|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

USA Rare Earth, Inc. USAR and Teck Resources Limited TECK are both familiar names operating in the Zacks Mining - Miscellaneous industry. As rivals, each company is focused on the extraction and development of important minerals that support electrification, clean energy technologies and advanced manufacturing.

Both companies operate in capital-intensive mining businesses that require long-term project development, regulatory approvals and hefty investment in infrastructure and technology. Rising demand for minerals and metals used in electric vehicles and renewable energy projects is creating strong growth opportunities for these mining companies.

USA Rare Earth is advancing its Stillwater magnet manufacturing facility in Oklahoma toward commercial production. The plant is designed to produce Neodymium Iron Boron (NdFeB) magnets, which are widely used in defense, aviation, automotive and other high-growth industries. Once operational, Stillwater is expected to be among the first large-scale magnet manufacturing facilities in the United States, supporting efforts to build a domestic rare earth supply chain.

During 2025, the company focused on installing equipment at the Stillwater site, assembling Line 1a and preparing for its commissioning planned for early 2026. USAR also began recruiting and training engineers and technicians to operate the facility, steps that should enhance its ability to reach commercial-scale output and secure long-term customer agreements.

To fund these initiatives, USA Rare Earth strengthened its financial position through PIPE financing and warrant exercises, lifting its cash balance to more than $400 million as of November 2025. The capital is being used to upgrade the Stillwater plant, expand magnet finishing capabilities and complete Line 1b, which is expected to raise total NdFeB magnet production capacity to about 1,200 metric tons.

In a major strategic move, the company completed the acquisition of Less Common Metals in November 2025, providing a reliable source of critical metal and alloy feedstock for the Stillwater facility. With this acquisition and continued progress across its development plans, USA Rare Earth appears well-positioned to scale production and expand capacity in the coming quarters.

Though USA Rare Earth has a promising project pipeline, it is still in the exploration and development stage and has yet to generate revenues, resulting in continued losses. Also, the company has been grappling with rising operational expenses, thereby adversely impacting its margins and profitability. In third-quarter 2025, its selling, general and administrative expenses climbed to $11.4 million from $0.8 million in the year-ago quarter, driven by an increase in legal and consulting costs, higher headcount and recruiting fees and other costs.

Research and development expenses also rose to $4.45 million compared with $1.16 million due to an increase in employee-related expenses related to a rise in headcount, and other costs.

The absence of revenues and higher expenses, somewhat offset by higher interest and dividend income due to higher balances in its money market funds, led to the 25 cents per share loss in the third quarter.

Teck Resources is undergoing a major strategic transformation as it positions itself for long-term growth in mining copper and other critical minerals. The company has entered into a merger agreement with Anglo American plc to create the Anglo Teck group, which will be one of the world’s leading copper producers with more than 70% of its portfolio in copper. The combined company will feature six top-tier copper assets, along with premium iron ore and zinc operations. Its annual copper production is projected at 1.2 million tons, expected to rise 10% to 1.35 million tons by 2027.

Anglo Teck will also rank among the world’s largest zinc producers, operating major assets like the Red Dog mine in Alaska and the Trail Operations in British Columbia. The merger is expected to generate approximately $800 million in annual pre-tax synergies within four years, with around 80% of that to be achieved within the first two years through operational efficiencies and economies of scale. The company’s Zafranal copper-gold project has an expected mine life of 19 years and will produce copper-gold concentrates through an open-pit mining and conventional concentration process. The mine and concentrator are expected to produce an average of 126,000 tons of copper contained in the concentrate during its first five years of production.

The Highland Valley Mine Life Extension is expected to extend the mine’s life from 2028 to 2046. Expected average annual copper production will likely be 132,000 tons over the life of the mine. The San Nicolas project’s annual estimated production (on a 100% basis) is 63,000 tons of copper and 147,000 tons of zinc in the first five years. It is progressing through engineering, procurement and site mobilization, with early and permanent works including infrastructure setup, pipeline relocations, tree clearing and earthworks. The company expects to increase copper production to around 800,000 tons before the end of this decade.

However, at QB, the third-quarter copper production was 39,600 tons, impacted by the ongoing TMF development at the mine. This has hampered production through 2025, causing additional downtime of the concentrator, particularly in the third quarter. Also, production at Highland Valley Copper was 28,100 tons in the third quarter, lower than expected due to decreased grades and reduced mill online time owing to unplanned maintenance.

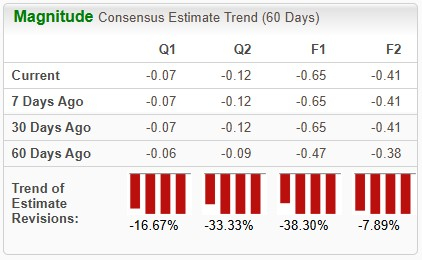

The Zacks Consensus Estimate for USAR’s 2025 bottom line is pegged at a loss of 65 cents per share. Also, the company’s consensus estimate for the 2026 bottom line is pegged at a loss of 41 cents per share.

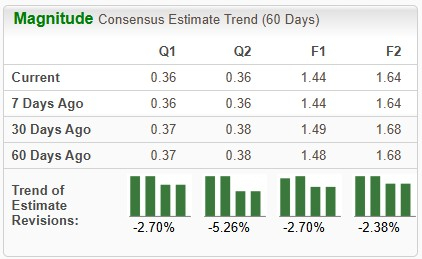

The Zacks Consensus Estimate for TECK’s 2025 bottom line is pegged at 1.44 per share. Also, the company’s consensus estimate for 2026 bottom line is pegged at 1.64 cents per share.

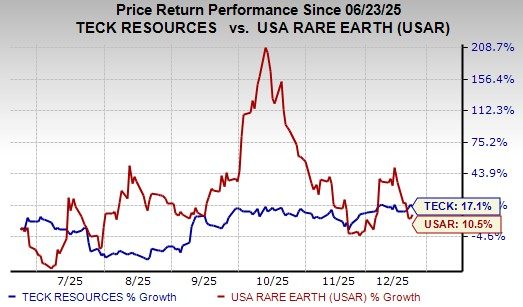

In the past six months, USAR’s shares have risen 10.5%, while TECK stock has surged 17.1%.

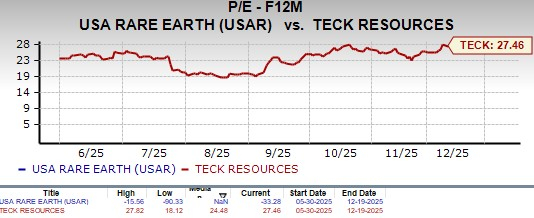

USA Rare Earth is trading at a forward 12-month price-to-earnings ratio of negative 33.28X while Teck Resources’ forward earnings multiple sits at 27.46X.

Though USA Rare Earth is still in the development phase, its Stillwater magnet facility positions it well for long-term demand for NdFeB magnets. Recent financing and the acquisition of Less Common Metals strengthen its strategic outlook. However, the company is yet to generate revenues and is facing rising operating expenses, which led to continued losses in 2025.

In contrast, Teck Resources appears better positioned for strong performance in the coming quarters, supported by its scale of operation, asset diversity and strategic transformation. The planned merger with Anglo American will create a global copper and critical minerals leader, with more than 70% exposure to copper and strong zinc operations. Though near-term production at Quebrada Blanca and Highland Valley Copper has been impacted by operational issues, these are temporary. Teck’s long-life assets, growth projects and expected cost and operational synergies are expected to generate stronger cash-flow and lower execution risk.

Given these factors, TECK seems a better pick for investors than USAR currently. While Teck Resources carries a Zacks Rank #2 (Buy), USA Rare Earth currently has a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Anglo American Writes Down De Beers Diamond Unit Value by Another $2.3 Billion

TECK

The Wall Street Journal

|

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite