|

|

|

|

|||||

|

|

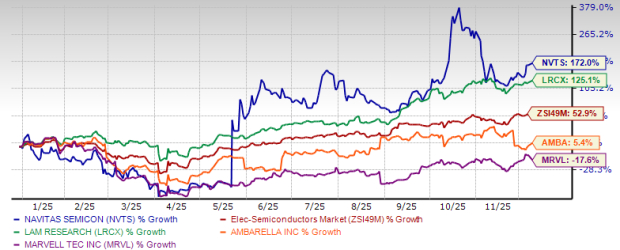

Navitas Semiconductor (NVTS) shares have rallied 172% year to date, outperforming the Zacks Electronics - Semiconductors industry’s growth of 52.9%. The stock also outperformed its industry peers, including Lam Research (LRCX), Marvell Technology (MRVL) and Ambarella (AMBA). Year to date, shares of Lam Research and Ambarella have gained 125.1% and 5.4%, respectively, while Marvell Technology shares have plunged 17.6%.

Navitas Semiconductor’s focus on power chips for artificial intelligence (AI) data centers and its shift to cost-efficient manufacturing have fueled optimism about its growth prospects. The outperformance of Navitas Semiconductor’s share price raises the question: Does it still have room to run, or is it time for investors to consider taking profits? Let us find out.

Navitas Semiconductor is trying to reposition itself around high-power markets, and its inclusion in NVIDIA’s new 800-volt AI factory ecosystem is an important step. The new architecture shifts data center power distribution from traditional AC/DC stages to a high-voltage DC approach that requires faster, more efficient power electronics. This creates an opening for Navitas Semiconductor’s gallium nitride (GaN) and high-voltage silicon carbide (SiC) technologies, both of which are now part of the NVIDIA-led ecosystem.

In the third quarter of 2025, Navitas Semiconductor highlighted that it is one of the few companies offering both GaN and SiC solutions across the full power path, from the grid to the graphics processing unit (GPU). The company has begun sampling mid-voltage GaN devices at 100 volts, which target the last stage of power conversion inside AI servers. It is also sampling 2.3 kV and 3.3 kV SiC modules for grid and energy storage applications that support these new data center designs.

Navitas Semiconductor expects 2026 to be a transition year, with small but growing shipments tied to traditional server power supplies. The larger opportunity depends on how fast hyperscalers adopt the 800-volt architecture and will depend on Navitas Semiconductor's ability to secure multi-generation design wins.

Navitas Semiconductor is moving quickly to shift its business away from low-margin mobile business and toward high-power markets, such as AI data centers, performance computing, energy storage, and grid infrastructure. Management calls this transition “Navitas 2.0,” and the company has already started reallocating its engineering, sales, and Research and Development resources to support these markets, as the company believes high-power markets offer better long-term potential.

Moreover, the company is witnessing growing customer interest in its GaN and high-voltage SiC products, especially as hyperscalers and GPU vendors work on new power architectures for AI data centers. Navitas Semiconductor’s customers require faster development and deeper collaboration, where the company’s GaN and high-voltage SiC technologies will play a pivotal role to support these new-age AI architectures, driving the company to accelerate its shift to these fast-growing high-power markets.

The transition will take time. Navitas Semiconductor expects 2026 to show gradual quarter-over-quarter growth as high-power programs ramp. The bigger opportunity is expected in 2027, when new AI power designs begin volume adoption. The company also expects margins to improve as high-power products carry higher value and more predictable, multi-generation demand.

For the full-year 2025, the Zacks Consensus Estimate for NVTS’ bottom line is pegged at a loss of 21 cents per share, narrowed down by a penny over the past 60 days. NVTS reported a loss of 24 cents per share in 2024.

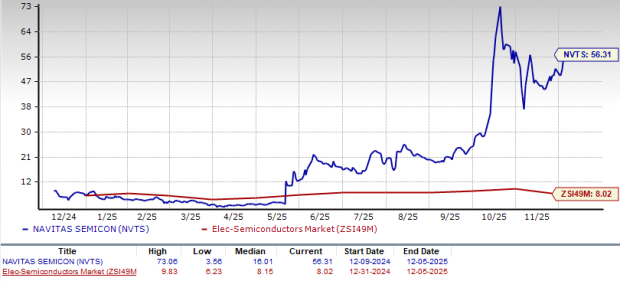

Navitas Semiconductor is currently trading at a higher price-to-sales (P/S) multiple compared with the industry. NVTS’ forward 12-month P/S ratio sits at 56.31X, significantly higher than the industry’s forward 12-month P/S ratio of 8.02X.

Navitas Semiconductor stock also trades at a higher P/S multiple compared with other industry peers, including Lam Research, Marvell Technology and Ambarella. At present, Lam Research, Marvell Technology and Ambarella have P/S multiples of 8.99X, 8.66X and 7.5X, respectively. NVTS’ rally reflects investor excitement about AI-related chip demand, putting it above the industry and peers in terms of valuation, reflecting the high growth expectations of the company in the long term.

Navitas Semiconductor is in a good position to benefit from the fast growth of AI data centers. Its GaN and SiC chips are well-suited for new high-voltage systems that need more efficient power use. Moreover, the company’s GaN and high-voltage SiC products now play a role in NVIDIA’s new 800-volt power setup, which shows that the technology is relevant and in demand.

Additionally, the company’s focus on the AI data center boom supports its long-term potential. If the company executes well, it could see better margins, a stronger product mix, and a clearer path to stable long-term growth.

Navitas Semiconductor currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 1 hour | |

| 2 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite