|

|

|

|

|||||

|

|

nVent Electric NVT and Amphenol APH are two key players in the electrical equipment and connectivity industry. They benefit from growing demand for data centers, electrification, and industrial upgrades.

nVent Electric mainly sells electrical enclosures, connections, and protection products used across industrial, commercial, and infrastructure markets, including data centers. Amphenol designs and manufactures electrical, electronic, and fiber-optic connectors and interconnect systems for a wide range of industrial and technology applications.

Both NVT and APH are positioned to benefit from long-term infrastructure and data-center investment trends. However, from an investment point of view, one stock offers a more favorable outlook than the other right now. Let’s break down their fundamentals, growth prospects, market challenges and valuation to determine which stock offers a more compelling investment case.

nVent Electric is witnessing strong demand from data center customers, driven by rising growth in artificial intelligence (AI) workloads. In the third quarter of 2025, organic orders rose around 65% year over year, mainly driven by large orders for the AI data center buildouts. Furthermore, nVent Electric's backlog also grew in double digits sequentially in the third quarter, giving the company a solid base for future revenues.

Liquid cooling continues to be a core driver. Less than 10% of data centers are liquid-cooled today, but new graphics processing unit chips require more advanced cooling, which supports long-term demand. nVent Electric has more than a decade of experience in this area and has deployed more than 1 gigawatt of cooling.

The company is also expanding capacity. A new Minnesota facility will double its footprint for liquid cooling production in early 2026. Additionally, during the third quarter, nVent Electric was also added to NVIDIA’s partner network, which increases its visibility among global AI infrastructure customers.

Moreover, the overall trend in AI infrastructure and liquid cooling demand appears strong. nVent Electric’s backlog, customer pipeline and ongoing investments suggest that data center demand is likely to remain an important growth driver for the company.

The Zacks Consensus Estimate for nVent Electric’s full-year 2025 total revenues is pegged at $3.83 billion, indicating a year-over-year increase of 11.1%. The consensus mark for 2026 indicates revenues to grow 14.8% year over year to $4.39 billion.

However, nVent Electric is dealing with higher costs from tariffs and inflation. In the third quarter, inflation negatively impacted adjusted operating income by $45 million, including nearly $30 million from tariffs. Furthermore, for full-year 2025, nVent Electric expects tariffs to hurt its profit by approximately $90 million. This shows that tariffs remain a significant headwind due to which margins could come under pressure.

Amphenol is seeing very strong demand from the IT datacom market, mainly driven by the rapid buildout of AI data centers. In the third quarter of 2025, IT datacom became the company’s largest end market, accounting for about 37% of total revenues. Sales in this segment grew 128% year over year in U.S. dollars and organically, showing how fast demand is rising.

This growth is coming from Amphenol’s high-speed and high-power interconnect products that are used inside AI servers, racks and data centers. As AI workloads increase, data centers need faster data transfer and much higher power capacity. Amphenol’s connectors, cables and power solutions help move data and electricity efficiently from the power source all the way to the chips. These products are critical for AI systems to work reliably and at scale.

In the latest earnings call of the third quarter of 2025, management also noted that growth is not limited to AI alone. Traditional cloud and enterprise datacom demand also improved during the third quarter, helping support overall growth in the IT datacom market. Looking ahead, Amphenol expects IT datacom revenues to more than double in full-year 2025.

The company also said that it has strong positions in current and future AI platforms, supported by long-term customer relationships and early involvement in system design. This suggests AI and IT datacom should remain a key growth engine for Amphenol over the upcoming quarters. The Zacks Consensus Estimate for Amphenol’s 2025 and 2026 total revenues indicates a year-over-year increase of 49.4% and 12.4%, respectively.

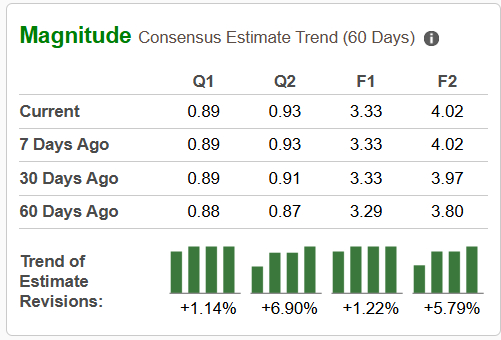

The earnings estimate revision trend for the two companies reflects that analysts are turning more bullish toward Amphenol.

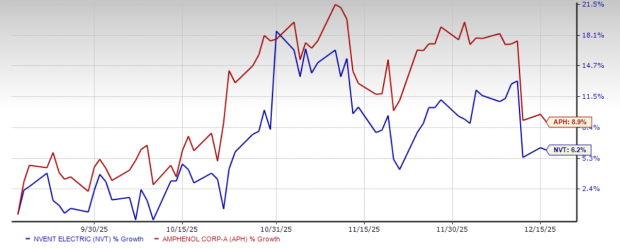

In the past three months, nVent Electric shares have gained 6.2%, and shares of Amphenol have risen 8.9%.

Currently, nVent Electric is trading at a forward sales multiple of 3.79X, lower than Amphenol’s forward sales multiple of 6.25X. Amphenol does seem pricey compared with nVent Electric. However, Amphenol’s valuations also reflect higher growth expectations for the company.

Both nVent Electric and Amphenol are benefiting from higher spending on AI data centers and infrastructure. However, nVent Electric’s near-term prospects suffer from higher costs from tariffs and inflation, which are putting pressure on margins and could limit near-term growth.

In contrast, Amphenol is seeing much faster growth, especially in its IT datacom business, which is now its largest revenue source. While Amphenol trades at a higher valuation, this reflects stronger revenue growth, improving earnings estimates, and better recent stock performance.

Currently, Amphenol sports a Zacks Rank #1 (Strong Buy), giving a clear edge over nVent Electric, which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 | |

| Mar-04 | |

| Mar-03 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

NVent Electric's Growth Story Heats Up On Liquid Cooling, Data Center Transformation

NVT

Investor's Business Daily

|

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite