|

|

|

|

|||||

|

|

Axon Enterprise, Inc. AXON and Woodward, Inc. WWD are two prominent names operating in the aerospace and defense equipment industry. As rivals, these companies are engaged in producing highly engineered public security and defense solutions in the United States and internationally. Both companies have been enjoying significant growth opportunities in the public safety and defense industries on account of growing instances of terrorism and criminal activities and the expansionary U.S. budgetary policy. Let’s take a closer look at their fundamentals, growth prospects and challenges.

Axon has been experiencing strong momentum in its Connected Devices segment. The company continues to witness robust demand for its next-generation TASER 10 products, whose shipment began a couple of years back. Growth in cartridge revenues, driven by higher adoption of the TASER products, has been driving the segment’s performance. Also, Axon’s next-generation body-worn camera, Axon Body 4, is generating significant demand, thus bolstering the segment’s growth. The segment’s revenues increased 26% year over year in the first nine months of 2025.

In the same period, revenues from the company’s TASER product line increased 18% year over year, driven by TASER 10, while those from the Personal Sensors surged 24%, led by Axon Body 4. Also, revenues from the Platform Solutions product line soared 69%, supported by counter-drone, virtual reality and fleet.

Growth in the aggregate number of users to the Axon network is supporting the Software & Services segment. After witnessing a year-over-year 33.4% jump in revenues in 2024, revenues from the segment increased 39.6% in the first nine months of the year.

The company remains focused on strategic collaborations to expand its product offerings and customer base. In October 2025, Axon’s Dedrone business announced its partnership with TYTAN (a leading provider of interceptor systems for Group 3 drones) to boost its Counter-Unmanned Aircraft Systems (CUAS) mitigation capability, making it suitable to deploy against Group 3 threats.

On the flip side, escalating costs and expenses are a concern for Axon’s bottom line. In the first nine months of 2025, its cost of sales and SG&A expenses increased 28.4% and 39.7%, respectively, year over year. Total operating expenses climbed 47% year over year to $1.21 billion. The company incurred high costs and expenses related to business integration activities, an increase in headcount and higher wages and stock-based compensation expenses.

Axon has been facing the pressure of rising debt levels. Exiting the third quarter of 2025, the company’s long-term notes payable (net) were $1.73 billion. The same stood at zero at 2024-end. This increase was primarily due to funds raised to support the company’s strategic investments, expansion activities and potential acquisitions.

Woodward’s Aerospace business is gaining momentum with strength in the commercial aftermarket as well as higher defense activity, despite supply-chain challenges. In the fourth quarter of fiscal 2025 (ended September 2025), net sales for the segment were up 19.6% year over year, driven by broad-based strength across commercial services and defense OEM. Driven by strength across its business, Woodward projects its Aerospace segment to grow 9-15% in fiscal 2026 (ending September 2026).

The company’s Industrial business segment has also been gaining from solid demand for power generation and continued requirement for primary and backup power for data centers. Higher investment in gas-powered generation to support grid stability is another tailwind. WWD expects a strong demand environment to continue into fiscal 2026, with solid momentum in the Industrial segment. For fiscal 2026, Woodward expects consolidated net sales to rise 7-12%, with the Industrial segment anticipated to increase 5-9%.

The company’s disciplined capital deployment remains focused on three priorities: reinvesting for growth, returning cash to shareholders and pursuing strategic acquisitions. As part of this strategy, the company is making a multiyear investment in a new state-of-the-art facility to support the Airbus A350 spoiler actuation program and long-term organic growth. Also, its recent acquisition of Safran’s Electronics & Defense electromechanical actuation business further strengthens its position in electromechanical actuation systems.

During fiscal 2025, the company returned $238 million to its shareholders in the form of $65 million of dividends and $173 million of share repurchases. Also, in November 2025, the company finished its previous three-year, $600 million share repurchase program a year earlier than planned, demonstrating its strong focus on shareholder returns.

Recently, the company also announced a new three-year authorization for up to $1.8 billion in common stock repurchases. For fiscal 2026, the company expects to return between $650 million and $700 million to shareholders via dividends and share repurchases.

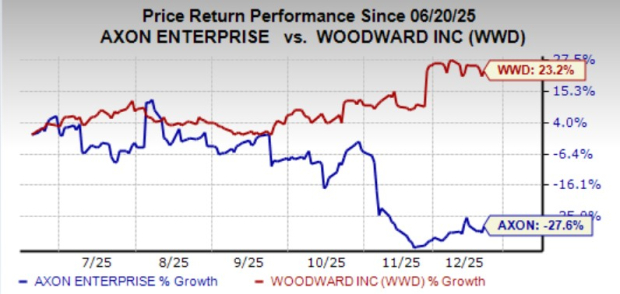

In the past six months, Axon shares have lost 27.6%, while Woodward stock has gained 23.2%.

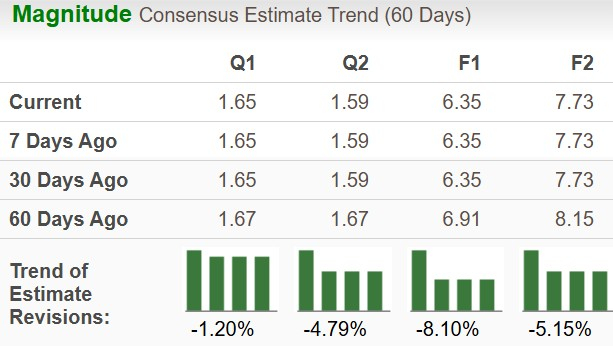

The Zacks Consensus Estimate for AXON’s 2025 sales and earnings per share (EPS) implies year-over-year growth of 31.3% and 6.9%, respectively. However, the EPS estimates for 2025 and 2026 have decreased 8.1% and 5.2%, respectively, over the past 60 days.

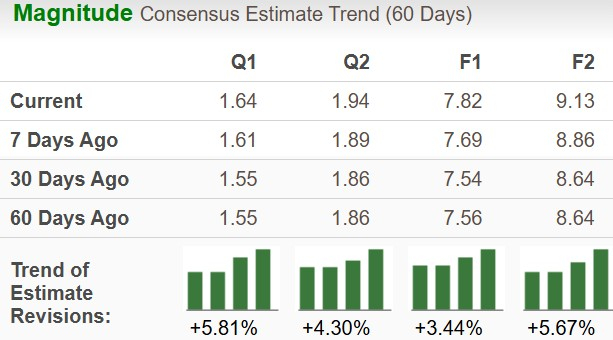

The Zacks Consensus Estimate for WWD’s 2025 sales implies growth of 11.1% year over year, while the EPS estimate implies a 13.5% increase. WWD’s EPS estimates have increased 3.4% for fiscal 2026, while the same has improved 5.7% for fiscal 2027 (ending September 2027) over the past 60 days.

Woodward is trading at a forward 12-month price-to-earnings ratio of 36.42X, while Axon’s forward earnings multiple sits much higher at 73.29X.

Axon’s strength in both the segments and strategic partnerships have been dented by rising costs and expenses and high debt level, which might affect its margins and performance. Also, AXON’s expensive valuation warrants a cautious approach for existing investors.

In contrast, Woodward’s market leadership position and strength in both the aerospace and industrial businesses provide it with a competitive advantage to leverage the long-term demand prospects in the market. WWD holds robust prospects due to strong estimates, stock price appreciation, attractive valuation and better prospects for sales and profit growth.

Given these factors, WWD seems to be a better pick for investors than AXON currently. While WWD currently carries a Zacks Rank #2 (Buy), AXON has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours |

S&P 500 Stock Axon Surges; How Taser Maker Disarmed AI Software Doubts

AXON +5.77%

Investor's Business Daily

|

| 8 hours |

Axon Stock Surges; How Taser Maker Disarmed AI Software Doubts

AXON +5.77%

Investor's Business Daily

|

| 12 hours | |

| 13 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Axon Disarms AI Software Doubts; How Taser Maker Wins In AI Age

AXON +17.55%

Investor's Business Daily

|

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite