|

|

|

|

|||||

|

|

AtriCure ATRC recently took a major step forward in surgical ablation innovation with the first patients successfully treated using its new dual-energy platform. The system uniquely pairs Pulsed Field Ablation (PFA) with Advanced Radiofrequency Ablation (RFA), aiming to deliver faster, more efficient, and more flexible ablation options for surgeons.

For investors, this marks an important validation milestone for ATRC’s next-generation platform as it advances toward a planned clinical trial next year.

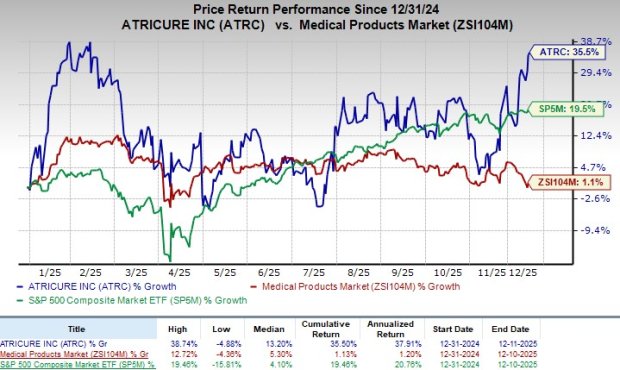

Following the announcement, the company's shares traded flat at yesterday’s close. Year to date, shares have gained 35.5% compared with the industry’s 1.1% growth. The S&P 500 has risen 19.5% over the same period.

This platform strengthens ATRC’s long-term growth outlook by advancing its technology in surgical ablation and positioning the company to capture future demand for faster, more efficient PFA-enabled procedures. By pairing PFA with its proven RFA ecosystem, ATRC increases surgeon adoption potential, extends the lifecycle of its flagship platforms, and enhances recurring revenue opportunities once commercialized, all supporting a more durable and scalable business over time.

ATRC currently has a market capitalization of $2.05 billion.

AtriCure’s new dual-energy platform is designed to merge the strengths of PFA and RFA, offering surgeons a faster and more versatile approach to creating durable lesions. The platform leverages the company’s EnCompass clamp, allowing physicians to switch between or combine energy modalities depending on clinical need.

The intent is to shorten RF ablation times, introduce PFA as a complementary option and streamline surgical workflows without sacrificing safety or effectiveness. This builds directly on the strong clinical legacy of the Isolator Synergy ablation system, which has supported over 450,000 patients and is backed by more than 100 published studies.

The first-in-human experience highlights the potential efficiency gains. In the initial two patients treated in Australia, surgeons achieved complete box lesions, simultaneously isolating the pulmonary veins and the posterior left atrial wall, in under 60 seconds of total ablation time.

Each lesion demonstrated acute electrical isolation, an important validation step. Combining PFA’s ability to deliver transmural lesions in seconds with the reliability of RFA offers a compelling workflow enhancement for surgical ablation, particularly as efficiency and predictability remain key needs in cardiac operating rooms.

Although the Advanced RFA and PFA components are not yet approved in any market, AtriCure plans to initiate a clinical trial next year, marking a meaningful milestone in the development pipeline. This upcoming study is likely to serve as the foundation for regulatory submissions and eventual commercialization. For investors, the launch of this investigational platform signals continued category leadership, a widening technological moat, and a well-defined R&D pathway that aligns with long-term growth in atrial fibrillationsurgical treatment volumes.Top of Form

Per a report by Grand View Research, the global atrial fibrillation market size was estimated at $26.89 billion in 2024 and is projected to reach $65.33 billion by 2033, expanding at a CAGR of 10.44% from 2025 to 2033.

The atrial fibrillation market is driven by a growing disease burden, rapid technological evolution in treatment and diagnostics, and the shift toward remote patient monitoring.

Bottom of Form

Currently, ATRC carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader medical space are Medpace Holdings MEDP, Intuitive Surgical ISRG and Boston Scientific BSX.

Medpace, currently carrying a Zacks Rank #2, reported third-quarter 2025 earnings per share (EPS) of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company beat earnings estimates in each of the trailing four quarters, the average surprise being 14.28%.

Intuitive Surgical, sporting a Zacks Rank #1 at present, posted third-quarter 2025 adjusted EPS of $2.40, exceeding the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Boston Scientific, currently carrying a Zacks Rank #2, reported third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion outperformed the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite