|

|

|

|

|||||

|

|

Investing in undervalued stocks with robust fundamentals is a sound way to create long-term wealth. Buying a stock that trades below its intrinsic value provides a margin of safety, guarding capital from market volatility while setting it up for an upside. Investors can draw in returns by purchasing these undervalued stocks as soon as the market recognizes their true value.

Strong fundamentals ensure quality stocks by filtering out businesses that are deteriorating. It displays an image of those stocks that can make stronger comebacks despite tackling economic setbacks. Investing in these stocks is a no-brainer, as this approach lowers stress and converts the temporary downturn into long-term gains.

As we look toward 2026, OppFi OPFI, Green Dot GDOT and Evertec EVTC are the three undervalued stocks that investors should add to their portfolios.

OppFi: It is revolutionizing the credit game by leveraging its proprietary AI and machine learning-based Model 6, resulting in improving the auto approval rate to 79.1% in the third quarter of 2025 from 76.8% in the year-ago quarter. This provided a major impetus to its profitability position as the proportion of total expenses to revenues dipped 500 basis points (bps) year over year, leading to a 136.9% surge in net income.

Model 6 showed promising results in curbing credit risks as evidenced by a reduction in the net charge-off as a percentage of total revenues by 430 bps year over year for the nine months ending Sept. 30, 2025.

Management’s optimism is highlighted by the consistent increment in the company’s adjusted net income and adjusted EPS guidance. During the fourth quarter of 2024, it had anticipated adjusted net income of $95-$97 million for 2025, which was hiked to $137-$142 million in the third quarter of 2025. For adjusted EPS, expectations were $1.06-$1.07 in the fourth quarter of 2024, which was raised to $1.54-$1.6 in the third quarter of 2025. Such major hikes in these metrics highlight OPFI’s confidence in its profitability position, raising green flags for investors.

The company currently has a Zacks Rank #2 (Buy) and a Value Score of A. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

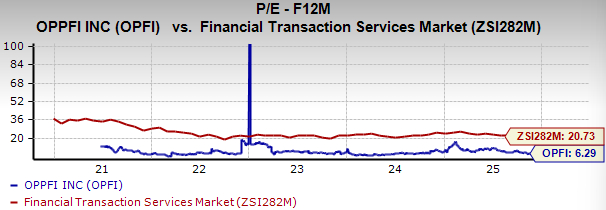

Based on the five-year 12-month price-to-earnings ratio (P/E), OPFI is trading at 6.29X, significantly lower than the industry’s 20.73X. The stock has declined 8% over the past three months.

The Zacks Consensus Estimate for 2025 revenues is pinned at $598 million, suggesting 13.6% year-over-year growth. For 2026, the same is expected to gain 9.1% from the preceding year. The consensus mark for 2025 EPS is set at $1.57, indicating a 65.3% year-over-year surge. For 2026, the same is anticipated to gain 8.6% from the previous year.

Over the past 60 days, two EPS estimates for both 2025 and 2026 have been revised upward without any single downward adjustment. During the same period, the Zacks Consensus Estimate for 2025 and 2026 earnings has increased 10.6% and 15.5%, respectively.

OppFi Inc. price-consensus-chart | OppFi Inc. Quote

Green Dot: The company’s B2B segment is the core growth engine, resulting in more than 30% growth in revenues in the third quarter of 2025. This improvement is driven by the Arc platform and high-scale partnerships with brands like Crypto.com, Stripe and Workday. It is further strengthened by a robust pipeline and Project 30, which cuts partner onboarding time to just 30 days, propelling the path to sales.

During the recent earnings call, management stated that it was positive about Earned Wage Access (EWA) due to its expansive potential market and robust profit margins. The company integrated the EWA platform with Workday, which allows the company to utilize a greater number of employers across the country to sell either in partnership with those partners or to employers directly.

GDOT’s cash and equivalents as of Sept. 9, 2025, stand at $1.6 billion with no current debt, signaling a strong balance sheet position. Furthermore, its long-term debt of $63 million results in a long-term debt to equity of 7% compared with an industry average of 70.7%, reflecting its solvency. It displays a massive equity buffer and minimal interest burden, providing immunity to bankruptcy.

The company currently has a Zacks Rank #2 and a Value Score of A.

Based on the five-year 12-month P/E, GDOT is trading at 8.75X, substantially lower than the industry’s 20.73X. The stock dipped 13% over the past three months.

The Zacks Consensus Estimate for 2025 revenues is pegged at $2.1 billion, suggesting a 20.4% year-over-year rally. For 2026, the same is estimated to rise 11.3% from the preceding year’s actual. The consensus mark for 2025 EPS is kept at $1.39, indicating a 1.5% year-over-year jump. For 2026, the same is anticipated to increase 9% from the previous year’s actual.

Over the past 60 days, two EPS estimates for 2025 and one for 2026 have been revised upward without any single downward adjustment. During the same period, the Zacks Consensus Estimate for 2025 and 2026 earnings has gained 3% and 0.7%, respectively.

Green Dot Corporation price-consensus-chart | Green Dot Corporation Quote

Evertec: Recent performance highlights EVTC’s strides to becoming a more diversified fintech company across Latin America. In the third quarter of 2025, the company registered 8% year-over-year growth in its top line, facilitated by modernization in Brazil and Grandata and Nubity buyouts. In Puerto Rico, the Merchant Acquiring and Payment Services segment revenues gained 3% and 5%, respectively, resulting in a boost in sales volume and popularity of the ATH Movil Business.

Despite management’s anticipated $14-million headwind affecting the majority of the Business Solutions segment, leading to a 10% discount on services for Banco Popular, the Tecnobank buyout and contract wins with Banco de Chile and Financiera Oh in Peru are expected to offset these setbacks. EVTC’s liquidity position appears strong with cash and equivalents of $500 million as of Sept. 9, 2025, and current debt of $24 million. The strength is further highlighted by the fact that its current ratio in the third quarter of 2025 was at 2.91, increasing from the year-ago quarter’s 1.97, standing significantly higher than the industry’s 1.15.

The company currently has a Zacks Rank #2 and a Value Score of A.

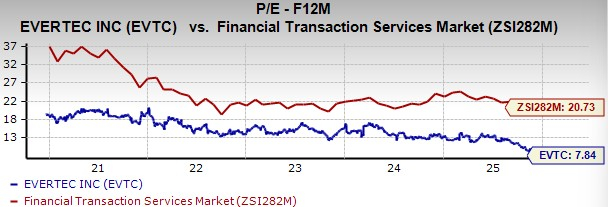

Based on the five-year 12-month P/E, EVTC is trading at 7.84X, way lower than the industry’s 20.73X. The stock has dipped 13.7% over the past three months.

The Zacks Consensus Estimate for 2025 revenues is kept at $924 million, suggesting a 9.3% year-over-year gain. For 2026, the same is expected to increase 5.3% from the preceding year. The consensus mark for 2025 EPS is kept at $3.59, indicating a 9.5% year-over-year rise. For 2026, the same is anticipated to increase 4% from the previous year’s actual.

Over the past 60 days, four EPS estimates for 2025 and 2026 have been revised upward without any single downward adjustment. During the same period, the Zacks Consensus Estimate for 2025 and 2026 earnings has gained 2.9% and 3.3%, respectively.

Evertec, Inc. price-consensus-chart | Evertec, Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-12 | |

| Feb-12 | |

| Feb-04 | |

| Feb-02 | |

| Feb-02 | |

| Jan-28 | |

| Jan-21 | |

| Jan-20 | |

| Jan-16 | |

| Jan-14 | |

| Jan-13 | |

| Jan-13 | |

| Jan-12 | |

| Jan-07 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite