|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Neogen Corporation NEOG is well-poised to gain in the coming quarters, thanks to its continued product development efforts that enhance its existing offerings and advance its business strategy. The Animal Safety segment is gaining from strong performances of a complete line of consumable products marketed to veterinarians and animal health product distributors. The integration of the former 3M Food Safety business is also very promising. Meanwhile, an unfavorable solvency position and macroeconomic impacts remain concerns for Neogen’s operations.

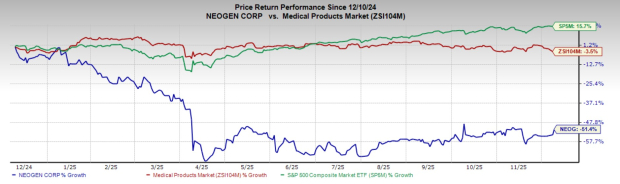

The Zacks Rank #3 (Hold) stock has declined 51.4% in the past year, underperforming the industry’s 3.5% fall as well as the S&P 500 composite’s 15.7% gain.

The renowned food and animal safety product provider has a market capitalization of $1.31 billion. The company has an estimated earnings growth rate of 36.4% for fiscal 2026 compared with the S&P 500’s 16.7% growth. Neogen’s earnings yield of 7.3% favorably compares with the industry’s 0.1% yield.

Let’s delve deeper.

Product Launches: Neogen’s recent key launches include the Molecular Detection Assay - Listeria Right Now, a rapid, enrichment-free solution for detecting Listeria species in the environment. Neogen introduced Igenity BCHF to improve overall bovine heart health standards. It also launched the Neogen Molecular Detection Assay 2 – Quantitative Salmonella (MDA2QSAL96), which integrates qualitative pathogen testing solutions and Quantitative Rapid Enrichment Dehydrated (QRED) media to enable controlled growth rates for quantitation, allowing poultry producers to verify the effectiveness of their interventions.

In December 2024, the company introduced the Neogen Petrifilm Bacillus cereus Count Plate, a new addition to the Petrifilm product line. Neogen has ongoing development projects for several new and improved diagnostic tests and other complementary products for both the Food Safety and Animal Safety markets, many of which are expected to be commercially available at various times during fiscal 2025 and 2026.

3M Integration Synergy Appears Impressive: Neogen’s 2022 merger with 3M’s Food Safety business is expected to generate significant long-term value for shareholders of the combined company. The combined company will have the enhanced geographic footprint, innovative product offerings, digitization capabilities and financial flexibility to capitalize on robust growth trends in sustainability, food safety and supply-chain integrity. The transaction also added 3M’s globally recognized indicator testing brand, Petrifilm, which is now part of Neogen Culture Media. Neogen has made significant progress in integrating the former 3M Food Safety business, navigating through a complex process amid execution and macroeconomic challenges.

With respect to Petrifilm, the company recently began initial product testing to confirm that the different steps of production are able to execute processes within the required parameters. With promising early results, Neogen expects to complete the testing process within the next couple of months, before transitioning individual SKUs to the line for full validation.

Strong Prospects for Animal Safety: Within the Animal Safety segment, Neogen continues to focus on driving growth in the direct-to-producer beef and dairy segments while targeting actions to right-size the cost base to better align with the current level of revenues. In the first quarter of fiscal 2026, the Animal Care product category delivered solid growth, led by higher sales of biologics and wound care products.

Life Sciences product category growth reflected higher sales of substrates and reagents, while Biosecurity sales were driven by growth in insect control products. In addition, the genomics business marked the quarter of growth since fiscal year 2023, reflecting the strategic exit from certain less attractive, end-market exposures. The global genomics business had core growth of 4%, aided by strong performance in the bovine market.

Weak Solvency: Neogen exited the first quarter of fiscal 2026 with cash and cash equivalents of $138.9 million and a significantly high total outstanding debt of $800.0 million. The debt-to-capital ratio was 27.2%, down 2.9% on a sequential basis.

Global Economic Problems Dent Growth: The current macroeconomic environment has adversely affected Neogen’s financial operations. Governments and insurance companies continue to look for ways to contain the rising cost of healthcare, potentially putting pressure on players in the healthcare industry. Deteriorating international trade, global inflationary pressure, freight charges and rising interest rates have resulted in higher raw material and labor costs. Additionally, due to the current steep tariff rates imposed by the U.S. government, the company expects an approximately $10 million annualized impact, given the status of surcharges, competitor actions and the timing of certain resourcing opportunities.

In the past 30 days, the Zacks Consensus Estimate for Neogen’s earnings for fiscal 2026 has remained constant at 45 cents.

The Zacks Consensus Estimate for fiscal 2026 revenues is pegged at $823.8 million, which indicates a 7.9% decline over 2025.

Some better-ranked stocks in the broader medical space are BrightSpring Health Services BTSG, lllumina ILMN and Omnicell OMCL.

BrightSpring Health Serviceshas an estimated long-term earnings growth rate of 53.3% compared with the industry’s 15.5% growth. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 45.1%. BTSG shares have surged 93.9% against the industry’s 0.1% drop in the past year.

BTSG sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Illumina, sporting a Zacks Rank #1, has an earnings yield of 3.7% compared to the industry’s -17.9% yield. Shares of the company have dropped 10.8% in the past year against the industry’s 9.9% growth. ILMN’s earnings outpaced estimates in three of the trailing four quarters and missed on one occasion, the average surprise being 6.7%.

Omnicell, carrying a Zacks Rank #2 (Buy), has an earnings yield of 3.9% against the industry’s -0.9% yield. Shares of the company have fallen 7.8% compared with the industry’s 2.6% drop. OMCL’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 38.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Stock Market Leaders, Top-Performing IPOs Tend To Share This Common Trait

BTSG

Investor's Business Daily

|

| Feb-20 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-13 |

IPO Stock Of The Week: Health Care Leader BrightSpring Eyes New Buy Point

BTSG

Investor's Business Daily

|

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite