|

|

|

|

|||||

|

|

Altria Group, Inc. (MO) is trading at one of the most attractive valuations in the tobacco space, with a forward 12-month price-to-earnings (P/E) ratio of 10.46. This is below the Tobacco industry’s average of 13.89, the Consumer Staples sector’s 16.02 and the S&P 500’s 23.46. Even compared with major peers, Philip Morris International Inc. (PM), Turning Point Brands, Inc. (TPB) and British American Tobacco p.l.c. (BTI), which trade at 18.12, 24.78 and 11.82, respectively, MO remains discounted.

With such a clear valuation gap, investors must decide whether this marks a buying opportunity or supports a hold strategy

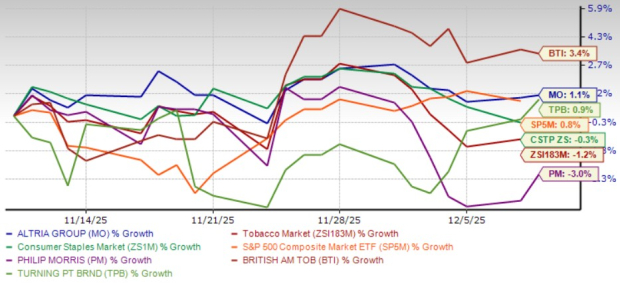

Altria’s one-month share performance shows steady momentum against key competitors. MO rose 1.1% over the period, edging past Turning Point Brands, which gained 0.9% and significantly outperforming Philip Morris, which declined 3%. British American Tobacco delivered the strongest peer performance, advancing 3.4%.

Looking beyond competitors, the Consumer Staples sector and the industry slipped 0.3% and 1.2%, respectively, while the S&P 500 delivered a modest 0.8% gain. This breakdown highlights Altria’s balanced positioning, outpacing several peers and broader benchmarks while maintaining solid short-term momentum.

So far, Altria’s appealing valuation and steady stock performance have helped explain why the stock continues to draw investor interest. But to understand what is supporting this momentum and whether this can be sustained over the long run, it’s important to look beyond the market action. A closer look at Altria’s fundamentals, including earnings stability, product portfolio and strategic growth efforts, provides a clearer picture of its overall strength.

Altria’s financial fundamentals remain supported by resilient earnings growth and strong profitability. In the third quarter of 2025, adjusted earnings per share (EPS) rose 3.6% to $1.45, while year-to-date EPS increased 5.9%, driven by higher adjusted operating companies income (“OCI”) and a lower share count. The smokeable products segment maintained impressive adjusted OCI margins of 64.4%, reflecting effective pricing strategies.

The company’s smokeable business, anchored by Marlboro, continues to deliver stable profit despite industry volume declines. Marlboro expanded its premium-segment share to 59.6%, reinforcing Altria’s pricing power and long-term brand strength. At the same time, Altria met rising price sensitivity with its Basic brand, which gained solid share without taking business away from Marlboro. This balanced strategy helps the company compete at different price points while still protecting overall profitability.

Altria’s oral tobacco portfolio is showing an improving quality of growth, with on! playing a larger role in long-term strategy. Despite third-quarter shipment volatility caused by competitor promotions, on! reported volume grew nearly 1%. Segment adjusted OCI margins expanded 2.4 percentage points to 69.2%. The recent launch of on! PLUS, with premium flavors and enhanced comfort, positions Altria to regain share and strengthen its presence in the fast-growing nicotine pouch category.

Strategically, Altria strengthened the long-term outlook through its collaboration with KT&G, targeting international modern oral expansion and U.S. non-nicotine adjacencies. The partnership also explores operational efficiencies in traditional tobacco and potential expansion of the on! portfolio into global markets. Combined with consistent cash returns, including Altria’s 60th dividend increase in 56 years, these initiatives help reinforce its overall stability and long-term growth positioning.

However, Altria continues to contend with meaningful volume pressures across both smokeable and oral categories. Cigarette shipment volumes fell 8.2% in the third quarter and 10.6% year to date, reflecting ongoing macroeconomic strain on consumers and the rapid growth of flavored disposable e-vapor products. These unregulated products draw volume away from the legal market and add further uncertainty to the competitive environment.

The Zacks Consensus Estimate for Altria’s earnings has seen mixed revisions in recent weeks, reflecting a balanced but steady outlook. Over the past 30 days, the 2025 EPS estimate has inched up 1 cent to $5.44, while the 2026 estimate has dipped 1 cent to $5.56. Even with these modest adjustments, Altria is still projected to deliver solid earnings growth, up 6.3% in 2025 and 2.3% in 2026.

Altria’s combination of attractive valuation, steady earnings growth and a reliable dividend underpins its appeal to value and income-focused investors. Strong pricing power, brand leadership and progress in the oral nicotine segment add further stability. That said, ongoing volume declines and competitive pressure from disposable e-vapor products pose persistent risks. With earnings estimates showing modest but positive momentum, Altria offers disciplined long-term potential, though investors should remain mindful of evolving category headwinds and regulatory developments. Currently, the stock appears better suited for holding rather than aggressive buying and carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 4 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite