|

|

|

|

|||||

|

|

NuScale Power SMR and Oklo OKLO are both important companies in the nuclear energy industry. NuScale Power focuses on building small modular reactors for clean energy projects. Oklo focuses on developing next-generation fission powerhouses and compact fast reactors that can recycle used nuclear fuel.

According to a report from Fortune Business Insights, the global small modular reactor market was valued at $5.81 billion in 2024 and is expected to reach $8.37 billion by 2032, witnessing a CAGR of about 4.98% from 2025 to 2032. Both NuScale Power and Oklo are well-positioned to benefit from this growth because their technologies can help meet rising demand for safe, reliable, and carbon-free nuclear energy.

However, from an investment point of view, one stock offers a more favorable outlook than the other right now. Let’s break down their fundamentals, growth prospects, market challenges and valuation to determine which stock offers a more compelling investment case.

NuScale Power is moving forward in the small modular reactor market. The company is still the only small modular reactor vendor with U.S. Nuclear Regulatory Commission (NRC) design approval, which gives it a clear advantage over other players. NuScale Power also received approval for its 77-MW uprate, which strengthens its product and is important for customers who need more reliable power.

A key development is the 6-GW plan announced by ENTRA1 and Tennessee Valley Authority (TVA). This is the largest small modular reactor program announced in the United States and represents 72 modules across up to six plants. NuScale Power stated that it already has 12 modules in production for the first project. TVA leadership has also publicly shown that they want new nuclear power.

The U.S.-Japan framework agreement is a major positive for NuScale Power. Under this agreement, NuScale Power and ENTRA1 were the only group named for power development for AI, which shows strong government-level support. In the third quarter of 2025, management said ENTRA1 could receive up to $25 billion to help develop baseload energy projects. This support is aimed at meeting rising power demand from AI data centers, advanced manufacturing and national defense, which bodes well for the company's prospects.

NuScale Power is also progressing its work on the RoPower project, which aims to deploy a power plant with 6 NuScale Power Modules in Romania. The Fluor’s Phase 2 of the front-end engineering design study project for RoPower’s power plant in Doicesti is close to completion and is bringing in steady revenues.

However, the company faces several risks. NuScale Power’s revenues are still very small, with $8.2 million reported for the third quarter of 2025. The company also paid $128.5 million to ENTRA1 during the third quarter as part of its milestone agreement. Moreover, the management stated that total payments across all six TVA projects could reach several billion dollars before NuScale Power receives any equipment orders.

Another key risk is that the TVA agreement is not a binding Power Purchase Agreement (PPA) yet, and delays in signing PPAs could push out orders and revenues. Additionally, Project timelines are long, with the first plant expected around 2030, which shows that meaningful revenues are still years away.

Oklo is working to expand its presence in the small modular reactor market by building a model that can scale beyond a single project. The company is positioning its first Aurora reactor at Idaho National Laboratory as the starting point for a broader rollout of similar reactors in the future. In the third quarter of 2025, management described this first plant as a template that can be repeated across multiple sites.

A key part of Oklo’s expansion strategy is the use of the U.S. Department of Energy (DOE) authorization pathway. This allows Oklo to start building and operating its reactor under DOE oversight before getting full approval from the NRC. This helps Oklo move faster, reduce delays, and collect real operating data. That data can then be used to support approvals for future small modular reactors. This approach is meant to reduce delays and lower risk as the company scales.

Oklo is also expanding its small module reactor footprint by running more than one reactor program at the same time. In addition to the Aurora reactor, the company is advancing the Pluto test reactor for fuel and component testing and supporting Atomic Alchemy’s reactor for isotope production. These projects help Oklo improve its technology, gain operating experience, and support future small modular reactor deployments.

Fuel supply is another focus area. Oklo is investing in fuel fabrication and recycling facilities, including a planned advanced fuel center in Tennessee. This is meant to support many reactors over time and reduce reliance on outside fuel suppliers.

On the demand side, in the third quarter of 2025, Oklo stated that it has a customer pipeline of about 14 gigawatts. Most of this interest comes from data centers that need steady, reliable power. Overall, Oklo is taking steps to build a larger and more scalable position in the small modular reactor market.

The Zacks Consensus Estimate for NuScale Power’s 2025 bottom line is pegged at a loss of $1.64 per share. The current estimate has widened from a loss of 46 cents projected 60 days ago. NuScale Power reported earnings of 42 cents per share in 2024.

For 2025, the Zacks Consensus Estimate for Oklo’s bottom line is pegged at a loss of 61 cents per share, which has widened by 3 cents over the past 30 days. Oklo reported a loss of 74 cents per share in 2024.

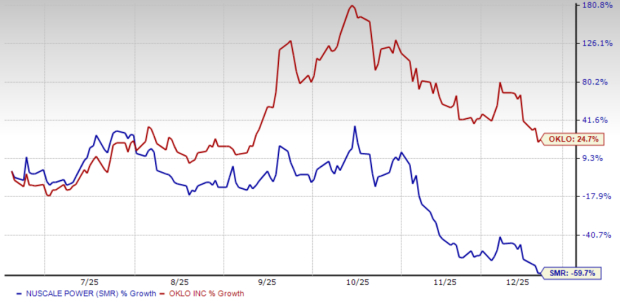

In the past six months, NuScale Power shares have plunged 59.7%, while Oklo shares have surged 24.7%.

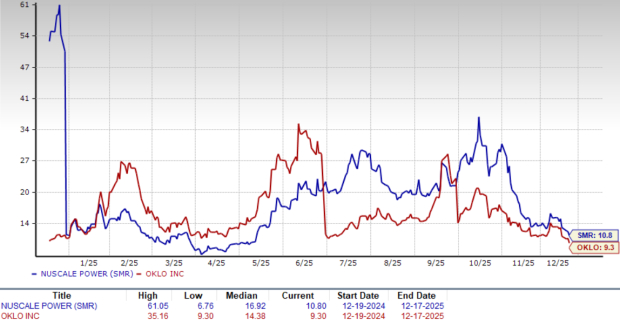

In terms of trailing 12-month Price/Book, NuScale Power shares are trading at 10.8X, higher than Oklo’s 9.3X. NuScale Power does seem pricey compared with Oklo. In contrast, Oklo’s reasonable valuation makes it more attractive for investors looking for value and stability.

Both NuScale Power and Oklo are poised to benefit from the nuclear energy boom. NuScale Power has important technology advantages and major long-term project announcements, but its revenues remain very small, project timelines are long, and key agreements are not yet firm.

In contrast, Oklo is building a model that can scale faster. It is moving ahead with multiple reactor programs, working on its own fuel supply, and seeing strong interest from data center customers. Moreover, the company’s reasonable valuation makes the stock look more attractive.

Oklo carries a Zacks Rank #3 (Hold), making it a clear winner over NuScale Power, which has a Zacks Rank #5 (Strong Sell) at present.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite