|

|

|

|

|||||

|

|

Bristol Myers Squibb Company BMY has been performing well recently. Shares of this biotech giant have gained 13.1% in the past three months compared with the industry’s growth of 15.2%.

While BMY stock has underperformed the industry in this timeframe, it has outperformed the sector and the S&P 500 during this period.

This uptrend has been prominent after the company posted better-than-expected results for the third quarter on Oct. 30, buoyed by higher demand for Opdivo, Breyanzi, Reblozyl and Camzyos. Concurrently, BMY raised its revenue guidance to reflect this performance.

The recent rally has helped BMY regain its lost territories, giving anxious investors a ray of hope.

Let us analyze BMY’s fundamentals in such a scenario to help make a prudent investment choice:

BMY’s Growth Portfolio comprises drugs like Opdivo, Opdivo Qvantig, Orencia, Yervoy, Reblozyl, Camzyos, Breyanzi, Opdualag, Zeposia, Abecma, Sotyku, Krazati and Cobenfy.

The recent performance of this portfolio has been strong, maintaining top-line growth for BMY.

Opdivo sales in the United States are being driven by a strong launch in MSI-high colorectal cancer and continued growth in first-line non-small cell lung cancer, while international sales are supported by label expansion of the drug across multiple markets.

The approval of Opdivo Qvantig (nivolumab and hyaluronidase-nvhy) injection for subcutaneous use has boosted BMY’s immuno-oncology portfolio. The initial uptake has been strong and the launch is going well in the United States across all indicated tumor types.

Bristol Myers now expects global Opdivo sales, together with Qvantig, to increase in the high single-digit to low double-digit range in 2025 (previous guidance: mid to high single-digit range in 2025), driven by strong performance year to date.

The stellar performance of the thalassemia drug Reblozyl, for which BMY has a collaboration agreement with Merck MRK, has significantly boosted BMY’s top line. BMY is now annualizing over $2 billion in Reblozyl sales. Revenue growth continues to be strong, primarily due to demand in first-line RS-positive and RS-negative settings as well as improved duration of therapy.

Breyanzi sales are now annualizing over $1 billion, reflecting strong growth in large B-cell lymphoma and expansion in new indications approved last year.

Cardiovascular drug Camzyos sales continue to increase on robust demand.

The FDA approval for xanomeline and trospium chloride (formerly KarXT), an oral medication for the treatment of schizophrenia, in adults (under the brand name Cobenfy) is a sginficant boost for the company.

Cobenfy represents the first new pharmacological approach to treating schizophrenia in decades. The initial uptake is encouraging, with sales of $105 million year to date. Cobenfy is expected to contribute meaningfully to BMY’s top line in the coming years as the company looks to expand the drug’s label into other indications.

These drugs should maintain top-line momentum in the coming quarters.

While BMY is progressing with its growth portfolio, its legacy portfolio is being adversely impacted due to continued generic impact on Revlimid, Pomalyst, Sprycel and Abraxane.

The decline in sales of legacy drugs has adversely impacted the top line. BMY continues to expect the legacy portfolio to decline approximately 15-17% in 2025.

Legacy portfolio also comprises blood thinner medicine Eliquis, for which BMY has a worldwide co-development and co-commercialization agreement with pharma giant Pfizer PFE. Eliquis is the biggest contributor to the top line.

BMY recently announced that it will acquire privately held biotechnology company Orbital Therapeutics for $1.5 billion in cash.

The acquisition will add OTX-201, Orbital’s lead RNA immunotherapy preclinical candidate currently in IND-enabling studies, to BMY’s pipeline. OTX-201, a next-generation CAR T-cell therapy, is designed to reprogram cells in vivo with a potential best-in-class profile for autoimmune disease. BMY will also add Orbital’s proprietary RNA platform to its pipeline.

The company had earlier collaborated with BioNTech for the global co-development and co-commercialization of BioNTech’s investigational bispecific antibody BNT327 across numerous solid tumor types.

Developing bispecific antibodies that target two proteins, namely PD-1 and VEGF, has lately been one of the lucrative areas in cancer treatment. BNT327, a next-generation bispecific antibody candidate, targets PD-L1 and VEGF-A.

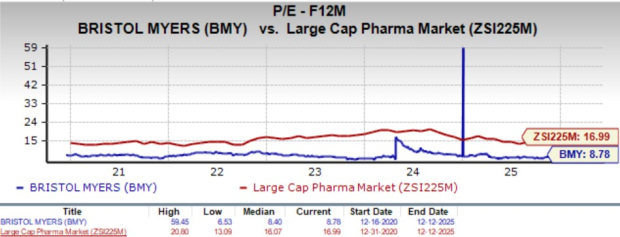

Going by the price/earnings ratio, BMY is inexpensive as of now. Shares currently trade at 8.78x forward earnings, higher than its mean of 8.40x but lower than the large-cap pharma industry’s 16.99x.

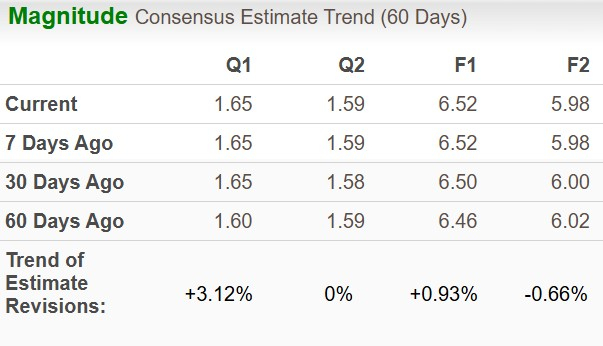

The Zacks Consensus Estimate for 2025 EPS has moved north to $6.51 from $6.43 in the past 60 days, while that for 2026 has moved south.

BMY is one of the largest biotechs and such large biotech companies are generally considered safe havens for investors interested in this sector. BMY’s performance has been strong in 2025 as drugs like Opdivo, Reblozyl, Breyanzi and Camzyos have stabilized its revenue base amid generic competition for its legacy drugs.

Approval of additional new drugs and label expansion of top drugs should further diversify its pipeline.

However, generic competition is a major headwind for the company as of now and the new drugs will take some time to offset this steep decline. Hence, we recommend prospective investors to wait and watch for the time being.

For investors already owning the stock, staying invested would be a prudent move. The company’s attractive dividend yield (4.73%) is a strong reason for existing investors to stay invested.

BMY currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 min | |

| 7 min | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 12 hours | |

| 12 hours | |

| 12 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite