|

|

|

|

|||||

|

|

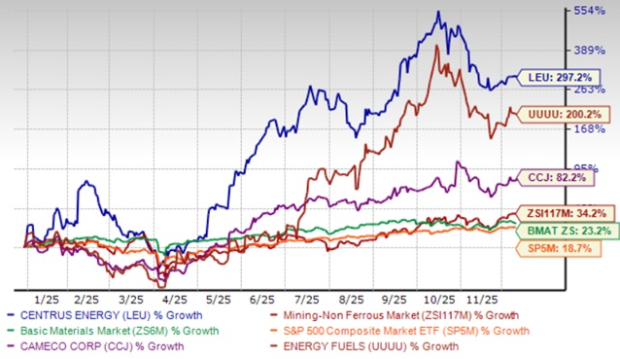

Centrus Energy LEU has skyrocketed 297.1% so far this year, outperforming the non-ferrous mining industry’s 34.1% growth, the Zacks Basic Materials sector’s 23.2% gain and the S&P 500’s 18.7% increase.

Among peers, Cameco CCJ and Energy Fuels UUUU have gained 82.2% and 200.2% year to date, respectively.

With LEU shares soaring, investors may be inclined to jump in. Before making a decision, it’s essential to assess the drivers behind the rally, the company’s growth outlook and any potential risks.

Q3 Results Highlight Y/Y Improvement: Centrus Energy’s total revenues increased 30% to $75 million in the third quarter of 2025. Revenues for the Low-Enriched Uranium segment rose 29% year over year to $44.8 million, attributed to uranium sales in the quarter (contributing $34.1 million). The company had not made any uranium sales in the year-ago quarter. Meanwhile, Separative Work Units revenues were down 69% to $10.7 million due to lower prices.

The Technical Solutions’ segment revenues climbed 31% to $30 million in the quarter, driven by a $7.3 million boost from the HALEU Operation Contract, along with contributions from other contracts.

Cost of sales rose for both the segments, due to higher volumes in the Low-Enriched Uranium segment and an increase in costs incurred under the HALEU Operation Contract in the Technical Solutions segment.

Operating loss widened to $16.6 million in the quarter from the last year quarter’s loss of $7.6 million. Despite this, Centrus Energy delivered net income of $3.9 million (or earnings per share of 19 cents), attributed to an income tax benefit and higher investment income. LEU had reported a loss per share of 30 cents in the year-ago quarter.

Centrus Energy ended the quarter with a $3.9-billion revenue backlog, which includes long-term sales contracts with major utilities through 2040.

Ongoing Plans For Major Capacity Boost: In September, LEU announced plans to significantly expand its uranium enrichment plant in Piketon, OH, to boost the production of Low-Enriched Uranium and High-Assay, Low-Enriched Uranium (HALEU). The scale of this project depends on Centrus Energy securing funding from the U.S. Department of Energy (DOE) and will mark a significant step in restoring America’s ability to enrich uranium at scale.

To this end, Centrus Energy has already raised more than $1.2 billion through two convertible note offerings and secured contingent purchase commitments of more than $2 billion from utility customers. The company also signed a Memorandum of Understanding (MOU) with Korea Hydro & Nuclear Power (“KHNP”) and POSCO International to bring private capital into the expansion.

Centrus Energy remains the only U.S.-based enricher that manufactures centrifuges and related equipment exclusively with American technology. This sets it apart from foreign, state-owned enterprises that control nearly all global enrichment capacity using centrifuge technologies manufactured overseas.

LEU had a total debt-to-total capital ratio of 0.77 as of Sept. 30, 2025, higher than the industry. Meanwhile, Cameco has a total debt-to-total capital ratio of 0.13, while Energy Fuels boasts a debt-free balance sheet.

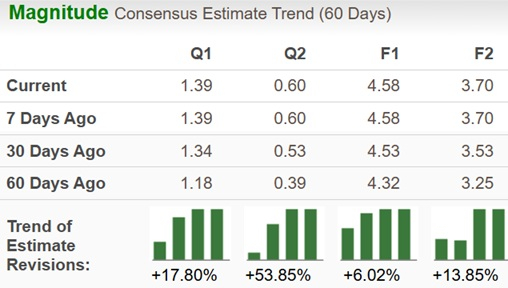

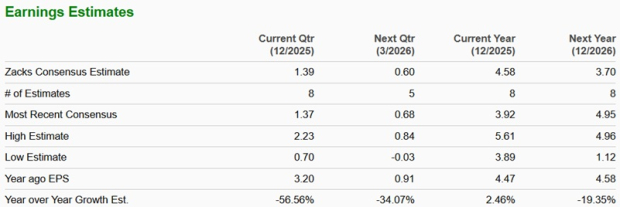

The Zacks Consensus Estimate for earnings per share for 2025 and 2026 has been revised upward over the past 60 days, as shown in the chart below.

The estimate for Centrus Energy’s 2025 earnings is pegged at $4.58 per share, indicating 2.47% year-over-year growth. The same for 2026 is $3.70, indicating a decline of 19.35%.

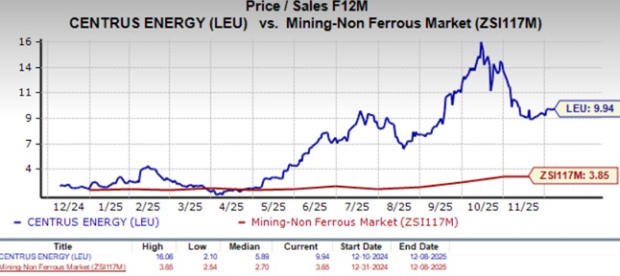

LEU is trading at a forward 12-month price/sales multiple of 9.94X, a significant premium to the industry’s 3.85X. It has a Value Score of F.

Meanwhile, Energy Fuels is trading higher at 42.22X and Cameco at 15.82X.

Centrus Energy provides the enrichment component of LEU, which is measured in SWUs, to utilities that operate commercial nuclear power plants. Its current facilities can process 3.5 million SWU annually, which can be scaled to 7 million SWU.

The company has demonstrated success in producing HALEU and is the only licensed producer in the Western world. While LEU contains uranium concentration below 5%, HALEU contains uranium enriched to between 5% and 20%. It has an edge offering improved efficiency, extended fuel cycles and lower waste.

HALEU demand is expected to surge to power existing reactors and a new generation of advanced reactors. The HALEU market value is projected to reach $0.26 billion in 2025 and grow thereafter to $6.14 billion by 2035, providing a strategic advantage to the company.

Centrus Energy’s leadership in HALEU, backed by the only Nuclear Regulatory Commission license for enrichment, gives it a powerful early-mover edge as demand accelerates. Investors holding LEU shares should continue to do so to benefit from the solid long-term fundamentals.

However, new investors can wait for a better entry point, considering the premium valuation, projected decline in earnings for 2026 as well as its elevated debt levels. Centrus Energy stock currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-10 | |

| Mar-10 | |

| Mar-10 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-09 | |

| Mar-08 | |

| Mar-08 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite