|

|

|

|

|||||

|

|

When it comes to Wall Street heavyweights, there are not many names that wield more influence than Goldman GS and Morgan Stanley MS. Both are global financial leaders with strong investment banking expertise, advising on major mergers, underwriting high-profile IPOs, and guiding clients through complex capital markets.

After a few years of subdued volumes and episodic deal-making, 2025 marked a solid revival of global mergers and acquisitions (M&As) due to clarity on several macro issues and easing monetary policy. While investor confidence was shaken in April following the announcement of “Liberation Day” tariff plans, things improved in the second half of the year. A strong U.S. economy, a more accommodating regulatory environment under Trump, clearer trade policies and the Federal Reserve’s rate cuts have improved the operating environment for the capital markets business. Against this, which IB powerhouse – Goldman or Morgan Stanley – is a smarter bet for 2026? Let’s decipher this.

Goldman is a dominant player in M&A, trading and capital markets. For the first nine months of 2025, the company’s IB revenues rose 19% year over year, supported by a rebound in global M&A activity and capital markets issuance. Throughout 2025, its IB division has capitalized on the resurgence in global deal-making, advising on more than $1 trillion in announced M&A volumes.

David Solomon, chairman and CEO of Goldman, highlighted improvements in M&A throughout the year and expects the constructive environment to persist, with stronger M&A activity anticipated in 2026 amid a favorable backdrop.

Further, GS has embarked on a deliberate transformation to exit non-core consumer banking and double down on the divisions where it maintains a clear competitive advantage. Hence, the company is accelerating expansion in the asset and wealth management business. In December, Goldman agreed to acquire Innovator Capital Management to expand active ETF capabilities, while, in October, it agreed to buy Industry Ventures to expand its exposure to the innovation economy and solidify its position in the global alternatives market. Moreover, in September, Goldman expanded its alliance with T. Rowe Price to give individuals greater access to private markets, with new offerings set for launch in phases.

Goldman plans to ramp up its lending services to private equity and asset managers and expand internationally. The company's asset management unit intends to expand its private credit portfolio to $300 billion by 2029. Management expects to witness high-single-digit annual growth in private banking and lending revenues over time.

Morgan Stanley has leaned heavily into the IB business, although it has been diversifying into more stable revenue-generating sources like asset and wealth management businesses, creating a more balanced revenue stream across market cycles. Similar to GS, the company’s IB performance improved in the first nine months of 2025, driven by trade clarity and optimism surrounding interest rate cuts.

Ted Pick, chairman and CEO of Morgan Stanley, said the rebound in the operating environment enabled strategic M&A and renewed financing activity. While he remained cautious, remarking that “whether we are entering a golden age of investment banking remains to be seen,” he affirmed that IB activity should trend upward over the next couple of years. Hence, given the improving macroeconomic scenario, MS will be able to capitalize on it.

Also, Morgan Stanley’s partnership with Mitsubishi UFJ Financial Group, Inc. will continue to support profitability. With further solidification of this collaboration in 2023, the company’s market share in Japan has improved. The company’s Asia region revenues jumped 29.3% year over year to $7.27 billion during the first nine months of 2025.

As mentioned above, MS is focusing on expanding its wealth and asset management operations, which supported its financials during the post-pandemic slowdown in the IB business. In sync with this initiative, in October, the company announced a deal to acquire EquityZen in an effort to tap the rapidly growing private markets landscape. Earlier, it acquired Eaton Vance, E*Trade Financial and Shareworks, which lowered its dependence on the capital markets business. The wealth and asset management businesses’ aggregate contribution to total net revenues jumped to more than 55% in 2024 from 26% in 2010. The momentum continued this year, with total client assets across both segments reaching $8.9 trillion by September-end. This brings Morgan Stanley closer to its longstanding goal of $10 trillion in asset management set by former CEO James Gorman.

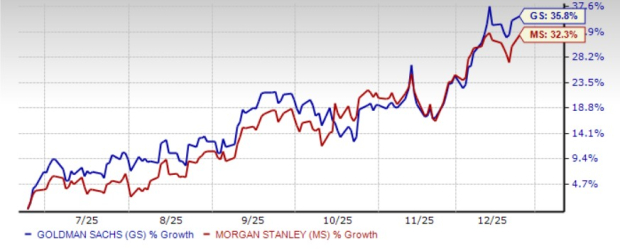

Over the past six months, shares of Goldman and Morgan Stanley have gained 35.8% and 32.3%, respectively.

GS & MS Six-Month Price Performance

Both outpaced the Zacks Investment Bank industry and the S&P 500 Index. In terms of investor sentiments, Goldman clearly has the edge over MS.

In terms of valuation, Goldman is currently trading at a 12-month forward price-to-earnings (P/E) of 16.34X. The MS stock, on the other hand, is currently trading at a 12-month forward P/E of 17.29X.

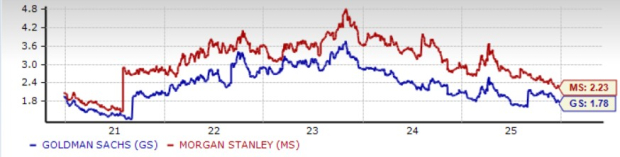

P/E F12M

Further, both are trading at a premium compared with the industry average of 15.09X. So, Goldman is inexpensive compared with Morgan Stanley.

GS’s dividend yield of 1.78% is lower than Morgan Stanley’s 2.23%. Moreover, GS’ dividend yield is lower than the industry’s average dividend yield of 1.79%, while Morgan Stanley offers a superior dividend yield than the industry.

Dividend Yield

Further, Goldman’s return on equity (ROE) of 15.29% is below Morgan Stanley’s 16.4%. This reflects Morgan Stanley’s efficient use of shareholder funds to generate profits.

ROE

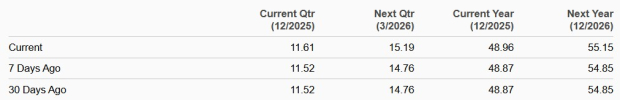

The Zacks Consensus Estimate for GS’ 2025 revenues implies a 10.8% year-over-year rise, while for 2026, the metric is expected to grow 6%. Likewise, the consensus estimate for 2025 earnings indicates 20.8% growth, while the same is anticipated to rise 12.6% in 2026. Earnings estimates for both years have been revised upward over the past seven days.

Estimate Revision

On the contrary, analysts are slightly more bullish on Morgan Stanley’s prospects this year. The consensus mark for 2025 and 2026 revenues suggests a year-over-year jump of 13.4% and 4.4%, respectively. Also, the consensus estimate for earnings suggests a 24.3% and 5.4% increase for 2025 and 2026, respectively. Earnings estimates for both years have been revised upward over the past week.

Estimate Revision

Goldman’s organic efforts to grow its IB income and strategic buyouts alongside efforts to strengthen the AWM segment are likely to bolster its financials. Further, its attractive valuation can offer a higher margin of safety for value investors.

By contrast, Morgan Stanley offers greater upside potential, driven by stronger projected revenue and earnings growth, a robust deal pipeline and continued expansion in wealth and asset management. Despite its higher valuation, the success of its strategic diversification efforts, superior dividend yield and capital allocation make it an attractive pick for long-term, growth-oriented investors.

At present, Goldman carries a Zacks Rank #3 (Hold) while Morgan Stanley carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 15 min | |

| 38 min | |

| 53 min | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite