|

|

|

|

|||||

|

|

The global merger and acquisition (M&A) cycle appears to have entered a decisive upswing. Following several years of subdued volumes and episodic deal-making, 2025 marked a structural inflection point as corporates and financial sponsors returned to offset slowing organic growth, reposition portfolios, and secure long-term competitive advantages, particularly in technology and artificial intelligence (AI)-enabled capabilities.

Early in the year, investor confidence was tempered by volatility post “Liberation Day,” particularly in the small and mid-cap segments. Momentum returned in the latter half of the year as deal-making pressures eased, and volatility fatigue set in, prompting buyers to strike before the tide turned. According to the M&A Highlights FY25 report by Dealogic, global M&A activity jumped 41% year over year to $4.81 trillion so far in 2025, the second-highest total on record after 2021. The year also set a new benchmark for scale, with 70 megadeals exceeding $10 billion.

This momentum in M&As is reinforced by regulatory shifts under the Trump administration, as the regulators move to relax “well-managed” requirements and streamline approval processes, creating a more favorable environment for consolidation. With improving global M&A trends, investors must keep an eye on investment banks like Morgan Stanley MS, The Goldman Sachs Group, Inc. GS, and Raymond James Financial, Inc. RJF, to generate robust returns in 2026.

Despite a volatile start to 2025 due to aggressive tariff policies and geopolitical tensions, the recent surge in M&As suggests a broader market recalibration. Buyers have increasingly learned to operate through uncertainty, supported by easing financing conditions and improved confidence in long-term growth prospects.

Looking to 2026, large-scale M&As are expected to be driven less by high-risk transformational deals and more by de-conglomeration and “buy-and-build” strategies. This back-to-basics approach, focused on portfolio optimisation and core competencies, should particularly benefit mid-market activity, where smaller, complementary acquisitions can deliver faster synergies and accelerate technology integration.

Despite ongoing market volatility, decent GDP growth, coupled with the Federal Reserve’s signal for an additional rate cut in 2026, is easing financing conditions and driving increased strategic activity into 2026. Private equity (PE)-backed deals are projected to rise in 2026, thanks to undeployed capital, better exit opportunities and less restrictive debt markets.

For 2026, the EY-Parthenon Deal Barometer forecasts a 3% increase in deal volume. The pent-up demand is likely to drive significant growth in PE, with an expected 5% increase in deal volume compared with corporate, which is likely to record a 3% rise.

Considering the favorable outlook for 2026, it is an opportune time for investors to keep the fundamentally strong investment banking stocks mentioned above on their radar to leverage growing opportunities.

To choose these Investment bank stocks, we ran the Zacks Stocks Screener to identify stocks with an expected 2026 earnings growth rate of more than 5%. Also, these stocks rose more than 5% in the past year.

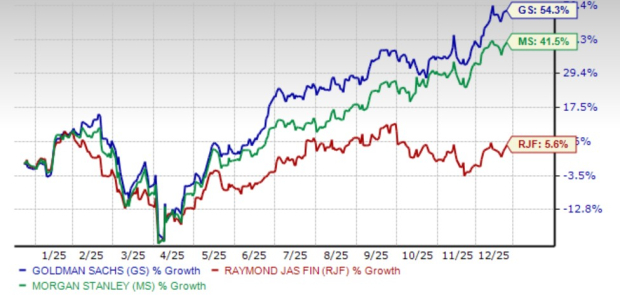

Price Performance

Morgan Stanley’s investment banking (IB) revenues were $5.2 billion in the first nine months of 2025, up 15% year over year, riding a wave of deal-making and IPO activity. On the third-quarter 2025 earnings call, Morgan Stanley CEO Ted Pick said that the improving environment supported strategic M&As and renewed financing activity. While being cautious, remarking that “whether we are entering a golden age of investment banking remains to be seen,” he noted that IB activity should continue to rise over the next couple of years. Going forward, a healthy IB pipeline, an active M&A market and Morgan Stanley’s strong franchise position enable it to capitalize on the improving macro backdrop.

MS is lowering its reliance on capital markets for stabilizing earnings growth over the cycles. The company’s focus on expanding its wealth and asset management operations and strategic acquisitions, including Eaton Vance, E*Trade Financial and Shareworks, are steps in that direction. In October 2025, the company announced an agreement to acquire EquityZen in an effort to tap the rapidly growing private markets landscape. As such, the wealth and asset management businesses’ aggregate contribution to total net revenues jumped to more than 55% in 2024 from 26% in 2010. In the first nine months of 2025, their aggregate contribution to net revenues was 53%.

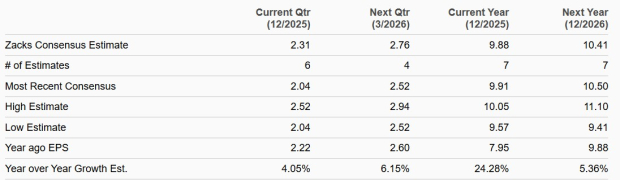

The Zacks Consensus Estimate for Morgan Stanley’s earnings per share for 2025 and 2026 is pegged at $9.88 and $10.41, respectively. This implies year-over-year increases of 24.3% and 5.4% for 2025 and 2026, respectively. The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings Estimates

Goldman reinforced its leadership in global M&As in the third quarter of 2025, ranking first in both announced and completed deals. Throughout 2025, the company’s IB division capitalized on the resurgence in global deal-making, advising on more than $1 trillion in announced M&A volumes year to date. Management remains confident, projecting an even stronger M&A environment in 2026, provided macroeconomic conditions remain stable. With the IB backlog at a three-year high and its leadership position, the company is set to benefit in the upcoming period.

Moreover, apart from focusing on its core strengths in IB and trading and scaling back its consumer banking footprint, Goldman is expanding its asset management business. In sync with this, in December 2025, Goldman agreed to acquire Innovator Capital Management. The deal will significantly expand Goldman’s active ETF capabilities and is part of a broader pivot toward building durable revenue streams through diversified asset management and wealth-management offerings.

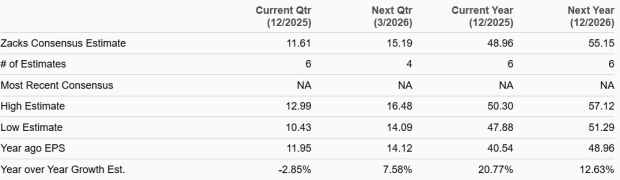

The Zacks Consensus Estimate for the company’s earnings per share for 2025 and 2026 is pegged at $48.96 and $55.15, respectively. This reflects rallies of 20.8% and 12.6% for 2025 and 2026, respectively. GS currently carries a Zacks Rank #3 (Hold).

Earnings Estimates

Raymond James has accomplished several opportunistic deals over the past few years, which have helped expand its footprint in Europe and Canada. In October 2025, it announced the acquisition of a majority interest in GreensLedge Holdings to strengthen its capital markets platform. In May 2024, the company announced that it had forayed into the lucrative private credit business through a partnership with Eldridge Industries. In fiscal 2023, Raymond James acquired Canada-based Solus Trust Company Limited. These deals, along with several past ones, have positioned Raymond James well for growth. Management looks forward to actively growing through acquisitions to strengthen the Private Client Group and Asset Management segments.

The company’s IB fees (in the Capital Markets segment) declined 4% in fiscal 2022 and 41% in fiscal 2023 with subdued M&A activity. Nonetheless, the trend reversed in fiscal 2024 and fiscal 2025, with IB fees growing 7% and 26%, respectively, as clarity on several macroeconomic matters and interest rate cuts globally drove deal-making activities. RJF will likely continue to witness a solid improvement in IB fees going forward, driven by a healthy pipeline and active M&A market.

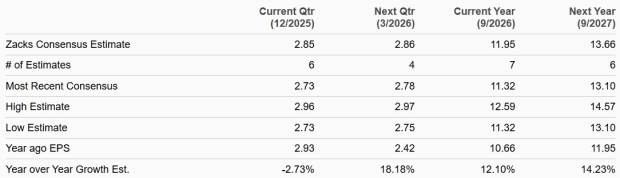

The Zacks Consensus Estimate for Raymond James’ earnings per share for fiscal 2026 and fiscal 2027 is pegged at $11.95 and $13.66, respectively. This suggests growth of 12.1% and 14.2% for fiscal 2026 and 2027, respectively. The company currently carries a Zacks Rank #3.

Earnings Estimates

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 4 hours | |

| 5 hours | |

| 10 hours | |

| 11 hours | |

| 12 hours | |

| 13 hours | |

| 13 hours | |

| 15 hours | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite