|

|

|

|

|||||

|

|

Carlsmed CARL recently announced the U.S. commercial launch of its aprevo Technology Platform for cervical fusion procedures at the Cervical Spine Research Society (CSRS) 53rd Annual Meeting in Washington, D.C. The launch marks the company’s most important expansion of its patient-specific surgical ecosystem, following the successful adoption of its lumbar fusion platform. More than 50 cervical cases have already been completed. Early clinical findings are being shared by surgeon adopters in a dedicated CSRS workshop.

The cervical system extends Carlsmed’s AI-driven approach to surgical planning, pairing three-dimensional preoperative modeling with 3D-printed implants designed for each patient’s anatomy. Early clinical observations highlight efficient workflow integration, enhanced endplate coverage and the ability to meet sagittal and coronal alignment goals more reliably than stock implants—an increasingly important capability given the 370,000 cervical fusion surgeries performed annually in the United States. Surgeons participating in the evaluation cited improved precision and expanded opportunities to treat complex patients.

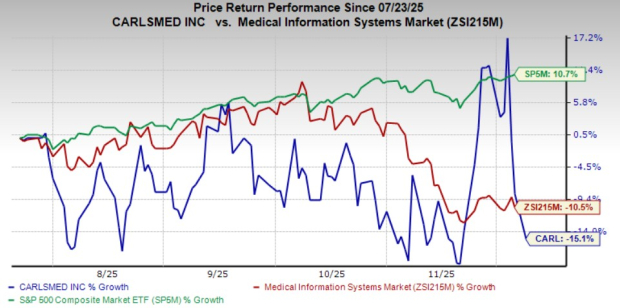

Following the announcement on Dec. 3, the company's shares declined 27.5% till yesterday’s closing. CARL’s shares have declined 15.1% compared with the industry’s 10.5% fall since its IPO on July 23, 2025. The S&P 500 has gained 10.7% in the same time frame.

With robust clinical validation, strong reimbursement tailwinds, FDA clearance and a growing base of surgeon adopters, Carlsmed’s cervical platform positions it at the forefront of personalized spine surgery. As demand accelerates, the launch signals not just an expansion of product offerings, but a meaningful shift toward precision-engineered spinal care in one of the largest fusion markets in the United States.

CARL currently has a market capitalization of $352.6 million.

The launch comes on the heels of several milestones that have built momentum for Carlsmed’s cervical platform. In July 2025, the company announced that its first personalized cervical spine surgery had been performed at UC San Diego by Dr. Joseph Osorio, who emphasized the platform’s ability to achieve alignment levels difficult to match with traditional implants. Executives framed the milestone as a natural extension of the company’s expansion into personalized cervical procedures, particularly following its IPO and growing clinical partnerships.

Regulatory and reimbursement progress bolstered the platform’s commercial outlook. In August 2025, the Centers for Medicare & Medicaid Services granted New Technology Add-On Payment (NTAP) status to cervical fusion procedures using aprevo implants, enabling hospitals to receive up to $21,125 in additional reimbursement per qualifying procedure beginning in October 2025. This decision followed CMS’s earlier reimbursement support for lumbar applications and is expected to accelerate adoption by reducing financial barriers for both hospitals and payors.

Carlsmed’s path toward cervical commercialization began with the FDA 510(k) clearance of the aprevo Cervical ACDF Interbody System in late 2024. The device — also designated as a Breakthrough Technology — was recognized for its potential to address unmet needs in cervical fusion by replacing one-size-fits-all implants with level-specific customization. Clinical leaders highlighted the system’s ability to improve coverage and alignment, both critical to reducing complications and revision rates. The company had initially expected a 2025 commercial launch, and the recent rollout thus meets the timeline.

Carlsmed, Inc. price | Carlsmed, Inc. Quote

Currently, Carlsmed carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are Medpace Holdings MEDP, Intuitive Surgical ISRG and Boston Scientific (BSX).

Medpace, currently carrying a Zacks Rank #2 (Buy), reported third-quarter 2025 earnings per share (EPS) of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy)stocks here.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company beat earnings estimates in each of the trailing four quarters, the average surprise being 14.28%.

Intuitive Surgical, sporting a Zacks Rank #1 at present, posted third-quarter 2025 adjusted EPS of $2.40, exceeding the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Boston Scientific, currently carrying a Zacks Rank #2, reported third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion outperformed the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite