|

|

|

|

|||||

|

|

MercadoLibre MELI and JD.com JD represent two of the most prominent e-commerce platforms operating outside the United States, with MercadoLibre leading across Latin America and JD.com commanding a strong presence in China. Both companies have evolved beyond traditional online marketplaces into vertically integrated ecosystems that combine commerce, proprietary logistics networks and expanding fintech operations, positioning themselves as comprehensive digital commerce solutions in their respective regions.

As global investors seek growth opportunities beyond U.S. e-commerce giants, MercadoLibre and JD.com offer contrasting exposure to large emerging markets with distinct competitive dynamics and macroeconomic backdrops. However, both face intensifying competitive pressures while investing heavily to defend market share, raising the question of which company is better positioned to deliver returns. Let us delve deep to determine which one is a better investment now.

MercadoLibre operates as a marketplace-centric platform with asset-light economics, differentiating from JD.com's inventory-heavy first-party model through commission-based revenues that require minimal working capital. This business model enables rapid geographic expansion across Latin America without the procurement financing and inventory risk inherent in direct merchandising approaches. MercadoLibre delivered 39% revenue growth in the third quarter of 2025 compared to JD.com's 15% expansion. However, this growth differential came alongside margin compression as operating income grew just 30%, revealing profitability trade-offs underlying the accelerated top-line performance.

The platform reached 75 million quarterly active buyers with 7.8 million net additions in the third quarter, demonstrating successful user acquisition momentum. However, sustaining this growth has required aggressive free shipping subsidies and promotional spending that compressed contribution margins to multi-year lows, as intensifying competition forces ongoing investment in user acquisition rather than near-term profitability optimization.

MercadoLibre's fintech operations through Mercado Pago introduce balance sheet intensity through credit card issuance and consumer lending. Nearly 50% of credit card volume now comes from profitable cohorts older than two years, validating the underwriting approach in mature markets like Brazil. However, simultaneous launches in Argentina and continued scaling in Mexico create near-term margin pressure, while elevated funding costs in volatile macroeconomic environments pressure net interest margins.

The Zacks Consensus Estimates for MELI’s 2025 EPS is pegged at $39.80 per share, down by 1.17% over the past 30 days and indicating year-over-year growth of 5.6%.

MercadoLibre, Inc. price-consensus-chart | MercadoLibre, Inc. Quote

MercadoLibre's fintech operations through Mercado Pago introduce balance sheet intensity through credit card issuance and consumer lending. Nearly 50% of credit card volume now comes from profitable cohorts older than two years, validating the underwriting approach in mature markets like Brazil. However, simultaneous launches in Argentina and continued scaling in Mexico create near-term margin pressure, while elevated funding costs in volatile macroeconomic environments pressure net interest margins.

The platform's vertically integrated logistics infrastructure spanning over 20 JD Malls and more than 100 JD Appliance City flagship stores creates fulfillment differentiation in categories where speed and authenticity matter. Core electronics categories face persistent high comparison bases from prior-year government subsidies, while general merchandise segments delivered 19% revenue growth as the company diversifies into less-penetrated categories.

JD.com's marketplace and advertising revenues accelerated to 24% growth in the third quarter of 2025, with active merchant counts increasing more than 200% year over year, reflecting efforts to build higher-margin revenue streams. However, this ecosystem development remains earlier-stage compared to MercadoLibre's established marketplace dominance. The food delivery business represents a strategic bet on capturing on-demand commerce synergies, though achieving profitability requires navigating intense competition in a market dominated by established players.

The Zacks Consensus Estimates for JD’s 2025 EPS is pegged at $2.82 per share, unchanged over the past 30 days and indicating a year-over-year decline of 33.8%.

JD.com, Inc. price-consensus-chart | JD.com, Inc. Quote

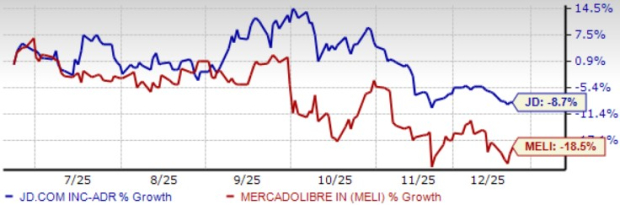

Over the trailing six-month period, MELI shares have declined 18.5%, while JD shares have fallen 8.7%. MELI's substantially weaker performance reflects investor concerns about margin compression from aggressive investments in free shipping subsidies and promotional spending to defend market share. JD.com's more modest decline suggests greater investor confidence in its balanced growth approach that sustains profitability improvement alongside revenue expansion. The performance divergence indicates market preference for JD.com's disciplined execution, maintaining margin expansion over MercadoLibre's margin-sacrificing market share defense strategy.

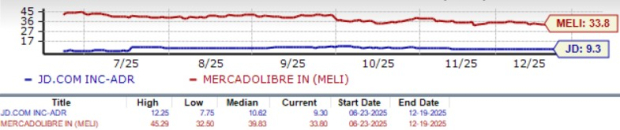

MercadoLibre trades at 33.8x forward earnings compared to JD.com's 9.3x multiple, a premium reflecting expectation for superior long-term growth from Latin American market expansion potential. JD.com's substantial valuation discount appears disconnected from operating fundamentals, given consistent retail margin expansion and accelerating marketplace revenues. JD.com's discount appears attractive given its ability to sustain double-digit growth while improving profitability, supporting stronger risk-adjusted returns than MercadoLibre's growth-at-any-cost approach within intensifying competitive dynamics.

JD.com's disciplined approach, balancing growth with margin expansion, positions it favorably against MercadoLibre's profitability-sacrificing strategy. The company's accelerating marketplace revenues and vertically integrated logistics support ongoing profitability improvement, while MercadoLibre faces persistent margin compression from aggressive competitive investments. With a more modest price decline over the trailing six-month period and trading at less than one-third of MercadoLibre's forward multiple, JD.com holds an edge for emerging market e-commerce exposure. Both stocks currently carry a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 min | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite