|

|

|

|

|||||

|

|

Pulse Biosciences PLSE recently announced that the FDA has granted Investigational Device Exemption (“IDE”) approval to initiate its nPulse Cardiac Catheter Ablation System study for the treatment of paroxysmal atrial fibrillation. The approval allows PLSE to begin a multicenter clinical trial evaluating its proprietary Nanosecond Pulsed Field Ablation (nsPFA) technology, marking an important regulatory milestone for the cardiac portfolio.

For investors, the IDE clearance de-risks the clinical pathway, builds on encouraging European feasibility data and positions PLSE to generate meaningful U.S. clinical evidence that could support broader adoption and future commercialization.

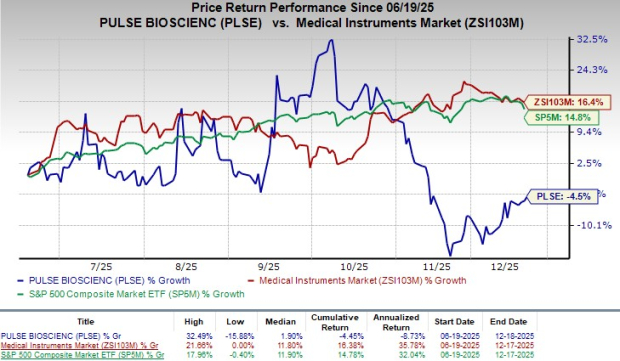

Following the announcement, the company's shares closed flat at yesterday’s market closing. Shares of the company have lost 4.5% in the year-to-date period compared with the industry’s 16.4% growth. The S&P 500 has gained 14.8% in the same time frame.

Over the long run, the FDA IDE approval strengthens PLSE’s business by advancing its nPulse system toward U.S. commercialization in the fast-growing AF ablation market, while validating its differentiated nanosecond PFA technology versus competing microsecond-based systems. Successful execution of the study could generate pivotal clinical data to support regulatory approval, drive physician adoption and establish PLSE as a next-generation ablation platform with potential workflow, safety and durability advantages, ultimately expanding revenue opportunities.

PLSE currently has a market capitalization of $966.4 million.

The FDA IDE approval enables Pulse Biosciences to formally launch its NANOPULSE-AF study, a single-arm, multicenter, prospective trial designed to evaluate the safety and effectiveness of the nPulse Cardiac Catheter Ablation System in patients with recurrent, drug-resistant paroxysmal atrial fibrillation. The study plans to enroll up to 145 patients across as many as 30 sites, including leading centers in the United States and three sites outside the country, giving PLSE broad geographic exposure and clinical diversity. The trial’s design aligns with regulatory expectations for early-stage cardiac device validation and represents a meaningful step forward in PLSE’s U.S. clinical strategy.

A key differentiator highlighted in the announcement is PLSE’s use of nanosecond pulsed field ablation, which delivers substantially lower total energy compared with traditional microsecond PFA systems. Management believes this approach may further reduce collateral damage to surrounding cardiac structures while maintaining effective lesion formation. The nPulse catheter is also engineered to create a complete circumferential pulmonary vein isolation lesion in a single energy application, eliminating the need for repeated repositioning and stacked lesions — an advantage that could simplify workflows, reduce procedure times and improve consistency in real-world EP labs.

Importantly, the IDE builds on encouraging clinical momentum in Europe, where PLSE’s ongoing feasibility study has already enrolled 150 patients with follow-up underway. Positive early outcomes from that experience provide real-world validation for the technology and help de-risk the U.S. study. With strong support from prominent electrophysiologists and plans to share follow-up data in 2026, PLSE is positioning its nsPFA platform as a next-generation ablation solution that could enhance safety, procedural efficiency and durability, key attributes that matter for long-term adoption and commercial success.

Per a report by Grand View Research, the global atrial fibrillation market size was estimated at $26.89 billion in 2024 and is projected to reach $65.33 billion by 2033, registering a CAGR of 10.44% from 2025 to 2033.

The atrial fibrillation market is driven by a growing disease burden, rapid technological evolution in treatment and diagnostics and the shift toward remote patient monitoring.

Recently, PLSE announced that it initiated a research collaboration with The University of Texas MD Anderson Cancer Center to test its nPulse technology — Vybrance — for treating malignant thyroid tumors. The FDA has given approval for PLSE’s IDE application so they can commence human trials. The clinical trial is scheduled to begin in early 2026 and will enroll 30 patients across two sites.

Currently, PLSE carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Intuitive Surgical ISRG, Medpace Holdings MEDP and Boston Scientific BSX.

Intuitive Surgical, sporting a Zacks Rank #1 (Strong Buy) at present, posted a third-quarter 2025 adjusted EPS of $2.40, exceeding the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%. You can see the complete list of today’s Zacks #1 Rank stocks here.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Medpace, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 EPS of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 14.28%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion outperformed the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 16 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite