|

|

|

|

|||||

|

|

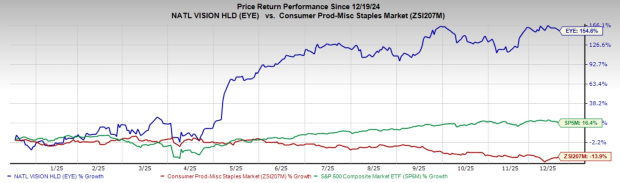

National Vision EYE has shown impressive momentum in the past 12 months, with its shares rising 154.6%. This has significantly outperformed the industry, which fell 13.9%, as well as the S&P 500 composite’s 16.4% growth.

Currently carrying a Zacks Rank #3 (Hold), the renowned U.S. optical retailer continues to gain from the strong performance of its America’s Best brand. Following a comprehensive store fleet review, the company is taking action to improve the underlying strength of its core business. Strong execution of strategic initiatives is reflecting early progress.

National Vision provides budget-friendly eye exams, eyeglasses and contact lenses to low-income consumers and aims at making eye care and eyewear reasonable for all Americans. As of Sept. 27, 2025, the company operated through a diverse portfolio of 1,242 retail stores across four brands and associated omni-channel consumer websites. Further, National Vision’s distribution network features a 118,000-square-foot distribution center in Georgia and also includes a 52,000-square-foot distribution center in Ohio.

The rally in the share price can be linked to the company’s Owned & Host segment, which continues to gain from positive comparable store sales growth and new store openings. In the third quarter of 2025, Owned & Host net revenues rose 9.1% year over year, driven primarily by America’s Best. The brand has continued to strengthen its value offerings and attract new customers through promotional offers and exclusive partnerships.

National Vision opened four America’s Best stores during the third quarter and completed four Eyeglass World-to-America’s Best conversions during the September 2024 to September 2025 period. The company is also incorporating insights from its fleet optimization review into the go-forward store growth plans and testing a few smaller-sized store formats for America's Best.

Additionally, the company is driving improvements in Eyeglass World, bringing in a new leadership team earlier in the year. National Vision leverages remote capabilities to expand exam capacity, with approximately two-thirds of its store base now enabled with remote technology. Its remote hybrid pilot is also progressing well, with more in-store doctors now trained to perform remote exams in other locations.

Building on its 2022 strategic transformation, the new strategy now emphasizes segmentation, personalization, and digitization in messaging, product, pricing architecture and customer experience, with an emphasis on managed care, progressive and outside Rx customers. In the third quarter, traffic trends across these cohorts remained healthy.

The company is also seeing early indicators of stronger customer engagement, supported by its new marketing strategy and customer relationship management (CRM) platform, as well as in-store selling tools. Newly added premium frames like Lam, Ted Baker, Jimmy Choo, HUGO Boss are selling faster than expected.

The overall economic environment continues to be challenging, and macroeconomic factors such as inflation and geopolitical uncertainties could indirectly impact National Vision’s results of operations. Competitive pressures in the optical retail industry are also a concern.

The Zacks Consensus Estimate for National Vision’s 2025 and 2026 earnings per share (EPS) is expected to increase 32.6% and 26.8% year over year, respectively, to $69 cents and $88 cents. In the past 30 days, the Zacks Consensus Estimate for the company's 2025 EPS has remained constant.

Revenues for 2025 are projected to grow 5.2% to $1.98 billion, while the same for 2026 is expected to reach $2.05 billion, implying a 3.3% increase.

Some better-ranked stocks in the broader medical space are BrightSpring Health Services BTSG, lllumina ILMN and Insulet PODD.

BrightSpring Health Serviceshas an estimated long-term earnings growth rate of 53.3% compared with the industry’s 15.5% growth. Its earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 45.1%. BTSG shares have surged 115% compared with the industry’s 7.1% growth in the past year.

BTSG sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Illumina, sporting a Zacks Rank #1, has an earnings yield of 3.7% compared to the industry’s -17.9% yield. Shares of the company have dropped 2.5% in the past year against the industry’s 16.2% growth. ILMN’s earnings outpaced estimates in three of the trailing four quarters and missed on one occasion, the average surprise being 6.7%.

Insulet, carrying a Zacks Rank #2 (Buy), has an earnings yield of 3.9% against the industry’s -0.9% yield. Shares of the company have increased 14.1% compared with the industry’s 2.1% growth. PODD’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 17.8%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-21 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Stock Market Leaders, Top-Performing IPOs Tend To Share This Common Trait

BTSG

Investor's Business Daily

|

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite