|

|

|

|

|||||

|

|

Cencora, Inc. COR recently agreed to acquire a majority of the remaining equity interests in OneOncology — a physician-led national platform that supports independent oncology practices — from TPG and other shareholders for $3.6 billion. The transaction gives COR greater strategic control of the OneOncology platform and supports its pharmaceutical-centric strategy. This move further drives the company’s progress across all three growth objectives by advancing the specialty solutions portfolio, partnering with industry leaders and improving patient and provider access to pharmaceuticals.

Management raised its long-term guidance for adjusted operating income growth to 7%-10% and adjusted diluted EPS growth to 10%-14% for Cencora’s U.S. Healthcare Solutions segment. OneOncology’s growth by helping patients get high-quality care close to home supports the company’s strategy of investing in growing healthcare businesses tied to pharmaceuticals.

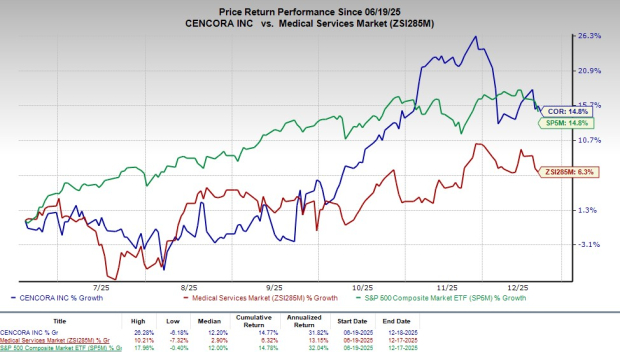

Shares of COR have edged down 2.8% since the announcement on Monday. Over the past six months, shares of COR have climbed 14.8% compared with the industry’s 6.3% growth and the S&P 500’s 14.8% rise.

In the long run, the acquisition strengthens COR’s ability to support specialty physicians and pharmaceutical innovators by utilizing OneOncology’s MSO and clinical tools and builds community with market leaders to advance best practices in community-based care. By combining OneOncology’s strengths with Cencora and Retina Consultants of America, the acquisition will enhance cancer care navigation, clinical trial access and novel therapy availability.

COR currently has a market capitalization of $66.53 billion.

The transaction values OneOncology at an enterprise value of $7.4 billion and an equity value of approximately $6 billion. COR will pay off $1.3 billion of OneOncology’s existing corporate debt, resulting in total cash consideration of about $5 billion. Expected to close by the end of the second quarter of fiscal 2026, Cencora plans to pay for the transaction with new debt financing while maintaining its investment-grade credit rating and focusing on reducing debt.

Cencora expects the acquisition to have a neutral impact on its fiscal 2026 adjusted earnings per share, projecting it to be closer to the lower end of the range of $17.45 to $17.75. On acquiring OneOncology, the company is temporarily pausing share repurchases.

From a strategic standpoint, by bringing OneOncology fully under its umbrella, COR is better positioned to deliver pharmaceuticals, healthcare products and services. OneOncology’s contribution in simplifying cancer care navigation, accelerating clinical trials and expanding access to novel treatments fits well with Cencora’s relationships with pharmaceutical innovators. This alignment supports earlier adoption of new treatments for the majority of cancer patients.

Going by data provided by Precedence Research, the oncology market is valued at $225.01 billion in 2025 and is expected to witness a CAGR of 11.5% through 2034. Factors like the rising prevalence of cancer disease among the global population, which significantly fosters the demand for various oncology diagnostics and treatment products, are driving the market’s growth.

In early 2025, COR announced the acquisition of Retina Consultants of America to strengthen its footprint on MSO solutions, grow its support services for medical practices and provide more value to shareholders, including doctors and patients. With the acquisition of Retina Consultants of America, COR aims to improve both platforms, strengthen clinical trials, technology and physician leadership, and deliver greater value to stakeholders.

Cencora, Inc. price | Cencora, Inc. Quote

Currently, COR carries a Zacks Rank #2 (Buy).

Other top-ranked stocks from the broader medical space are BrightSpring Health Services, Inc. BTSG, Pediatrix Medical Group, Inc. MD and Biodesix BDSX.

BrightSpring Health Services, sporting a Zacks Rank #1 (Strong Buy) at present, reported third-quarter 2025 adjusted earnings per share (EPS) of 30 cents, which surpassed the Zacks Consensus Estimate by 11.11%. Revenues of $3.33 billion beat the Zacks Consensus Estimate by 5.46%. You can see the complete list of today’s Zacks #1 Rank stocks here.

BTSG has an estimated long-term earnings growth rate of 53.3% compared with the industry’s 15.5% rise. The company beat earnings estimates in the trailing four quarters, the average surprise being 45.05%.

Pediatrix Medical Group, currently flaunting a Zacks Rank #1, reported a third-quarter 2025 adjusted EPS of 67 cents, which surpassed the Zacks Consensus Estimate by 45.65%. Revenues of $492.8 million beat the Zacks Consensus Estimate by 1.82%.

MD has an estimated earnings growth rate of 37.09% for 2025 compared with the industry’s 11.0% growth. The company beat earnings estimates in the trailing four quarters, the average surprise being 35.42%.

Biodesix, currently carrying a Zacks Rank #2, reported a third-quarter 2025 loss per share of $1.16, which surpassed the Zacks Consensus Estimate by 27.5%. Revenues of $21.8 million beat the Zacks Consensus Estimate by 2.68%.

BDSX has an estimated earnings growth rate of 20.0% for 2025 compared with the industry’s 11.0% growth. The company’s earnings have missed estimates in the trailing four quarters, the average surprise being 6.88%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 17 hours | |

| Mar-10 | |

| Mar-09 | |

| Mar-09 | |

| Mar-07 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about Finviz Elite