|

|

|

|

|||||

|

|

Artificial intelligence spending is increasingly shifting from experimentation to scaled deployment, forcing enterprises and governments to rethink how they collect, structure, govern and operationalize data. In this environment, companies that sit at the intersection of AI and data infrastructure are becoming critical enablers of the broader AI transformation.

Innodata INOD and Palantir Technologies PLTR approach this opportunity from different angles, but both play central roles in how organizations turn raw data into AI-driven outcomes. Innodata operates as a data engineering and AI services specialist, deeply embedded with Big Tech, enterprises and governments as a “picks-and-shovels” provider for generative AI. Palantir, by contrast, offers a full-stack enterprise AI software platform, combining data integration, ontology, analytics and AI applications into a unified operating system for decision-making.

With AI budgets expanding rapidly, both stocks have delivered strong share-price performance and accelerating fundamentals. Yet differences in scale, business model, valuation and earnings visibility raise a critical question for investors today: which AI data stock offers more upside from here? Let’s dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

Innodata’s investment thesis is rooted in its role as a foundational enabler of the generative AI ecosystem. The company has repositioned itself over the past two years from a traditional data services provider into a high-growth data engineering partner for large language model builders, enterprises and governments. This shift was clearly evident in its third-quarter 2025 results, which marked another record quarter for revenue, profitability and cash generation.

Management emphasized that demand is being driven by deepening relationships with large technology customers, many of which are expanding their spending as generative AI models move from development into production. Innodata disclosed that six of its eight major Big Tech customers are forecast to grow meaningfully in 2026, with several expanding substantially as training, evaluation and safety requirements scale. Importantly, Innodata continues to land new Big Tech customers, several of which are global leaders in cloud, commerce and AI, expanding both its revenue base and long-term optionality.

A key differentiator for Innodata relative to Palantir is its exposure to the data layer of AI rather than the application layer. Innodata is increasingly focused on high-value pre-training data, post-training data, model evaluation, safety testing and agentic AI benchmarking. Management highlighted that early investments in pre-training data capabilities have already resulted in signed and near-signed contracts representing approximately $68 million in potential revenue, with most of that opportunity expected to materialize in 2026. This positions Innodata as a direct beneficiary of the next wave of model scaling, particularly as frontier AI labs emphasize data quality over sheer compute.

Another emerging growth vector is Innodata Federal, a newly launched business unit targeting U.S. defense, intelligence and civilian agencies. Management described this initiative as potentially transformational, citing an initial high-profile government engagement expected to generate roughly $25 million in revenue, largely in 2026, with additional programs under discussion. While Palantir already has a dominant footprint in government AI, Innodata’s entry into this market expands its total addressable opportunity and reduces reliance on commercial customers over time.

From a financial perspective, Innodata is demonstrating operating leverage that contrasts with many smaller AI-linked services firms. Adjusted EBITDA margins expanded in the third quarter of 2025 despite ongoing growth investments, and cash balances rose meaningfully, strengthening the balance sheet. However, Innodata’s challenges are also clear. Revenue remains concentrated among a limited number of large customers, projects are often at-will, and visibility can be lumpy compared with a subscription-heavy software model like Palantir. Moreover, as a smaller-cap stock, Innodata remains more sensitive to execution risk and changes in AI spending cycles.

Palantir’s bull case rests on its evolution into what management calls the defining enterprise AI software platform of this generation. The company’s Artificial Intelligence Platform is designed to operationalize AI across enterprises by tightly integrating data, ontology, workflows and autonomous agents into production systems. This approach is resonating strongly with customers, as evidenced by Palantir’s explosive growth in 2025.

In the third quarter, Palantir delivered revenue growth of 63% year over year, driven by accelerating adoption across both commercial and government markets. U.S. commercial revenue surged 121% year over year, while U.S. government revenue grew 52%, underscoring Palantir’s unique ability to scale AI deployments across highly regulated and mission-critical environments. Management repeatedly emphasized that AI adoption is becoming a C-suite mandate, with customers rapidly expanding contracts after initial deployments prove value.

Unlike Innodata’s project-based model, Palantir benefits from long-duration contracts, expanding total contract value and rising remaining deal value, which enhances revenue visibility. In the third quarter of 2025 alone, Palantir closed a record $2.76 billion in total contract value, with U.S. commercial remaining deal value approaching $3.6 billion. This backlog-like structure provides a level of predictability that smaller AI services players struggle to match.

Palantir’s technology moat is another differentiator. Management highlighted that its ontology-centric architecture enables AI agents to operate with context, governance and security, allowing enterprises to deploy autonomous systems rather than isolated AI tools. New capabilities such as AI FDE, AI Hivemind and edge ontology extend Palantir’s reach from cloud environments to the operational edge, reinforcing switching costs and deepening customer dependence.

Financially, Palantir is operating from a position of strength. The company reported GAAP operating margins of more than 30%, adjusted operating margins of more than 50%, and strong free cash flow generation, all while sustaining hypergrowth. This combination places Palantir in rare territory among enterprise software companies, and sharply contrasts with Innodata’s smaller scale and services-oriented economics.

That said, Palantir’s primary challenge is valuation. The stock’s rapid appreciation reflects extremely high expectations, leaving little room for execution missteps. Any slowdown in U.S. commercial momentum or broader AI spending could pressure the multiple, even if fundamentals remain strong.

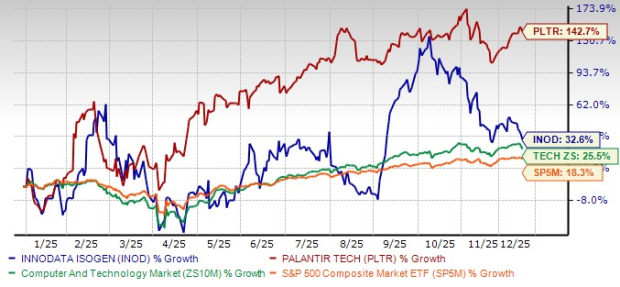

INOD stock has gained 32.6% year to date, while PLTR stock has surged 142.7% over the same period. Both stocks have outperformed the broader Zacks Computer and Technology sector, which is up 25.5%, as well as the S&P 500’s 18.3% gain. Palantir’s far stronger rally reflects accelerating revenue growth, expanding margins and rising investor confidence in its AI platform dominance, while Innodata’s more measured gains suggest improving fundamentals that are not yet fully priced in.

Share Price Performance

On a forward 12-month price-to-sales basis, Innodata trades at 5.47X, below the Zacks Computer and Technology sector average of 6.62X. Palantir, by contrast, trades at a much richer 71.19X forward sales multiple. This stark disparity highlights the market’s willingness to pay a premium for Palantir’s scale, profitability and contract visibility, while Innodata’s valuation reflects both its smaller size and higher execution risk.

Earnings estimate revisions have been favorable for both stocks, but Palantir’s revisions are notably stronger. Over the past 30 days, Innodata’s 2025 EPS estimate rose to 89 cents from 78 cents, while 2026 estimates imply solid growth. Revenue estimates point to growth of 45.6% in 2025 and 24.1% in 2026.

For Palantir, 2025 EPS estimates increased to 73 cents from 66 cents, representing 78.1% growth year over year, with 2026 EPS estimates rising sharply as well. Revenue is projected to grow 54.1% in 2025 and 41.1% in 2026, underscoring Palantir’s superior growth trajectory.

Both Innodata and Palantir are well-positioned beneficiaries of the AI data transformation, but their risk-reward profiles differ meaningfully. Innodata offers leveraged exposure to generative AI data spending at a reasonable valuation, supported by strong growth momentum, expanding margins and emerging opportunities in federal and sovereign AI. However, its smaller scale, customer concentration and services-heavy model introduce higher execution risk.

Palantir, despite its premium valuation, stands out as the more compelling near-term opportunity. Its accelerating revenue growth, expanding profitability, unmatched contract visibility and dominant enterprise AI platform position justify its Zacks Rank #2 (Buy) compared with Innodata’s Zacks Rank #3 (Hold). While valuation risk is real, Palantir’s combination of scale, momentum and earnings revisions suggests it has more upside potential right now for investors seeking exposure to enterprise AI leaders. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite