|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Revvity, Inc. RVTY recently introduced Signals Xynthetica, a next-generation AI-augmented design platform aimed at transforming molecular and materials discovery across scientific industries. Positioned within the existing Revvity Signals ecosystem, this new offering is delivered as a Models-as-a-Service (MaaS) solution that integrates advanced in-silico design capabilities with real experimental data under a governed, continuously learning framework.

The platform aims to provide scientific teams with a unified environment for generating, predicting, and validating candidate molecules and materials, reducing the barriers to applying predictive science in real-world research settings. Pre-registration has commenced, with early access slated for the first half of 2026.

At its core, Signals Xynthetica addresses a fundamental bottleneck in scientific R&D — the disconnect between powerful computational models and the experimental workflows scientists depend on. By unifying de novo generation, property prediction, and multi-objective optimization within a cohesive model-and-data loop, Revvity intends to accelerate discovery while reinforcing scientific rigor. Revvity points out that these models are adaptable to new data and can be benchmarked against real-world results, fostering confidence and iterative enhancement in predictive insights.

According to Kevin Willoe, president of Revvity Signals Software, the initiative is designed not merely as a computational tool but also as an operational backbone for predictive science that aligns AI predictions with laboratory realities. This alignment underscores Revvity’s broader strategic emphasis on embedding AI deeply into scientific workflows — a shift that holds significant implications for industries spanning pharmaceuticals, biotechnology and materials science.

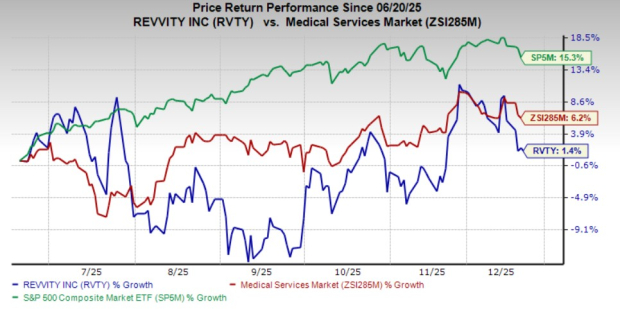

Following the announcement on Dec. 16, the company's shares traded almost flat till yesterday. Over the past six months, shares have gained 1.4% compared with the industry’s 6.2% growth. The S&P 500 has gained 15.3% in the same time frame.

In the long run, RVTY’s Signals Xynthetica is likely to boost its prospects. As scientific organizations increasingly demand predictive tools that are tightly integrated with empirical workflows, Revvity’s stepwise expansion into Models-as-a-Service offerings positions it at the intersection of data infrastructure, AI modeling and experimental science — potentially reshaping how discovery work is conducted in an era defined by data-driven innovation.

While Signals Xynthetica is the most recent addition to Revvity’s AI portfolio, it is part of a broader, multi-year evolution of the company’s software offerings, increasingly focused on AI-driven insights and seamless scientific data integration.

In April 2025, Revvity Signals Software unveiled Signals One, a unified data platform designed to span the entire drug discovery lifecycle — from design through decision-making. Signals One incorporates data workflows that make research data AI-ready, enabling advanced analytics such as semantic search and automated protocol suggestions while safeguarding intellectual property. This product laid the foundation for the company’s shift toward embedding predictive capabilities into everyday scientific operations.

Additionally, earlier in 2025, Revvity launched Living Image Synergy AI, a multimodal imaging analysis platform that harnesses AI to unify disparate imaging modalities, automate labor-intensive tasks and enhance reproducibility. This offering reflects Revvity’s commitment to embedding artificial intelligence directly within scientific interpretation and workflow execution, bridging human expertise with machine intelligence.

Beyond pure discovery software, Revvity has integrated AI into operational contexts. For instance, Transcribe AI, introduced in late 2024, leverages advanced AI for optical character recognition (OCR) in clinical laboratories, streamlining data entry and improving accuracy. This demonstrates that Revvity’s AI adoption extends beyond modeling to driving efficiencies across both research and clinical ecosystems.

Collectively, these initiatives illustrate a coherent strategic trajectory: Revvity is transforming from a provider of discrete scientific tools to a platform-centric technology partner that leverages AI and cloud delivery to accelerate discovery, standardize workflows, and democratize access to predictive models and insights. Signals Xynthetica exemplifies this aim by breaking down silos between computational predictions and empirical science, enabling a continuous learning loop where models improve as they are used.

Moreover, the company’s announced acquisition of ACD/Labs strengthens this strategy by incorporating specialized analytical and molecular design tools into the Signals ecosystem, enabling deeper integration of data generation, interpretation, and predictive modeling.

Revvity Inc. price | Revvity Inc. Quote

Revvity currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader medical space that have announced quarterly results are Medpace Holdings, Inc. MEDP, CareCloud CCLD and KORU Medical Systems KRMD.

Medpace Holdings, currently carrying a Zacks Rank #2 (Buy), reported second-quarter 2025 EPS of $3.10, which beat the Zacks Consensus Estimate by 3.3%. Revenues of $603.3 million outpaced the consensus mark by 11.5%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Medpace Holdings has a long-term estimated growth rate of 11.4%. MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 13.9%.

CareCloud reported third-quarter 2025 adjusted EPS of 10 cents, which beat the Zacks Consensus Estimate by 25%. Revenues of $31 million surpassed the Zacks Consensus Estimate by 8.3%. It currently carries a Zacks Rank of 2.

CareCloud has an estimated growth rate of 20% for 2025. CCLD’s earnings surpassed estimates in two of the trailing four quarters and missed twice, the average negative surprise being 2.88%.

KORU Medical Systems reported third-quarter 2025 adjusted loss per share of 2 cents, narrower than the Zacks Consensus Estimate of loss by 33.3%. Revenues of $10 million surpassed the Zacks Consensus Estimate by 7.1%. It currently carries a Zacks Rank #2.

KORU Medical Systems has an estimated growth rate of 83.3% for 2026. KRMD’s earnings surpassed estimates in two of the trailing four quarters, missed in one and met in the other, the average surprise being 20.83%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-16 | |

| Feb-15 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 |

The 'Key Negative' That Took Out Medpace's Sales, Profit Beat

MEDP -15.90%

Investor's Business Daily

|

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite