|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

After years of stagnation following its peak in early 2000s, nuclear energy is staging a meaningful comeback. Surging electricity demand from data centers, AI workloads and large-scale electrification, combined with energy security concerns and climate goals, is prompting governments to re-embrace nuclear as a reliable, carbon-free power source. Increased investment, innovation and supportive policies from governments will drive this new era of nuclear energy.

This global resurgence of nuclear power has put uranium under the spotlight again. The U.S. Geological Survey’s inclusion of uranium on its 2025 Critical Minerals List further highlights its strategic importance for national security and domestic supply chains. Against this landscape, stocks like Cameco Corp. CCJ, Uranium Energy UEC and Centrus Energy LEU stand out as key beneficiaries of the nuclear revival.

Global electricity demand is set to rise sharply over the coming decades and nuclear power is increasingly viewed as essential to meeting that demand while keeping emissions in check. Per the World Nuclear Industry Status Report, around 65 reactors are under construction worldwide (as of Dec.5, 2025). Alongside new construction, efforts are also underway to extend the operating lives of existing reactors.

Momentum has also accelerated at the policy level. Governments across the globe have signed the Declaration to Triple Nuclear Energy, committing to triple global nuclear capacity by 2050 in recognition of nuclear power’s role in energy security and climate mitigation. The World Nuclear Association estimates that global nuclear capacity could reach 1,428 GWe by 2050, surpassing the declaration’s 1,200 GWe target.

The United States is aggressively pursuing nuclear independence to enhance national and energy security and reduce its heavy reliance on foreign, nuclear fuel supplies. This drive involves significant legislative action, executive orders and public-private investments aimed at revitalizing the entire domestic nuclear fuel cycle. The US is also pursuing multiple partnerships with other countries with the goal of increasing mutual nuclear development.

Despite its advantages, nuclear projects are hard to finance due to their scale, capital intensity, long construction lead times and technical complexity. Small modular reactors (SMRs) are being hailed as the most promising advancement in the nuclear technology landscape and attracting particular interest given their smaller scale and lower capital requirements.

The deployment of cost-competitive SMRs, together with a new wave of large-scale reactors, enables Europe, the United States and Japan to reclaim leadership in nuclear technology.

At the same time, ensuring diversified and secure uranium supply and enrichment services is critical for the sector’s long-term expansion.

Saskatoon, Canada-based Cameco is one of the world’s largest global providers of uranium. It has the licensed capacity to produce more than 30 million pounds of uranium concentrates annually and more than 457 million pounds of its proven and probable mineral reserves. Cameco's operations span the nuclear fuel cycle from exploration to fuel services, which include uranium production, refining, conversion and CANDU fuel manufacturing for heavy water reactors.

Recently, Cameco, along with Brookfield, entered into a strategic partnership with the U.S. Government to accelerate the deployment of Westinghouse Electric Company’s nuclear reactor technologies and reinvigorate supply chains and the nuclear power industrial base in the United States and abroad. The U.S. Government’s aggregate investment of at least $80 billion will create significant growth opportunities for both Westinghouse and Cameco.

Operationally, Cameco benefits from flexible supply sourcing, meeting sales commitments through a mix of production, inventory and long-term purchases. The company is extending the life of its Cigar Lake mine to 2036 and ramping production at McArthur River/Key Lake toward its licensed annual capacity of 25 million pounds.

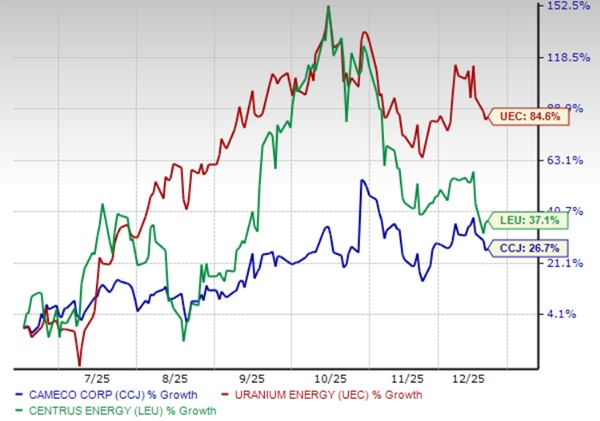

The Zacks Consensus Estimate for Cameco’s fiscal 2025 earnings projects 96% year-over-year growth and the estimate for fiscal 2026 indicates growth of 55%. Cameco stock has gained 26.7% in the past six months and currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Corpus Christi, TX-based Uranium Energy is advancing its next generation of low-cost, in-situ recovery (ISR) uranium mining projects. ISR mining offers advantages over conventional methods, including lower capital and operating costs, faster timelines and reduced environmental impact.

Fiscal 2025 marked a turning point as Uranium Energy transitioned from developer to producer with the successful restart of the Christensen Ranch ISR mine in Wyoming’s Powder River Basin. Production ramp-ups are expected to continue through 2026, alongside the anticipated startup of the Burke Hollow project, driving higher output into fiscal 2026.

Uranium Energy’s acquisition of Rio Tinto’s Sweetwater Complex added roughly 175 million pounds of historic resources, establishing its third U.S. hub-and-spoke production platform. This acquisition lifted UEC’s total licensed annual production capacity to 12.1 million pounds of uranium, the largest in the United States. Work is progressing under the FAST-41 permitting designation for Sweetwater. Drilling and engineering plans for mill refurbishment have been initiated.

The company also launched United States Uranium Refining & Conversion Corp. to position itself as the only vertically integrated US company with uranium mining, processing and planned refining and conversion capabilities.

The Zacks Consensus Estimate for UEC’s fiscal 2025 earnings is projected at a loss of 10 cents, suggesting a narrower loss than the 17 cents reported in the earlier fiscal year. The estimate for fiscal 2027 is at earnings of six cents per share. The Zacks Ranked #3 stock has gained 84.6% in the past six months.

Bethesda, MD-based Centrus Energy supplies nuclear fuel components for the nuclear power industry. It operates in two segments, Low-Enriched Uranium and Technical Solutions.

Centrus Energy provides the enrichment component of low enriched uranium, which is measured in SWU (Separative Work Units), to utilities that operate commercial nuclear power plants. Its current facilities can process 3.5 million annually, which can be scaled to 7 million SWU.

Under contract with the U.S. Department of Energy, Centrus Energy is currently producing High-Assay, Low-Enriched Uranium (HALEU), a next-generation fuel needed to power advanced reactors. HALEU has an edge over low enriched uranium, offering improved efficiency, extended fuel cycles and lower waste. Notably, Centrus Energy is the only licensed HALEU producer in the Western world.

In September, LEU announced plans to significantly expand its uranium enrichment plant in Piketon, OH, to boost the production of Low-Enriched Uranium and HALEU. The scale of this project depends on the company securing funding from the U.S. Department of Energy (DOE) and will mark a significant step in restoring America’s ability to enrich uranium at scale.

To this end, Centrus Energy has already raised more than $1.2 billion through two convertible note offerings and secured contingent purchase commitments of more than $2 billion from utility customers. The company also signed a Memorandum of Understanding with Korea Hydro & Nuclear Power (“KHNP”) and POSCO International to bring private capital into the expansion.

Centrus Energy remains the only US-based enricher that manufactures centrifuges and related equipment exclusively with American technology. This sets it apart from foreign, state-owned enterprises that control nearly all global enrichment capacity using centrifuge technologies manufactured overseas.

The estimate for Centrus Energy’s 2025 earnings indicates 2.46% year-over-year growth. The same for 2026 suggests a decline of 19.35%. The estimates are undergoing positive revisions lately, indicating analyst optimism. It currently carries a Zacks Rank of 3. LEU shares have gained 37.1% in the past six months.

The nuclear comeback heading into 2026 is shaping up as a steady, policy-backed expansion rather than a speculative boom. Cameco, Uranium Energy and Centrus Energy offer complementary exposure across uranium mining, fuel services and advanced enrichment technologies. Together, they provide investors with diversified access to the nuclear energy renaissance, as governments and industries increasingly rely on nuclear power to meet long-term energy and climate objectives.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 7 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite