|

|

|

|

|||||

|

|

CleanSpark, Inc. CLSK is a leading U.S. Bitcoin miner and data-center operator that is expanding beyond crypto mining into high-performance computing (HPC) and artificial intelligence (AI) infrastructure services.

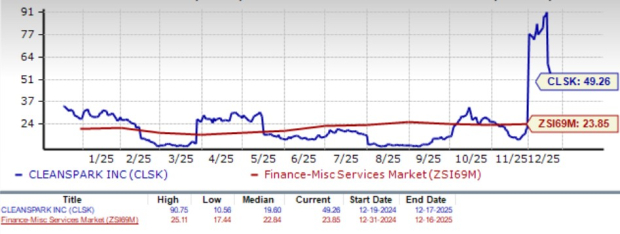

However, CLSK shares are currently overvalued, as indicated by its Value Score of D. In terms of the forward 12-month price-to-earnings (P/E) ratio, CLSK is trading at 49.26X, which is significantly above the Zacks Finance – Miscellaneous Services industry’s average of 23.85X.

This raises concerns about whether the stock can justify such lofty multiples, especially amid near-term challenges. Let us dig deep to find out.

CleanSpark’s business remains firmly linked to Bitcoin price movements, making volatility in BTC a persistent risk to revenue, earnings and balance-sheet stability. As all of the company’s revenues are generated from Bitcoin mining, even short-term swings in Bitcoin prices can materially impact operating results and cash flows. In addition, changes in Bitcoin’s fair value directly affect net income, increasing earnings volatility and investor sentiment.

Recent market action underscores this exposure. Earlier this week, the Chinese government reportedly cracked down on illegal Bitcoin mining operations in its Xinjiang province. This has resulted in the shutdown of approximately 100 EH/s of mining equipment. Following the report, Bitcoin prices closed approximately 2% down on Monday.

Operational data further reflects the challenging backdrop. CleanSpark’s Bitcoin mining output has declined for the second consecutive month. In November 2025, the company mined 587 Bitcoins, down from 612 in October and 629 in September. A weak crypto market and increased regulatory pressure have weighed on the company’s overall output.

Increasing regulatory pressures, the crackdown of illegal mining operations in China and declining Bitcoin output make us increasingly cautious about CleanSpark’s growth prospects in the near term.

CleanSpark is entering the AI and HPC infrastructure market at a time when competitive pressures are rapidly increasing, therefore raising the bar for successful entry. Several crypto-native peers are pursuing similar diversification strategies.

Applied Digital APLD, IREN Limited IREN and Cipher Mining CIFR are all transitioning from pure Bitcoin mining toward AI and HPC by repurposing existing power assets and data-center infrastructure. As Applied Digital, IREN and Cipher Mining aggressively chase AI compute opportunities, competitive pressure on customer acquisition, pricing and execution timelines is increasing across the sector.

Against this backdrop, CleanSpark's expansion into AI and HPC is still in its early and unproven stages. Management has outlined plans to transform select sites, including Sandersville, GA, and newly acquired Texas locations, into AI-ready data-center campuses. However, success depends on securing long-term customers and executing projects within tight timelines.

Additionally, this transformation requires new technical, operational and commercial capabilities, as CLSK has limited experience operating AI and HPC infrastructure. Although the company has raised significant capital, including $1.15 billion in zero-coupon convertible notes, returns from AI investments remain uncertain and depend on securing tenants, structuring financing and meeting construction milestones.

Investor sentiment toward CleanSpark is weakening as earnings expectations continue to slide. The Zacks Consensus Estimate for CLSK’s first-quarter fiscal 2026 loss is currently pegged at 8 cents per share, a sharp reversal from earnings of 9 cents over the past 30 days.

At the same time, the consensus mark for fiscal full-year 2026 earnings is currently pegged at 26 cents per share, marking a steep 66.2% downward revision over the past 30 days and implying a 63.4% year-over-year decline.

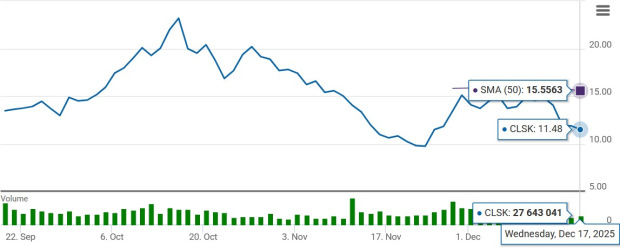

CleanSpark’s shares are trading below the 50-day moving average, indicating a bearish trend in the near term.

Additionally, CLSK shares have fallen 15.8% over the past three months, significantly lagging the Zacks Finance sector’s 0.7% rise. The stock has also trailed key crypto infrastructure competitors, with Cipher Mining and Applied Digital posting gains of 17.1% and 7.4%, respectively, while IREN fell 12.6% during the same timeframe.

CleanSpark’s stretched valuation and high sensitivity to Bitcoin price swings weaken its risk-reward profile at current levels. Heavy reliance on volatile Bitcoin prices continues to limit earnings visibility, while soft production trends add near-term uncertainty. Meanwhile, the company’s expansion into AI and high-performance computing remains early-stage and unproven, with intensifying competition from peers pursuing similar strategies.

Downward earnings estimate revisions, bearish technical signals and sustained underperformance versus the broader sector and competitors further erode the investment case.

Given the lack of earnings stability, CLSK is not a preferred stock at present, and investors may be better off avoiding this Zacks Rank #4 (Sell) for now.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite