|

|

|

|

|||||

|

|

What is happening in the Global Week Ahead?

Next are Reuters’ five world market themes, re-ordered for equity traders—

The shutdown-delayed U.S. jobs report for November will shed light on the extent of labor market weakening that could help determine the Federal Reserve's next rate move.

Tuesday's November non-farm payrolls report is expected to show a tepid -35,000 jobs added, according to a Reuters poll.

One of the key critical data reports that had been delayed due to the 43-day federal government shutdown comes after the Fed on Wednesday cut rates by a quarter-point for a third straight meeting. However, prospects for further easing remain unclear.

And there is more delayed data due to come out, including Retail Sales for October, also on Tuesday, while November's Consumer Price Index (CPI) on Thursday will detail inflation trends.

For market participants, a rate hike from the Bank of Japan on December 19th is all but certain, as evidenced by this month's surge in two-year Japan government bond yields to 18-year peaks.

What happens next is less particular. At least one additional quarter-point increase to 1% next year is generally agreed upon by some economists, who say that may be the terminal rate for this cycle.

Hawks argue the policy rate needs to rise as high as 1.5% to offset inflationary pressure from the new government's stimulus plan, the biggest since the pandemic.

The policy path and the messaging around it will be crucial for the yen, which is still sagging despite historic highs in bond yields. With more G10 peers turning hawkish of late, such as Canada and Australia, the momentum behind currency-depressing yen carry trades looks likely to build in 2026.

The European Central Bank's meeting on Thursday was meant to be a pre-Christmas snooze-fest.

But it just got much more interesting after investors moved to bet on a chance of an ECB rate hike, rather than a cut next year, after policymaker Isabel Schnabel said the next move might be a higher one.

Her words weren't too surprising coming from the bank's top policy hawk, and she even said a hike wouldn't come anytime soon. But stronger-than-expected growth and inflation data had already eroded bets on further cuts since the ECB last met in October.

So, while policymakers will likely keep rates steady at 2% again, markets are ready to seize on whatever ECB chief Christine Lagarde says about the outlook.

Sweden and Norway's central banks are also expected to keep rates on hold on Thursday.

A December rate cut from the Bank of England looks a near certainty, according to a Reuters poll, but questions about the trajectory for 2026 are likely to remain after Thursday's announcement.

Financial markets currently price in a roughly 90% chance of a rate cut to 3.75% from 4.0%, although a bad inflation reading on Wednesday could still shift the dial.

The Monetary Policy Committee voted to hold the key rate last month by a 5-4 margin. Whatever the result is on Thursday, divisions will remain going into 2026, based on comments from deputy governors Clare Lombardelli and Dave Ramsden.

While Lombardelli broached the idea of reaching the end of the BoE's easing cycle, Ramsden said gradual cuts to interest rates remained appropriate.

European Union leaders meet on Thursday to thrash out a deal to use frozen Russian cash on the continent to pay for Ukraine.

The stakes are high: Frozen assets are Europe's single biggest card to play to get a say in talks chiefly between Washington and Moscow, as they negotiate a settlement of the war in Ukraine.

The idea is to tap roughly 210 billion euros ($245 billion) of Russian assets in Europe, the lion's share of which is now cash and locked mainly in Belgium, which has stepped up its opposition to the plan.

It's a test of Europe's mettle. Can it overcome its divisions to counter the first major armed conflict in decades?

There could be a fallout for Western investors, who still own tens of billions of assets stranded in Russia, from factories to cash. But with Ukraine's money running out and the continent's security on the line, European leaders have few alternatives.

I picked a wide range of large-cap stocks this week.

(1) AB SKF SKFRY: This is a $27 a share stock, with a market cap of $12.2B. It is found in Zacks Manufacturing- Tools & Related Products industry. There is a Zacks Value score of C, a Zacks Growth score of D, and a Zacks Momentum score of F.

SKF AB engages in the manufacturing of ball and roller bearings, seals, tools for mounting/dismounting bearings, lubricants and measuring/monitoring instruments. It also produces roller bearing steel and other special steels.

The company operates in three divisions: Industrial Division, Service Division and Automotive Division.

It also offers products and knowledge-based services comprising hardware and software, consulting, mechanical services, predictive and preventive maintenance, condition monitoring, decision-support systems and performance-based contracts.

SKF AB is headquartered in Gothenburg, Sweden.

(2) Dillards DDS: This is a $728 a share stock, with a market cap of $11.4B. It is found in the Zacks Retail – Regional Department Store industry. There is a Zacks Value score of C, a Zacks Growth score of D, and a Zacks Momentum score of F.

Dillard's Inc. is a large departmental store chain featuring fashion apparel and home furnishings. As of Nov. 1, 2025, DDS operated 272 Dillard’s stores, including 28 clearance stores across 30 states and an online store at dillards.com.

The company also sells its merchandise through the Internet at www.dillards.com. Stores are mainly located in the Southwest, Southeast and Midwest regions of the United States.

The company’s primary product categories comprise women’s and children’s apparel, shoes, accessories and lingerie, men’s clothing and accessories, cosmetics, home, and children’s clothing. Its merchandise mix consists of both branded and private-label items.

The company’s strategy is to offer more fashion-forward and trendy products in order to attract customers.

Dillard’s also owns a real estate investment trust (REIT), which helps it to enhance its liquidity position. Revenues of a REIT company mostly come from either rent or mortgage payments. The company has an obligation to distribute at least 90% of its taxable income to investors in the form of dividends. A REIT company does not have to pay taxes at the corporate level.

Moreover, Dillard’s has a wholly owned captive insurance company, which enables it to manage its risks more efficiently and provide access to more reinsurance markets. A captive insurance company is an ‘in- house’ insurance company with limited purpose, which insures the risks of its parent company.

The captive insurance company may reinsure some or all risks, or may retain such risks of its parent company. The primary goal of forming a captive insurance company is to retain the profit that would have been made by an outside third-party insurance company or in a situation where the coverage is not available for business risks.

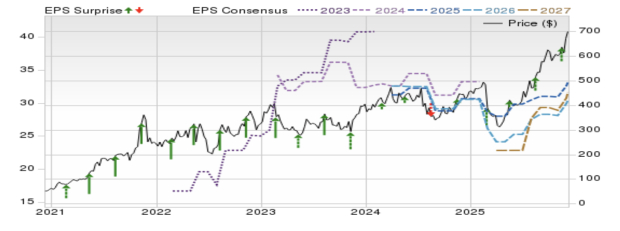

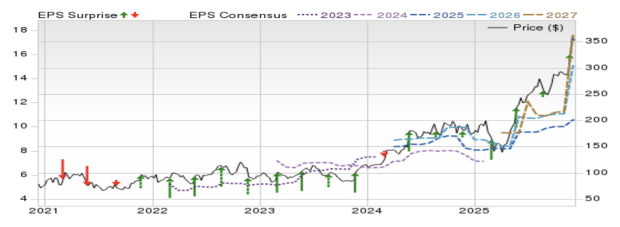

(3) Dycom Industries DY: This is a $364 a share stock, with a market cap of $10.3B. It is found in the Zacks Building Products-Heavy Construction industry. There is a Zacks Value score of D, a Zacks Growth score of C, and a Zacks Momentum score of A.

Based in North America, Dycom Industries Inc. is a specialty contracting firm operating in the telecom industry. The company provides diverse services such as engineering, construction, maintenance and installation services for the cable and telephone companies.

Dycom provides specialty constructing services to the following customers:

Monthly Federal U.S. jobs data is tardy. But it will come out on Tuesday.

On Monday, the Bank of Canada’s (BoC) core CPI data for November moved down to +2.8% from an upwardly revised +3.0% for October. Year over year, +2.2% was in-line with epectations and the prior broad CPI reading.

On Tuesday, ADP employment change, as a 4-week average, is out. I see a low 4.75K was the prior print.

U.S. establishment nonfarm payroll data for October comes out. Finally!

The U.S. U-6 broad unemployment rate is out for November too. The prior print there was 8.0%.

The November U.S. household unemployment rate is likely static at 4.4%.

On Wednesday, the Euro Area’s core HICP rate of consumer price inflation is out for November. The consensus is for +2.4% y/y, in line with the prior +2.4% y/y print.

On Thursday, the Bank of England (BoE) policy rate is likely cut to 3.75% from 4.0%.

The U.S. ex-food & energy CPI for November is out. The prior core CPI print was +3.0% y/y. The broad CPI is also out. The prior broad CPI was +3.0% y/y.

U.S. weekly Initial Jobless Claims come out. The prior reading was 236K. The 4-week average is 216.75K.

On Friday, U.S. Existing Home Sales for November come out. The m/m change expected is +1.2%.

U of Michigan December Consumer Expectations index (prior was a low 55) and Sentiment index (prior was another low of 53.3) come out.

On Dec. 10th, 2025 Zacks Research Director Sheraz Mian put out a new Q4 update.

Four Key Points:

(1) For 2025 Q4, total S&P 500 earnings are currently expected to be up +6.9% from the same period last year on +7.7% higher revenues.

This would follow +13.9% earnings growth in 2025 Q3 on +7.8% revenue growth.

(2) The Tech sector has been a key growth driver since 2023, and the sector is on track to be playing that role in 2025 Q4 and beyond as well.

Q4 earnings growth drops to +3.6% from +6.9% once the Tech sector’s enormous contribution is removed from the aggregate numbers.

The Tech sector is currently expected to account for almost half of S&P 500 earnings growth in 2026.

(3) The revisions trend for 2025 Q4 turned modestly negative in recent weeks, after staying positive earlier in the period.

The revisions trend was consistently positive in the comparable period of the preceding quarter (2025 Q3).

(4) Q4 earnings for the ‘Magnificent 7’ group of companies are expected to be up +16.6% from the same period last year on +16.2% higher revenues.

Excluding the ‘Mag 7’ contribution, Q4 earnings for the rest of the index would be up only +3.4% (vs. +6.9%).

Enjoy the holiday season!

Warm Seasonal Regards,

John Blank, PhD.

Zacks Chief Equity Strategist and Economist

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-10 | |

| Mar-09 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 |

Data Center Vendor Beats Earnings On Fiber Optic Cable Demand. Shares Dip.

DY

Investor's Business Daily

|

| Mar-04 | |

| Mar-04 | |

| Mar-04 | |

| Mar-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite