|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Franklin Resources, Inc. BEN and T. Rowe Price Group, Inc. TROW are long-established global asset managers with broad investment platforms across equities, fixed income, multi-asset, and alternatives. While both benefit from strong distribution networks and deep client relationships, their business mixes, growth strategies, and competitive positioning diverge in ways that may shape future performance.

This year, asset managers’ performance was impressive amid market rebounds, record inflows, and rising global asset under management (AUM). Heightened volatility boosted demand for active management, tactical strategies, and outcome-oriented products, driving flows into active Exchange-Traded Fund (ETFs), private credit, and multi-asset solutions. Alternatives remained in high demand as investors sought returns less tied to interest-rate swings. Higher AUM, better fee mix, and strong flows into high-margin strategies made 2025 one of the industry’s strongest post-pandemic years.

The outlook for 2026 remains constructive, supported by continued economic growth, declining interest rates (propelling investors to rotate out of money market mutual funds or short-term investments into other higher-yielding assets), impressive active ETF momentum, and ongoing product innovation.

Against this favorable backdrop, investors naturally ask: Which firm—TROW or BEN—has better potential? To answer that, we need to explore their fundamentals more closely.

Franklin has been expanding its platform through a series of recent acquisitions and partnerships. In November 2025, the company entered a multi-year partnership with Wand AI to accelerate the use of agentic AI across research, operations, and enterprise functions. A month earlier, BEN completed the acquisition of Apera Asset Management, which strengthened its alternatives franchise by adding more than $90 billion to global alternative credit AUM. The company also broadened its private-infrastructure capabilities in September 2025 through partnerships with Copenhagen Infrastructure Partners, DigitalBridge, and Actis. Earlier in 2024, Franklin expanded its ETF and digital-asset capabilities via a partnership with Japan’s SBI Holdings and moved to take a minority stake in Envestnet. Apart from these, several acquisitions of the past led to enhanced presence in the separately managed account space and bolstered its investment capabilities in private debt, real estate, hedge funds, and private equity. Such efforts will help the company improve and expand its alternative investments and multi-asset solutions platforms.

The company has been witnessing solid growth in AUM balance over the years. The company’s efforts to diversify its business into asset classes that are seeing growing client demand, like alternative asset classes, are expected to propel AUM growth. A regionally-focused distribution model has improved its non-U.S. business, with favorable net flows, aiding AUM growth.

Franklin benefits from a broad and diversified global distribution platform that has supported steady organic growth over the years. Strong inflows across fixed income, alternatives, and multi-asset strategies, combined with its early presence in key international markets, have deepened client engagement and expanded its revenue base. As the firm continues to diversify into higher-growth areas such as private credit and infrastructure, its revenue profile is expected to remain stable heading into 2026, underpinned by a mix of recurring and fee-generating assets.

The company also exhibits a solid liquidity position, which underpins its ability to continue deploying capital strategically. As of Sept. 30, 2025, the company held $5.6 billion in liquidity, comprising cash and cash equivalents, receivables, and investments, with no short-term debt on the balance sheet.

T. Rowe Price has also been strengthening its platform through targeted alliances and acquisitions. In September 2025, the company partnered with Goldman Sachs GS to develop public and private market solutions for wealth and retirement clients. In 2024, it partnered with Aspida to manage public and private assets for the insurer, deepening its presence in insurance-asset management. Earlier, the acquisition of Oak Hill Advisors, L.P. (OHA) in 2021 expanded TROW’s footprint in alternative credit and private markets.Together, these strategic moves have strengthened its alternative investment offerings and diversified revenue streams, supporting the company’s long-term growth prospects.

Meanwhile, T. Rowe Price’s diversified AUM across various asset classes, client bases, and geographies offers support and ensures sustainable earnings. Market appreciation and strength in multi-asset and fixed-income flows contributed to a favorable trend in AUM through 2025. A strong brand, consistent investment track record, and decent business volumes are expected to keep supporting AUM growth in the upcoming period.

At TROW, organic growth remains a core contributor to its revenue momentum. Strong investment-advisory fees, driven by consistent efforts to enhance investment capabilities, broaden distribution reach, and introduce new products, will continue to support the firm’s revenue base.

T. Rowe Price also maintains a robust liquidity position, which enables continued strategic capital deployment. As of Sept. 30, 2025, the company held $4.28 billion in liquid assets, including cash, cash equivalents, and investments, against total liabilities of $1.15 billion.

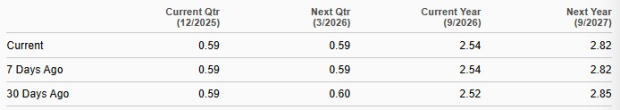

The Zacks Consensus Estimate for BEN’s fiscal 2026 revenue implies a year-over-year decline of 1.7%, while the fiscal 2027 estimate suggests growth of 3.5%. Further, the consensus estimate for earnings indicates a 14.4% and 10.9% rise for fiscal 2026 and fiscal 2027, respectively. Earnings estimates for fiscal 2026 have been revised upward, while for fiscal 2027, they have been revised downward over the past month.

The consensus mark for TROW’s 2025 and 2026 sales suggests year-over-year increases of 2.9% and 6.2%, respectively. Also, the consensus estimate for earnings indicates a 4.5% and 5.7% rise for 2025 and 2026, respectively. Earnings estimates for both years have been revised upward over the past 30 days.

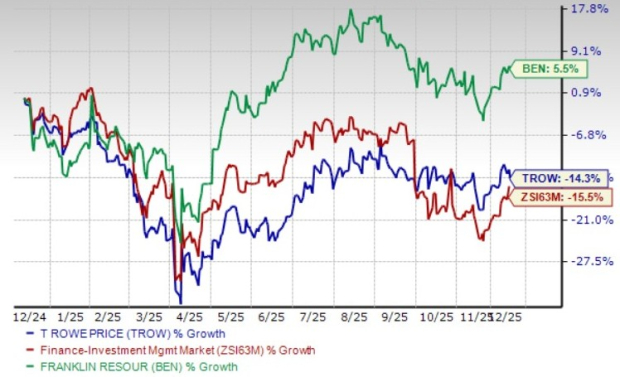

Over the past year, shares of TROW have lost 14.3%, while BEN stock gained 5.5%. Both have fared better than the industry, which lost 15.5% in the same time frame.

From a valuation standpoint, BEN is currently trading at a forward 12-month price-to-earnings (P/E) multiple of 8.98X, while TROW is currently trading at a forward 12-month P/E multiple of 10.08X. Both companies are trading at a discount relative to the industry average of 14.90X; however, BEN stock is cheaper than TROW.

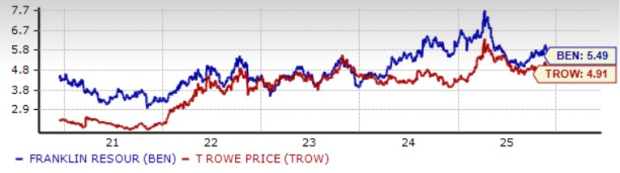

Meanwhile, both Franklin Resources and T. Rowe Price have rewarded their shareholders handsomely. Both companies have increased their dividends five times over the past five years. In December 2024, Franklin raised its quarterly dividend by 3.2% to 32 cents per share, yielding 5.49%. Comparatively, TROW has raised its quarterly dividend every year since its IPO in 1985, most recently increasing it by 2.4% to $1.27 per share in February 2025, with a yield of 4.91%. Here also, BEN holds an edge over TROW.

Both Franklin Resources and T. Rowe Price are well-managed asset managers with diversified investment platforms, solid AUM bases, and disciplined capital deployment. Each firm offers stable revenue, consistent shareholder returns, and strong liquidity, supporting continued growth and strategic initiatives across equity, fixed income, multi-asset, and alternative solutions.

However, BEN benefits from a clearer multi-year growth narrative, driven by expansion into higher-fee alternatives, private credit, and infrastructure, along with strategic acquisitions like Apera Asset Management and Putnam Investments. Its early presence in key international markets further strengthens organic growth, while a solid dividend yield and disciplined share repurchase program enhance shareholder value.

With a lower valuation, solid growth estimates, consistent capital returns, and a strong revenue mix, BEN appears to offer stronger upside potential heading into 2026.

Currently, BEN and TROW carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 |

Lloyd Blankfein Misses Being Goldman Sachs CEOMostly When Theres a Market Crisis

GS

The Wall Street Journal

|

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite