|

|

|

|

|||||

|

|

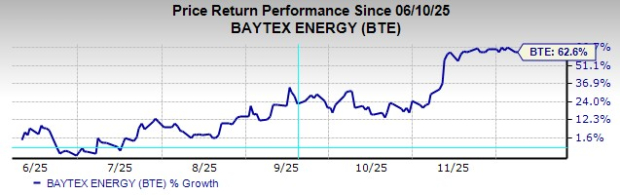

Baytex Energy (BTE) has surged more than 60% over the past six months and reached a fresh 52-week high of $3.32 on Friday. The rally reflects growing confidence in the company’s post-sale strategy, which refocuses the business on its highest-return Canadian assets. With lighter maintenance requirements, a stronger balance sheet and improving free cash flow visibility, the company is set to enter 2026 in a far better position to compound value.

A reset of this scale has important implications for long-term investors. The new Baytex is leaner, more cash-efficient and positioned to drive steady growth from heavy oil, its Viking and Pembina Duvernay assets. As investors continue to compare Baytex with bigger Canadian peers like Suncor Energy (SU) and Canadian Natural Resources (CNQ), the improving quality of Baytex’s asset base and growth outlook becomes increasingly evident.

The sale of the Eagle Ford assets for C$3.25 billion marks a transformational simplification of Baytex’s portfolio, eliminating exposure to U.S. interest costs while concentrating capital on its Canadian heavy oil, Viking and Pembina Duvernay properties. Management emphasized that the proceeds will repay the bank line and 2030 bonds, resulting in a net cash position at closing. This structure lowers sustaining capital requirements and materially reduces corporate breakeven, which had long been under pressure due to the mixed cost profile of Eagle Ford operations.

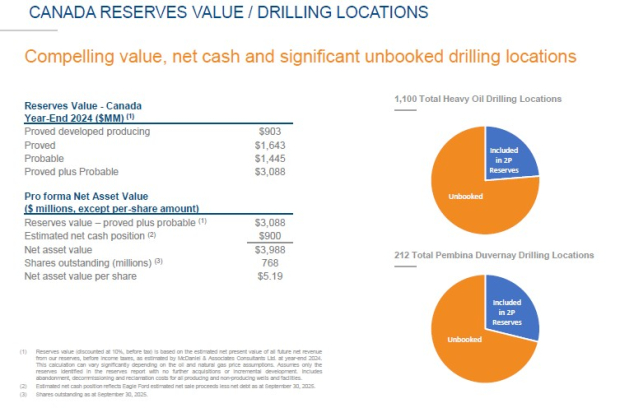

The substantially lower breakeven gives Baytex far greater flexibility in various pricing environments, while the strengthened balance sheet enhances its capacity to reinvest, return cash to shareholders and pursue smaller strategic acquisitions. With an estimated net cash position of roughly C$900 million and a pro forma net asset value of C$3.99 billion, Baytex enters 2026 as one of the financially strongest names in its peer set — particularly when compared to larger Canadian producers like Suncor Energy and Canadian Natural Resources.

Baytex delivered 5% quarter-over-quarter heavy oil growth in the third quarter of 2025. Record performance across Clearwater, Bluesky and Mannville assets was supported by new pool discoveries and multilateral development success, which together underpin the stability of Baytex’s heavy oil business. These plays are characterized by low breakevens, allowing the company to remain cash-flow positive even when pricing softens, further aided by improved market access following the Trans Mountain Expansion pipeline startup.

Inventory depth is another competitive advantage. Baytex controls approximately 1,100 heavy oil drilling locations, representing more than a decade of future development runway. This long-life, repeatable resource base gives Baytex multi-year visibility to production stability and cash flow generation — an attribute investors typically associate with large-cap peers like Canadian Natural and Suncor. The strategic shift back to heavy oil, supported by modern drilling efficiencies, positions Baytex to extract consistent value from a historically cyclical segment.

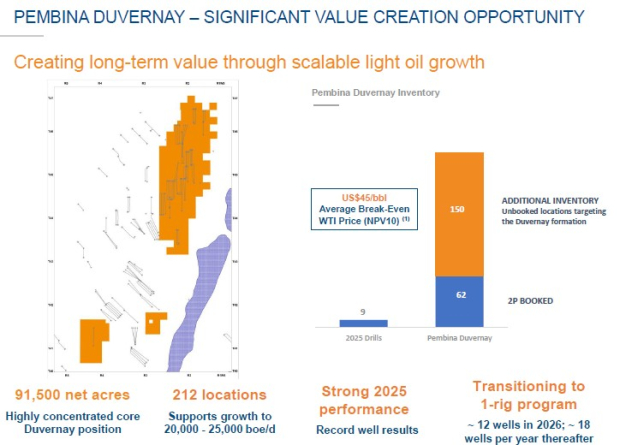

While heavy oil drives near-term cash flow, Pembina Duvernay is poised to be Baytex’s largest source of long-term growth. The asset’s recent quarterly results were exceptional. Pembina Duvernay production surged to a record 10,185 barrels of oil-equivalent per day (Boe/d) in the third quarter, up 53% sequentially. The strong performance across recent wells underscores the productivity and high quality of this condensate-rich play.

Baytex plans to scale development into a full one-rig continuous program in 2026, supported by 212 total drilling locations that provide years of growth runway. The company reiterated its goal of growing Pembina volumes to 20,000–25,000 Boe/d by 2029–2030. Given the robust well results and improved completion efficiency, this target appears well supported. Duvernay thus complements heavy oil by giving Baytex a scalable light-oil engine with strong capital efficiency — an important consideration relative to diversified competitors such as Canadian Natural and Suncor Energy.

Baytex’s third-quarter 2025 results underscore the benefits of its capex phasing. More than 80% of its 2025 exploration and development spending occurred in the first three quarters of the year, meaning softer fourth-quarter production expectations are offset by significantly lower capital outlays. The company generated C$143 million in free cash flow in the third quarter and, despite softer commodity prices, is projected to deliver meaningful free-cash-flow contributions in the fourth quarter and for the full year.

By year-end, net debt is expected to decline to about C$2.1 billion, and credit facility drawings should remain minimal, underscoring the continued strengthening of the balance sheet. As capex moderates further in 2026, free cash flow visibility strengthens materially, supporting both shareholder returns and disciplined reinvestment.

Baytex is currently a Zacks Rank #1 (Strong Buy) stock. The company’s strategic reset, strengthened financial position, high-quality heavy oil inventory and fast-growing Pembina Duvernay platform all point to sustained operational momentum. Supported by improving fundamentals, Baytex’s current investment profile appears increasingly compelling for investors seeking exposure to a leaner, more resilient Canadian producer.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite