|

|

|

|

|||||

|

|

Johnson & Johnson JNJ and Pfizer PFE are both healthcare leaders with large drug portfolios and diversified revenue streams, making them direct peers in the blue-chip healthcare space. Both companies have a strong presence in oncology. Other than that, J&J also has drugs for immunology, neuroscience, cardiovascular and metabolic diseases, pulmonary hypertension and infectious diseases, along with a strong presence in the medical devices segment.

Pfizer, meanwhile, has a solid presence in inflammation and immunology, rare diseases and vaccines.

Both firms face looming patent expirations and headwinds from Medicare Part D redesign. But which one is a better investment option today? Let’s take a closer look at their fundamentals, growth prospects and challenges to make an informed choice.

J&J’s biggest strength is its diversified business model, as it has not just pharmaceuticals, but also medical devices, helping it to withstand economic cycles more effectively. It operates through more than 275 subsidiaries and is less reliant on a single blockbuster drug.

J&J has recorded a strong operational performance so far in 2025, backed by double-digit growth in revenues from key brands and contributions from new launches.

Sales in J&J’s Innovative Medicine unit rose 3.4% in the first nine months of 2025 on an organic basis despite the loss of exclusivity (LOE) of its multi-billion-dollar product, Stelara, and the negative impact of the Part D redesign. Growth is being driven by J&J’s key drugs like Darzalex, Erleada and Tremfya. New drugs like Carvykti, Tecvayli, Talvey, Rybrevant and Spravato also contributed significantly to growth.

J&J’s MedTech business has improved in the past two quarters, driven by the acquired cardiovascular businesses, Abiomed and Shockwave, as well as Surgical Vision and wound closure in Surgery. Improvements in J&J’s electrophysiology business also drove the growth.

Moreover, the potential separation of its Orthopaedics franchise into a standalone orthopedics-focused company, called DePuy Synthes, should improve its MedTech unit’s growth and margins. The Orthopaedics franchise has been a slow-growth business for J&J.

However, the company continues to face headwinds in MedTech China. Sales in China are being hurt by the impact of the volume-based procurement (VBP) program, which is a government-driven cost containment effort in China. J&J expects continued impacts from VBP issues in China as the program continues to expand across provinces and products.

In 2026, J&J expects accelerated growth in both the Innovative Medicine and MedTech segments.

J&J has rapidly advanced its pipeline this year, attaining significant clinical and regulatory milestones that will help drive growth through the back half of the decade. This year, it gained approval for new products like Inlexzoh/TAR-200, a first-of-its-kind drug-releasing system, for treating high-risk non-muscle invasive bladder cancer and Imaavy (nipocalimab) for treating generalized myasthenia gravis. J&J believes that nipocalimab has a pipeline-in-a-product potential. Regulatory applications were recently filed for another key candidate, icotrokinra, for moderate-to-severe plaque psoriasis. J&J believes that icotrokinra has the potential to revolutionize the treatment of plaque psoriasis with a once-a-day pill.

J&J believes 10 of its new products/pipeline candidates in the Innovative Medicine segment have the potential to deliver peak sales of $5 billion, including Talvey, Tecvayli, Imaavy, Caplyta, Inlexzo, Rybrevant, plus Lazcluze and icotrokinra.

However, the Stelara patent cliff, the impact of Part D redesign, slowing sales in China in the MedTech segment and the pending talc lawsuits are significant headwinds.

Pfizer is one of the largest and most successful drugmakers in oncology. Oncology sales comprise around 28% of its total revenues. Its oncology revenues have risen 7% year to date, driven by drugs like Xtandi, Lorbrena, the Braftovi-Mektovi combination and Padcev.

Pfizer’s non-COVID operational revenues are improving, driven by its key in-line products like Vyndaqel, Padcev and Eliquis, new launches and newly acquired products like Nurtec and those from Seagen (December 2023). Pfizer's recently launched and acquired products rose approximately 9% operationally in the nine months of 2025, with the momentum expected to continue.

Continued growth of Pfizer’s diversified portfolio of drugs, particularly oncology, should support top-line growth in 2026.

Pfizer’s new products/late-stage pipeline candidates and newly acquired products position it strongly for operational growth in 2025 and beyond. Pfizer expects the 2025 to 2030 revenue CAGR to be approximately 6%.

Its significant cost reduction and efforts to improve R&D productivity measures are also driving profit growth. Pfizer expects cost cuts and internal restructuring to deliver savings of $7.7 billion by the end of 2027. Pfizer’s dividend yield stands at around 7%, which is impressive.

Pfizer is also trying to expand its pipeline through acquisitions. In the first nine months of this year, Pfizer has invested approximately $1.6 billion in business development transactions, primarily reflecting the 3SBio licensing deal. In addition, the $10 billion Metsera acquisition has brought Pfizer back into the lucrative obesity space after it scrapped the development of danuglipron, a weight-loss pill, earlier this year. The acquisition will add Metsera’s four novel clinical-stage incretin and amylin programs in obesity, which are expected to generate billions of dollars in peak sales.

Pfizer signed a drug pricing agreement with the Trump administration in September. It has offered to cut prescription drug prices and boost domestic investments in exchange for a three-year exemption from tariffs on pharmaceutical imports. This landmark agreement with the U.S. government was an important milestone for Pfizer as it provides longer-term clarity on the company’s strategic investment in innovation and growth.

However, Pfizer faces its share of challenges. It is seeing a softness in sales of its COVID products, Comirnaty and Paxlovid, due to lower vaccination rates and COVID infection rates.

Pfizer also expects a significant impact from the loss of patent exclusivity in the 2026-2030 period, as several of its key products, including Eliquis, Vyndaqel, Ibrance, Xeljanz and Xtandi, will face patent expirations. Pfizer expects an unfavorable impact of approximately $1 billion from the Medicare Part D redesign under the Inflation Reduction Act (IRA), which took effect in the first quarter of 2025 and is hurting Pfizer’s revenues. Higher-priced drugs, including Eliquis, Vyndaqel, Ibrance, Xtandi and Xeljanz, are most affected by the IRA.

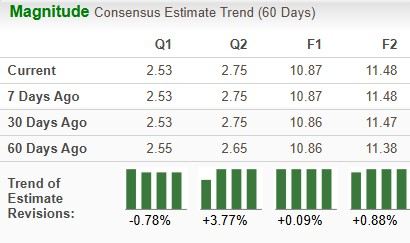

The Zacks Consensus Estimate for J&J’s 2025 sales and EPS implies a year-over-year increase of 5.5% and 8.9%, respectively. The Zacks Consensus Estimate for 2025 earnings has risen from $10.86 per share to $10.87 per share for 2025 and from $11.38 per share to $11.48 per share over the past 60 days.

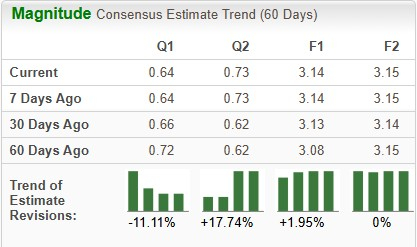

The Zacks Consensus Estimate for Pfizer’s 2025 sales implies a year-over-year decline of 1.08% while earnings are expected to increase around 1%. The Zacks Consensus Estimate for 2025 earnings has risen from $3.08 per share to $3.14 per share, while that for 2026 has been stable at $3.15 per share over the past 60 days.

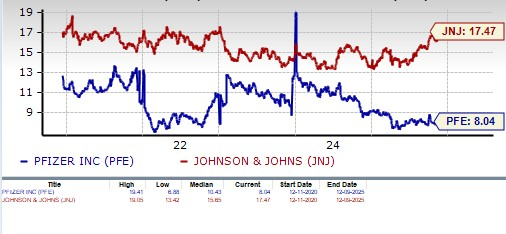

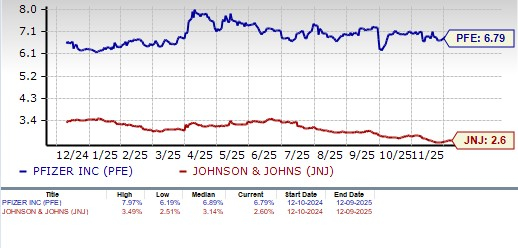

Year to date, J&J’s stock has risen 38.3%, while Pfizer’s stock has declined 4.5%. The industry has witnessed an increase of 12.8% in the said time frame.

Pfizer looks more attractive than J&J from a valuation standpoint. Going by the price/earnings ratio, J&J’s shares currently trade at 17.47 forward earnings, higher than 16.48 for the industry and the stock’s 5-year mean of 15.65. Pfizer’s shares currently trade at 8.04 forward earnings, lower than 16.48 for the industry and the stock’s 5-year mean of 10.43.

Johnson & Johnson's dividend yield is 2.6%, while Pfizer's is 6.8%.

Both J&J and Pfizer have a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This makes choosing one stock a difficult task.

However, J&J’s improving growth prospects, price appreciation this year and rising estimates clearly show that it is a better pick than Pfizer. J&J has shown steady revenue and EPS growth for years. J&J expects sales growth in both segments to be higher in 2026. It also boasts strong cash flows and has consistently increased its dividends for 63 consecutive years.

Despite headwinds like softness in the MedTech unit, the legal battle surrounding its talc lawsuits, the Stelara patent cliff and the impact of Part D redesign, J&J looks quite confident that it will be able to navigate these challenges.

Pfizer stock has taken a beating in the past three years as its revenues have declined substantially due to lower sales of its COVID products. Though Pfizer is on a recovery path, the upcoming patent cliff raises uncertainty about how the company navigates through the challenge.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite