|

|

|

|

|||||

|

|

Altria Group, Inc. (MO) and Philip Morris International Inc. (PM) rank among the most influential players in the global tobacco industry, each operating with distinct geographic exposure and strategic priorities. Altria, with a market capitalization of roughly $98.5 billion, remains firmly anchored in the U.S. market, where its Marlboro franchise continues to anchor cash flows alongside a growing portfolio of smoke-free and oral nicotine products.

By contrast, Philip Morris International commands a significantly larger market capitalization of about $248.6 billion, reflecting its broad international footprint and leadership in reduced-risk innovation. PM’s growth is supported by premium combustible brands and an expanding portfolio of next-generation products, including IQOS, ZYN and VEEV.

As both companies invest aggressively to offset declining cigarette volumes, investors face a critical question: which tobacco giant offers the stronger balance of growth potential, financial resilience and long-term positioning?

Altria continues to hold a commanding position in the U.S. tobacco market, anchored by its leading cigarette retail share and Marlboro’s dominance in the premium segment. Despite industry volume pressures, the smokeable segment achieved a 64.4% adjusted operating companies income margin in the third quarter of 2025, demonstrating strong pricing power and lower per-unit settlement costs. These strengths support a resilient earnings base as Altria adapts to declining consumption and evolving adult-consumer preferences.

Strategically, Altria is balancing core cash-flow generation with targeted investments in smoke-free growth platforms. The on! nicotine pouch shipments reached 133.6 million cans year to date, supported by resilient retail takeaway despite intensified competitive discounting. Product innovation, including the rollout of on! PLUS and FDA filings tied to Horizon’s Ploom heated-tobacco system continue to expand Altria’s reduced-risk portfolio and align the business with rising demand for regulated, smoke-free alternatives.

Capital returns remain a central pillar of the investment thesis. In August 2025, Altria increased its quarterly dividend by 3.9% to $1.06 per share, marking its 60th dividend increase in 56 years. Management also expanded the share-repurchase authorization to $2 billion through 2026, signaling confidence in cash-flow visibility and balance-sheet strength.

That said, structural headwinds persist. Domestic cigarette shipment volumes declined 8.2% during the third quarter, while Marlboro’s total-category share slipped 1.2 percentage points year over year to 40.4%. Oral tobacco brands Copenhagen and Skoal also faced pressure amid heightened competition in nicotine pouches. These trends highlight the ongoing need for disciplined execution and sustained innovation as Altria works to offset volume declines and reposition its portfolio for long-term relevance.

Philip Morris’ investment appeal is increasingly defined by its accelerating shift toward smoke-free products, a transformation that continues to reshape both revenue mix and earnings quality. In the third quarter of 2025, smoke-free products accounted for 41% of total net revenues and 42% of gross profit. Shipments advanced 16.6% year over year, led by IQOS, ZYN and VEEV, driving record quarterly smoke-free gross profit of $3.1 billion and reinforcing the company’s long-term profitability trajectory.

The company’s flagship smoke-free brands, IQOS, ZYN and VEEV, continue to deliver broad-based gains across key geographies. IQOS remains the global leader in heated tobacco, while ZYN is rapidly scaling both in the United States and internationally. VEEV is also gaining traction, strengthening Philip Morris’ presence in the closed-pod e-vapor category and diversifying its smoke-free portfolio.

Operational discipline remains a key differentiator. Ongoing productivity initiatives and cost controls have supported margin expansion and solid earnings growth, alongside resilient performance in the combustible segment. Management’s focus on efficiency and its multi-year cost-savings program provides additional support to cash flows and earnings visibility.

However, Philip Morris’ combustible portfolio remains under structural pressure, with cigarette shipment volumes declining 3.2% in the third quarter and long-term consumption trends continuing to deteriorate. Although pricing actions have partially supported net revenues and profitability, this lever is becoming increasingly constrained by regulatory scrutiny and consumer affordability. As the business grows more dependent on smoke-free products, any slowdown in IQOS, ZYN or VEEV adoption, regulatory delays or intensifying competition could significantly impair Philip Morris’ ability to offset ongoing combustible volume declines, amplifying execution and transition risks.

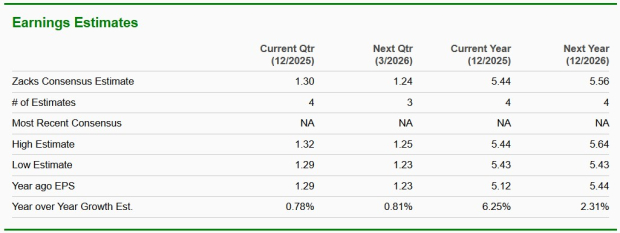

The Zacks Consensus Estimate for Altria’s 2025 and 2026 EPS indicates a year-over-year increase of around 6.3% and 2.3%, respectively. The consensus estimate for MO’s 2025 and 2026 EPS has remained unchanged in the past 30 days to $5.44 and $5.56, respectively.

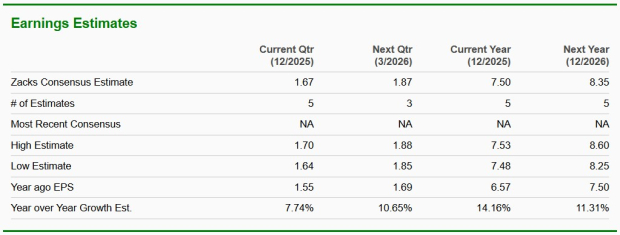

The Zacks Consensus Estimate for Philip Morris for 2025 and 2026 EPS implies year-over-year growth of 14.2% and 11.3%, respectively. The consensus estimate for 2025 and 2026 EPS has inched down 1 cent in the past 30 days to $7.50 and $8.35, respectively.

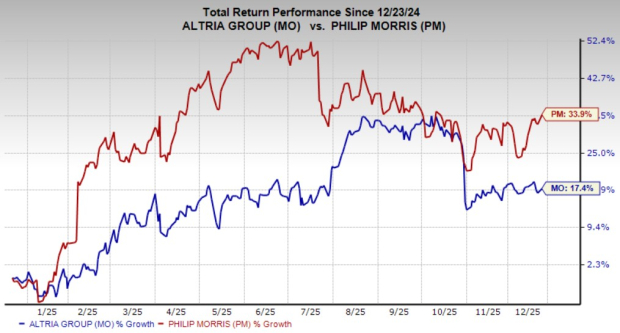

Over the past year, shares of Altria have gained 17.4%, while Philip Morris has delivered a stronger 33.9% advance. Currently, MO trades at $58.61, about 14.6% below its 52-week high. PM, at $159.70, sits roughly 14.5% below its peak.

Altria is trading at a forward 12-month price-to-earnings (P/E) ratio of 10.54, below its one-year median of 10.80. Meanwhile, Philip Morris’ forward P/E ratio stands at 19.17, also below its median of 20.59.

Both Altria and Philip Morris remain dominant players in a rapidly evolving tobacco landscape, but their investment appeal differs meaningfully. Philip Morris offers stronger global growth and clear leadership in reduced-risk products, supported by its expanding international footprint. Altria, however, delivers a more compelling value proposition through higher income visibility, resilient margins and steady earnings. With its attractive valuation, robust pricing power and growing smoke-free momentum, Altria stands out as the better bet for income-focused investors seeking stability and consistent returns, even as the industry continues its transition toward a smoke-free future.

MO currently has a Zacks Rank #3 (Hold), while PM carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite