|

|

|

|

|||||

|

|

EchoStar Corporation’s SATS subsidiary, Hughes Network Systems, LLC (HUGHES), is strengthening its position in next-generation satellite communications with the launch of a new portfolio of ruggedized Low Earth Orbit (LEO) terminals certified for Comms-on-the-Pause (COTP) service. Certified for use on Eutelsat’s OneWeb LEO network, these transportable terminals provide fast and reliable broadband connectivity wherever terrestrial networks fall short.

Built for rapid deployment in demanding environments, the new Hughes LEO terminals are housed in IP67-rated, pop-up transport cases engineered by C-COM Satellite Systems. Featuring crushproof construction, steel latches and recessed wheels, the cases are built to withstand harsh conditions. Their plug-and-play design enables rapid broadband deployment, ideal for temporary deployments and mission-critical use cases. The Hughes Electronically Steerable Antenna (ESA) terminals are available in single- and dual-panel configurations, providing organizations with the flexibility to choose the setup that best suits their operational requirements.

Hughes’ ruggedized LEO terminals are designed to address connectivity gaps across a wide range of industries and scenarios. First responders and government agencies can rapidly deploy communications following hurricanes, floods, or wildfires, maintaining connectivity for a longer interval in regions where terrestrial infrastructure has been damaged or destroyed. Enterprises and public-sector organizations can pre-stage satellite communication kits in disaster-prone areas, ensuring backup connectivity is available before severe weather or other emergencies strike.

Land-based drilling rigs that relocate every one to six weeks can maintain consistent Internet access for operational data transfer, safety systems and crew communications in even the most remote locations. Also, telecom providers can leverage satellite-enabled Cell on Wheels (COWs) and network trailers to extend coverage during major events, network outages, or early-stage network deployments.

Hughes is shifting its focus from consumer satellite broadband to enterprise customers as competition in consumer connectivity intensifies from SpaceX’s Starlink and future LEO players like Amazon’s Kuiper. Recognizing early that it could not compete in LEO consumer broadband, EchoStar pivoted toward enterprise markets. As a result, enterprise revenue is expected to surpass 50% of Hughes’ total revenue as early as next year. The company has also made strong progress in aviation connectivity, moving from a minimal presence three years ago to becoming one of the few global providers still growing in the aero segment.

Hughes’ ability to serve global brands worldwide positions the company to better monetize and maximize this strength, particularly in M&A opportunities that arise. In October, Hughes announced the acquisition of Anderson Connectivity, a Florida-based top aerospace innovator, strengthening its technology and engineering capabilities while positioning the company for faster growth across global aviation, space and defense markets.

It has also forged a strategic relationship with Celona, a pioneer in private 5G networks, to introduce a fully managed private wireless network solution. The collaboration aims to meet the surging demand for secure, high-performance and scalable wireless connectivity, empowering industries to advance their digital transformation and automation efforts.

However, for the third quarter of fiscal 2025, Hughes’ Broadband and Satellite Services segment reported total revenue of $346 million, down 10.6% year over year due to lower broadband service sales and weaker enterprise hardware demand. Adjusted OIBDA declined 3.9% year over year to $75 million, reflecting a smaller consumer subscriber base. Notably, Hughes’ enterprise momentum remains solid, supported by a contracted backlog of $1.5 billion that provides strong visibility into future revenue.

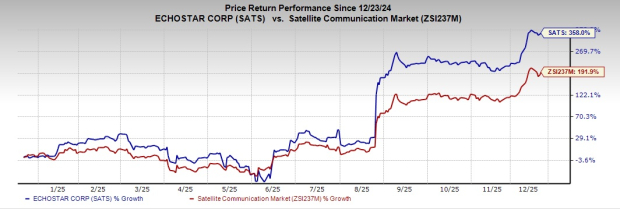

At present, EchoStar has a Zacks Rank #3 (Hold). In the past year, its shares have soared 358% compared with the Zacks Satellite and Communication industry's growth of 191.9%.

Some better-ranked stocks from the broader technology space are Teradata Corporation TDC, Western Digital Corporation WDC and Sandisk Corporation SNDK. TDC, SNDK & WDC sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Teradata’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 23.12%. In the last reported quarter, TDC delivered an earnings surprise of 35.85%. Its shares have surged 42.7% in the past six months.

Western Digital earnings beat the consensus estimate in each of the trailing four quarters, with the average surprise being 9.18%. WDC’s long-term earnings growth rate is 22.7%. Its shares have surged 194.1% in the past year.

Sandisk’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, with the average surprise being 470.1%. In the last reported quarter, SNDK delivered an earnings surprise of 37.1%. Its shares have surged 388.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 9 hours | |

| 9 hours | |

| 10 hours | |

| 10 hours | |

| 10 hours | |

| 11 hours | |

| 13 hours | |

| 13 hours | |

| 14 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite