company’s liquidity position as it hints at the inability to pay off short-term obligations. Microvast’s zero dividend policy makes dividend-seeking investors shy away from investing, which is another concern.

We expect these factors to lead to a further decrease in the share price. Hence, we recommend potential investors to stay away from this stock for now.

Microvast carries a Zacks Rank #4 (Sell) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-19 | |

| Feb-17 | |

| Feb-12 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-06 | |

| Feb-06 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite