|

|

|

|

|||||

|

|

Hologic HOLX and Labcorp LH are two established MedTech players with a history of collaboration, though each brings distinct strengths. With a market capitalization of $16.71 billion, Hologic specializes in diagnostic products, medical imaging systems and surgical products aimed at women’s health and well-being through early detection and treatment. Labcorp, valued at $20.89 billion, provides comprehensive laboratory services to doctors, hospitals, pharmaceutical companies, researchers and patients by leveraging its diagnostics and drug development capabilities.

Let’s take a closer look at which one of these two appears to be the better investment now.

Diagnostics is Hologic’s largest revenue-generating segment, with growth mainly driven by the Molecular Diagnostics unit. The growing utilization of the legacy automated Panther platform and the constantly expanding menu have supported demand. Since its 2019 launch, the BV, CV/ TV assay has quickly become the major driver for U.S. Molecular Diagnostics performance, now ranking as the company’s second largest worldwide. Hologic continues to address its vast U.S. vaginitis market opportunity by driving awareness and securing reimbursement for this test.

Meanwhile, the Panther Fusion add-on module is gaining traction with customers adopting more menus. A key feature is the platform’s Open Access functionality, which allows labs to run their laboratory-developed tests. The new FDA and CE-IVDR-approved Panther Fusion Gastrointestinal Bacterial and Expanded Bacterial Assays mark the planned diversification of the menu beyond respiratory testing. Additionally, the expanded CE marking for the Genius Digital Diagnostics System with digital pathology represents another solid step in Hologic’s innovation pipeline.

On the M&A front, the Biotheranostics acquisition in 2021 accelerated its entry into the oncology adjacency. In Breast Health, Endomagnetics broadened the interventional portfolio with wire-free breast surgery localization and lymphatic tracing solutions. The company’s AI-powered mammography solutions, including the Genius AI Detection, are seeing a lot of clinical momentum of late.

In 2025, Gynesonics enhanced the GYN Surgical product lineup with the Sonata System technology. Internationally, Myosure is gaining more market share than in the United States, underscoring the significant unmet demand for minimally invasive options, while NovaSure has consistently delivered growth abroad. That said, macroeconomic impacts, including tariffs and federal funding cuts, are likely to stay as headwinds for the company.

Labcorp is benefitting from the solid execution of its strategy, including its focus on being the partner of choice for health systems and regional/local laboratories. The company’s string of strong strategic relationships in recent years, including with Invitae, Inspira Health and Ballad Health, has bolstered its presence in important markets while increasing access to its broad test menu. More recently, Labcorp completed the acquisition of select outreach laboratory assets of Community Health Systems.

The company is also experiencing strong growth in businesses across high-growth specialty areas, such as oncology, women's health, neurology and autoimmune diseases, where science, clinical need, the use of genetic testing and innovation are seeing rapid momentum.

Notable capabilities introduced include the addition of HRD testing, IVDR CE-marked PGDx elio tissue complete for comprehensive solid tumor profiling, the first FDA-cleared blood-based test for Alzheimer's disease in specialty care settings and the Labcorp Plasma Complete liquid biopsy test. Labcorp also has a digital health platform called Labcorp OnDemand, through which it offers more than 50 health and wellness tests, and is also experiencing strong momentum.

Science and technology also play a crucial role in Labcorp’s strategy. Within its core laboratory operations, the company is investing in digital and AI capabilities to improve in areas such as pathology, cytology and microbiology. In terms of operational efficiency, it continues to focus on driving about $100-$125 million in annual savings under the LaunchPad initiative. The company is also bringing forward new tools to drive margin improvement, such as the Labcorp Diagnostic Assistant, eClaim Assist and Labcorp Test Finder.

While both companies have lagged the S&P 500 composite in the past 12 months, Labcorp has held up better.

Hologic trades at a forward one-year price-to-sales (P/S) of 3.86X, higher than its median. In contrast, Labcorp’s forward one-year 1 year P/S of 1.43X favorably compares both with its median as well as with Hologic.

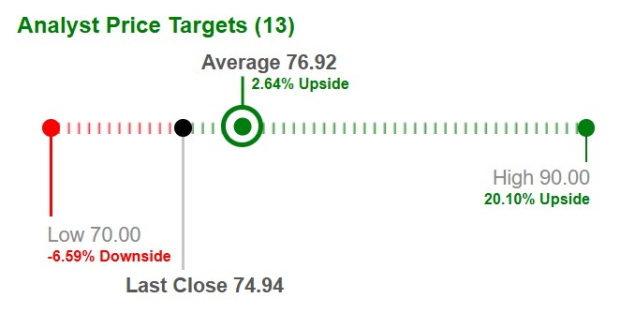

Based on short-term price targets by 13 analysts, the average price target for Hologic comes to $76.92, implying a 2.6% increase from the last close.

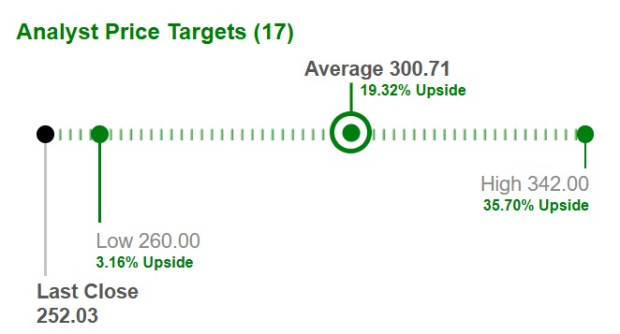

Based on short-term price targets by 17 analysts, Labcorp’s average price target of $300.71 implies a 19.3% upside from the last close.

Both Hologic and Labcorp presently carry a Zacks Rank #3 (Hold). Hologic’s underlying strength in Diagnostics and Breast Health and contributions from M&A continue to support its performance. Labcorp’s ongoing efforts to be the preferred partner, expanding in high-growth therapeutic areas, and using science and technology, are positively impacting its results. However, based on 12-month price performance, valuation and analyst price targets, Labcorp is positioned to be a stronger investment option now over Hologic. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 14 hours | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite