|

|

|

|

|||||

|

|

The rising demand for premium office spaces, coupled with declining supply, is defining the new wave of U.S. office real estate market leasing momentum, setting it up modestly for a comeback in 2026. With greater workforce attendance, interest rates easing and inflation anticipated to trend southward in the latter half of 2026, the office real estate industry is expected to further reap benefits.

These favorable dynamics draw attention to two office REITs — Cousins Properties CUZ and Vornado Realty Trust VNO. Before assessing their fundamentals, it is important to understand the broader industry backdrop supporting office REITs.

The U.S. economy showed notable resilience in 2025 despite macro headwinds such as tariffs and policy uncertainty. Real GDP growth of 3.8% in the second quarter highlights the underlying strength of economic activity. Reinforcing this outlook, the Federal Open Market Committee, at its December meeting, raised its 2026 GDP growth forecast to 2.3% from 1.8% projected in September. This improving macro backdrop is encouraging for landlords, as healthier economic conditions support tenant cash flows and confidence, allowing them to absorb higher rents. In turn, this bodes well for office occupancy levels and rental income stability.

Additionally, the accelerating adoption of artificial intelligence (AI) is driving productivity gains across corporate America. Improved operational efficiency and better business visibility are boosting corporate confidence and facilitating smoother real estate decision-making. AI-focused firms are emerging as an incremental source of office leasing demand, acting as a meaningful catalyst for the sector.

While elevated inflation has constrained the Federal Reserve’s pace of rate cuts, the central bank is expected to continue easing policy to support employment. Lower interest rates should reduce financing pressures for corporates, encouraging capital investment and hiring, thereby translating into improved demand for office space.

Moreover, the growing push for return-to-office initiatives, combined with employers’ focus on providing high-quality work environments to enhance employee productivity, is driving demand toward well-located, amenity-rich premium office assets. According to Cushman & Wakefield Office United States Outlook 2026, office job growth is expected to rebound in 2026 after two years of consolidation. Finance and legal services firms are contributing to office employment gains largely. With greater office-using employment, the demand for office space is going to improve.

Moreover, with office supply declining and the construction pipeline at its lowest level since the late 1990s, landlords are in a favorable environment and increasingly focusing on renovations to meet demand for modern spaces with all amenities. Vacancy remains structurally elevated in obsolete properties, while sublease availability continues to shrink. As a result, occupancy levels at premium assets are expected to improve further, supporting rental growth and reinforcing the recovery narrative for high-quality office portfolios.

Cousins Properties: This office REIT boasts a premier portfolio of Class A office assets concentrated in high-growth Sun Belt markets, which continue to benefit from strong population inflows. Favorable migration trends and a pro-business environment have accelerated corporate relocations and expansions across the region, driving sustained demand for office space. During the first nine months of 2025, the company executed 128 leases totaling 1.4 million square feet, with a weighted average lease term of 7.9 years, underscoring healthy leasing momentum and tenant commitment.

Apart from maintaining a well-diversified, high-quality tenant base that supports stable revenue generation across economic cycles, Cousins Properties also remains focused on enhancing portfolio quality through trophy asset acquisitions and opportunistic developments in attractive Sun Belt submarkets. Its robust development pipeline is expected to deliver meaningful incremental annualized net operating income (NOI) in the coming years. A strong balance sheet further enhances financial flexibility and positions the company well to capitalize on growth opportunities.

Over the past month, the Zacks Consensus Estimate for 2025 FFO per share has witnessed a marginal upward revision to $2.84. This suggests 5.6% growth year over year. CUZ currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Vornado Realty Group: This office REIT maintains a high-quality asset base with a strategic emphasis on expanding its market share in the New York City office market. The company holds a controlling interest in 555 California Street in San Francisco’s Financial District and owns theMART in Chicago’s River North District, which are iconic office assets located in premier gateway cities.

The combination of office-using job growth and continued expansion by technology, financial and media firms is expected to support Vornado’s rental revenue growth in the coming quarters. Demand remains resilient in New York, with office occupiers continuing to expand their footprint. During the first nine months of 2025, VNO leased 2.8 million square feet across its New York office portfolio, with a weighted average lease term of 12.2 years, highlighting strong tenant commitment.

VNO’s focus on a select group of high-rent, high-barrier-to-entry markets, along with a diversified tenant roster that includes several industry bellwethers, should drive stable cash flows and long-term growth. Ongoing portfolio repositioning initiatives and a healthy balance sheet further strengthen its growth outlook.

VNO currently carries a Zacks Rank #3 (Hold). Over the past week, the Zacks Consensus Estimate for 2025 FFO per share has witnessed a marginal upward revision to $2.34. This implies 3.5% growth year over year.

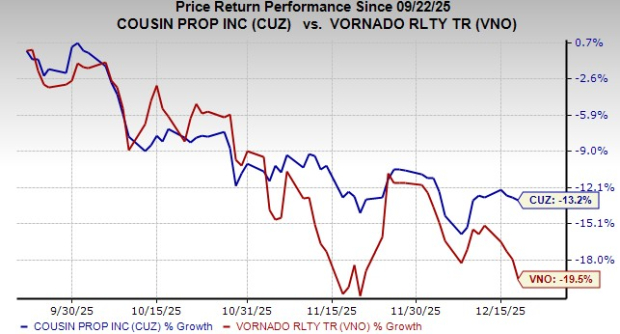

Here’s how both stocks have performed over the past three months.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite