|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

CorMedix CRMD and Puma Biotechnology PBYI are small-cap biotech companies focused on the successful commercialization of their core products as they work to establish leadership within their respective domains. Both companies have a market capitalization of less than $1 billion and exhibit some common attributes of small-cap biotech companies, notably limited product portfolios and high dependence on their existing marketed products.

While CorMedix is in the early commercialization cycle, focusing on infection prevention and the initial ramp-up of its marketed product DefenCath, Puma Biotechnology targets breast cancer and other tumor types and holds a relatively more established commercial footprint.

CorMedix’s lead therapy, DefenCath (Taurolidine + Heparin), was approved by the FDA in late 2023 as the first and only antimicrobial catheter lock solution available in the United States. Puma Biotechnology’s sole marketed product, Nerlynx, is approved for treating certain patients with breast cancer.

But which stock presents a better investment opportunity right now? Let’s dive into their fundamentals, growth outlook and potential challenges to make a well-informed comparison.

DefenCath is indicated to lower the risk of catheter-related bloodstream infections (CRBSIs) in adults with kidney failure undergoing chronic hemodialysis via a central venous catheter. The product was launched in 2024 in both the hospital inpatient and outpatient hemodialysis settings.

DefenCath is the first approved product in CorMedix’s marketed portfolio, giving the company a regular income stream. The product has witnessed a strong market adoption so far, and the momentum is expected to continue in 2026.

In the first nine months of 2025, DefenCath recorded $167.6 million in net sales, reflecting strong market adoption in its early commercial journey. Importantly, DefenCath holds a unique market position as the only FDA-approved therapy for a niche condition, supported by patent protection through 2033. This exclusivity is likely to offer a long runway for revenue generation.

Looking ahead, sales are expected to grow steadily as CRMD expands its commercial footprint and strengthens its marketing infrastructure, driving continued momentum for DefenCath. Per management, higher-than-expected utilization of DefenCath by outpatient dialysis customers is likely to drive growth in future quarters. CorMedix is also planning future potential label expansion of DefenCath into total parenteral nutrition to increase its customer base.

Meanwhile, CorMedix took a significant step toward diversifying its revenues and reducing dependence on DefenCath with the $300 million acquisition of Melinta Therapeutics. The acquisition, which closed in August 2025, added seven approved therapies to CRMD’s portfolio, strengthening its presence in hospital acute care and infectious disease markets. The Melinta acquisition underscores CorMedix’s long-term strategy to accelerate growth by expanding its hospital-focused offerings while building a more durable, diversified commercial platform.

Reflecting the growing momentum with DefenCath and early Melinta portfolio contributions, the company raised its full-year 2025 pro forma net revenue guidance to $390-$410 million, up from the prior expectation of at least $375 million.

Although CorMedix currently holds a first-mover advantage in the United States with DefenCath, the company’s heavy reliance on the product for revenues remains a concern. Also, competition from major players like Pfizer PFE, Amphastar Pharmaceuticals, B. Braun, Baxter and Fresenius Kabi USA that already market heparin for multiple uses remains a worry.

If either Pfizer or Amphastar expands its anticoagulant portfolio into catheter-related infection prevention, CorMedix could encounter significant competitive pressure within its primary therapeutic space.

The majority of PBYI’s revenues is currently being driven by Nerlynx sales.

Nerlynx is approved for treating early-stage HER2-positive breast cancer in patients previously treated with Herceptin-based adjuvant therapy. The drug is also approved in combination with Xeloda (capecitabine) for treating certain patients with advanced or metastatic HER2-positive breast cancer.

In the first nine months of 2025, Nerlynx recorded sales worth $144.2 million, increasing 2.4% on a year-over-year basis. The company expects continued demand-driven growth in Nerlynx sales heading into the new year.

Reflecting the increasing sales of Nerlynx, Puma Biotechnology increased its full-year 2025 revenue guidance to $220-$223 million, up from the previous expectation of $212–$222 million.

Net product sales from Nerlynx are now expected to be in the range of $198-$200 million compared with the earlier projection of $192-$198 million.

Despite the significant commercial potential of the breast cancer market, Puma Biotechnology’s heavy dependence on Nerlynx for revenue growth exposes the company to heightened risk. Any regulatory setbacks related to Nerlynx will be a major setback.

In addition, Nerlynx sales have declined in certain past quarters due to weaker demand, and while performance has since improved, a recurrence could materially pressure the company’s outlook. Intense competition from well-established players in the target market remains an ongoing headwind.

PBYI is developing its pipeline candidate, alisertib, an aurora kinase A inhibitor, in separate mid-stage studies for treating hormone receptor-positive breast cancer as well as small-cell lung cancer. Though still in the early days, management believes that the successful development of the candidate is likely to enhance the company’s position in the anti-cancer drug market. However, failure in ongoing studies will be a significant disappointment from the investors’ perspective.

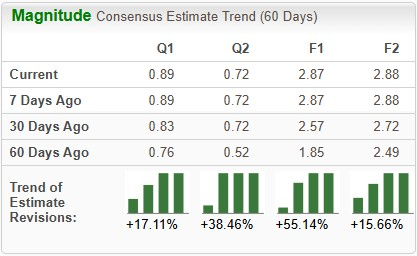

The Zacks Consensus Estimate for CorMedix’s 2025 sales and earnings per share (EPS) implies a year-over-year increase of around 613% and 1057%, respectively. EPS estimates for 2025 and 2026 have been trending upward over the past 60 days.

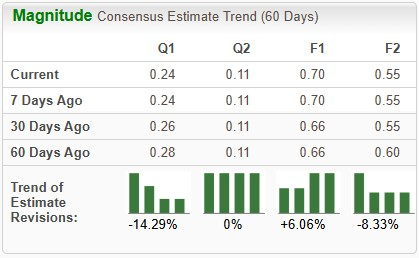

The Zacks Consensus Estimate for Puma Biotechnology’s 2025 sales and EPS implies a year-over-year decrease of around 4% and 10% respectively. While EPS estimates have increased for 2025, the same for 2026 have been trending down over the past 60 days.

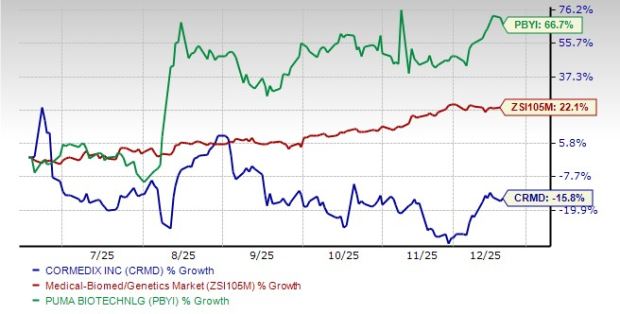

In the past six months, shares of CRMD have declined 15.8%, while those of PBYI have surged 66.7%. In comparison, the industry has returned 22.1%, as seen in the chart below.

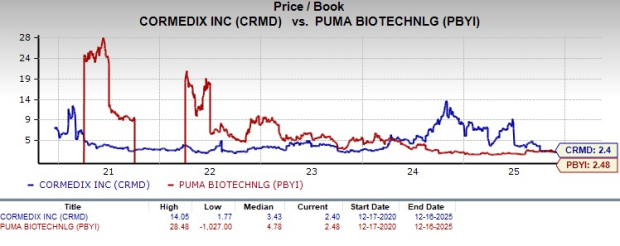

From a valuation standpoint, Puma Biotechnology looks more expensive than CorMedix. Going by the price/book (P/B) ratio, PBYI’s shares currently trade at 2.48 times trailing book value, higher than 2.40 for CRMD.

Between the two stocks discussed above, CorMedix sports a Zacks Rank #1 (Strong Buy) and can be backed as the better pick over Puma Biotechnology, which currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

CRMD’s strong commercial execution with DefenCath in the first nine months of 2025 and the upbeat guidance for 2025 present an optimistic outlook. The Melinta acquisition also helps the company to diversify its business goals. Analysts expect CRMD’s 2025 sales and EPS to substantially rise on a year-over-year basis, highlighting its strong upside potential.

On the contrary, Puma Biotechnology’s high reliance on Nerlynx for revenues is not a risk-free strategy and underlines the company’s vulnerability to regulatory and competitive risks. Although Nerlynx sales are rising, stiff competition in the breast cancer market from established players with huge resources remains a worry.

In a market favoring near-term results, CorMedix’s unique positioning, strategic diversification, improving earnings estimates and a cheaper valuation make it the more compelling small-cap biotech pick for investors over Puma Biotechnology heading into 2026.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 min | |

| 2 hours | |

| 7 hours | |

| 7 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite