|

|

|

|

|||||

|

|

Fortinet FTNT and Cisco CSCO stand as formidable players in the cybersecurity industry, both delivering comprehensive network security solutions to enterprises worldwide. Fortinet specializes in integrated security platforms with its FortiOS operating system, while Cisco offers a broader portfolio spanning networking hardware, cybersecurity software, and collaboration tools. Both companies are capitalizing on growing enterprise demand for AI-powered security and secure access service edge solutions.

With the network security market estimated at $24.95 billion in 2025 and projected to reach $42.93 billion by 2030, witnessing a compound annual growth rate of 11.47%, investors are keenly evaluating which stock offers superior growth potential. Let's delve deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

Fortinet delivered excellent third-quarter 2025 results, achieving record operating margins while maintaining robust revenue growth. Revenues climbed 14% year over year to reach $1.72 billion in third-quarter 2025, with product revenues surging 18% to $559.3 million. The company's non-GAAP operating margin reached a quarterly record of 37%, demonstrating exceptional profitability. Total billings grew 14% to $1.81 billion, reflecting broad-based demand across organizations of all sizes.

The company's strategic positioning in high-growth markets continues to strengthen. FortiSASE emerged as one of the fastest-growing SASE solutions at scale, with third-quarter billings increasing more than 100% year over year. Fortinet has natively developed key SASE functions, tightly integrating Next-Generation Firewall, SD-WAN, and SASE functionality into one unified solution. This New Generation SASE Firewall provides maximum deployment flexibility. Unified SASE annual recurring revenues reached $1.22 billion, up 13% year over year, while security operations ARR totaled $472 million, up 25%.

Fortinet's AI-powered security operations business is accelerating rapidly. The company powers more than 20 AI-driven solutions through its FortiAI technology across three main areas: FortiAI-Protect for secure AI usage, FortiAI-Assist for AI-assisted operations, and FortiAI-SecureAI for secure LLM and AI systems. With over 15 years of AI innovation and more than 500 issued and pending AI patents, Fortinet is well-positioned to capitalize on growing AI security demand. The company launched its Secure AI Data Center solution, the industry's first end-to-end framework specifically designed for AI workloads, delivering high-capacity connectivity and up to 69% lower energy consumption than alternative solutions.

Looking ahead, Fortinet's 2025 guidance projects revenues between $6.72 billion and $6.78 billion, with non-GAAP operating margins of 34.5% to 35%. Non-GAAP EPS is anticipated to be between $2.66 and $2.7. The Zacks Consensus Estimate for Fortinet’s earnings is pegged at $2.69 per share for 2025 and $2.89 per share for 2026. These projections imply year-over-year growth of 13.5% for 2025 and 7.52% for 2026.

Fortinet, Inc. price-consensus-chart | Fortinet, Inc. Quote

Cisco reported solid first-quarter fiscal 2026 results with revenues of $14.9 billion, representing 8% year-over-year growth. The company achieved non-GAAP earnings per share of $1, up 10% year over year and above the high end of guidance ranges. Product revenues increased 10% while services revenues grew 2%. Non-GAAP gross margin reached 68.1%, demonstrating continued operating leverage.

The company's AI infrastructure business emerged as a significant growth driver. AI infrastructure orders from hyperscaler customers totaled $1.3 billion in the first quarter of fiscal 2026, reflecting a substantial acceleration in growth. Cisco expects approximately $3 billion in AI infrastructure revenues from hyperscalers for fiscal 2026, with expectations for at least double the orders received in fiscal 2025 from the same customer set. All major hyperscalers are purchasing Cisco's pluggable optics, with four major hyperscalers growing triple digits. Industrial IoT orders grew more than 25%, supported by manufacturing onshoring trends.

Cisco's campus networking refresh cycle provides meaningful growth opportunities. Total product orders grew 13% year over year in the first quarter of fiscal 2026, with networking product orders accelerating to high-teens growth. All technologies within campus networking — switching, routing, wireless, and IoT — saw accelerated order growth. Next-generation solutions, including smart switches, secure routers, and WiFi 7 products, are ramping faster than prior launches.

However, Cisco faces notable challenges that temper near-term expectations. Security revenues declined 2% to $1.98 billion. While management remains committed to mid-teens long-term revenue guidance for security, organic security growth continues lagging pure-play competitors. Collaboration revenues slipped 3% to $1.06 billion. The Splunk integration, while strategically valuable, has created revenue mix timing issues as customers shift from on-premise to cloud subscription models.

The fiscal 2026 guidance includes estimated tariff impacts based on current trade policy, introducing uncertainty. Management provided full-year revenue guidance of $60.2 billion to $61 billion with non-GAAP EPS of $4.08 to $4.14. The consensus mark for CSCO’s fiscal 2026 earnings is currently pegged at $4.10 per share, up by 4 cents over the past 30 days, indicating year-over-year growth of 7.6%.

Cisco Systems, Inc. price-consensus-chart | Cisco Systems, Inc. Quote

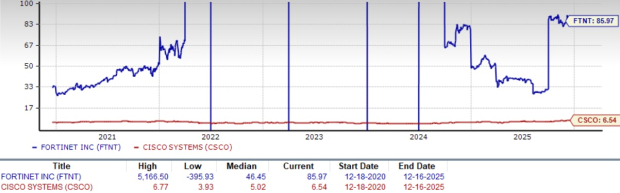

Both Fortinet and Cisco trade at premium valuations reflecting their market leadership, though their valuation profiles differ substantially. Fortinet's price-to-book ratio stands at 85.97x, significantly elevated compared to the broader cybersecurity industry and Cisco's price-to-book ratio of 6.54x. Fortinet's premium price-to-book ratio appears justified given its superior 37% operating margin versus Cisco's 34.4%, accelerating 18% product revenue growth versus Cisco's 10%, and strategic positioning in faster-growing security segments.

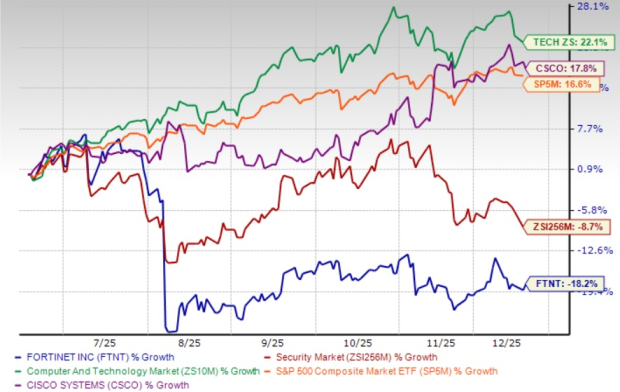

From a price performance perspective, the stocks have exhibited divergent trajectories. Cisco shares gained 17.8% over the past six-month period, benefiting from renewed investor enthusiasm around AI infrastructure opportunities. Fortinet experienced volatility, declining roughly 18.2% over a six-month period, creating a potential entry opportunity for investors seeking pure-play cybersecurity exposure with stronger margin profiles.

Fortinet's ability to generate record profitability while investing heavily in AI innovation and SASE development differentiates it from competitors pursuing growth at the expense of margins. The company's unified FortiOS platform creates switching costs and competitive moats that support premium valuations. Investors should watch Fortinet stock for attractive entry points given recent price volatility. At the same time, Cisco shareholders may consider holding positions or awaiting better entry opportunities as the company navigates its multi-year portfolio transformation, declining security revenues, Splunk integration complexity and tariff uncertainties. Fortinet and Cisco currently carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 7 hours | |

| 13 hours | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite