|

|

|

|

|||||

|

|

BrainsWay Ltd. BWAY recently announced an expansion of insurance coverage for its Deep TMS therapy in adolescent depression. The update signals growing payer confidence in non-drug neurostimulation treatments and improves reimbursement visibility for a younger patient population.

The development follows Optum Behavioral Health expanding its medical policy to include eligible adolescents, adding a meaningful number of covered lives. For investors, the decision reinforces Deep TMS’ growing clinical acceptance and supports BrainsWay’s longer-term commercial opportunity.

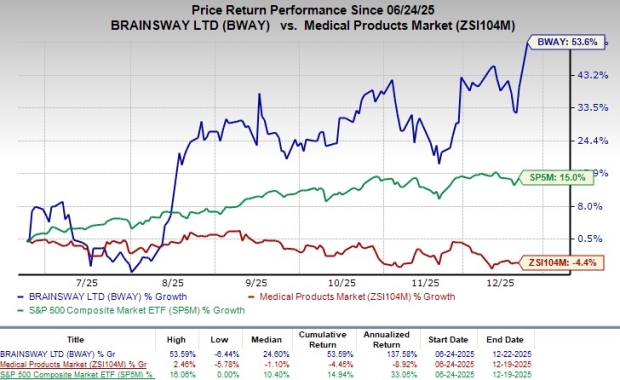

Following the announcement, BWAY shares gained 10.1% at yesterday’s market closing. Shares of the company have climbed 53.6% in the six-month period compared with the industry’s 5.5% growth and the S&P 500's 15.1% gain.

Over the long run, the coverage expansion strengthens BrainsWay by widening its reimbursable patient base at an earlier stage of the treatment journey, improving utilization and lifetime value per system. Broader insurer alignment reduces reimbursement friction, supports more predictable revenue growth and encourages clinics to invest in Deep TMS capacity, positioning the company to build durable demand and deepen its competitive moat in non-invasive depression treatment.

BWAY currently has a market capitalization of $334.8 million. The company projects an earnings growth of 100% for the current year.

Deep TMS is a noninvasive brain stimulation therapy developed by BrainsWay that uses patented H-coil technology to stimulate deeper and broader regions of the brain associated with mood regulation. FDA-cleared for depression, including as an adjunctive treatment for adolescents, Deep TMS delivers magnetic pulses without surgery or systemic drug exposure, offering a well-tolerated option for patients who do not respond adequately to antidepressant medications.

BrainsWay announced that Optum Behavioral Health, part of UnitedHealth Group, has expanded its medical policy to cover Deep TMS™ therapy for adolescents aged 15 and older diagnosed with major depressive disorder. Optum’s network represents more than 48 million covered lives, making this one of the most meaningful single-policy expansions for BrainsWay to date. The decision reflects growing payer confidence in Deep TMS as a clinically proven, non-drug treatment option, particularly for younger patients who do not respond to or cannot tolerate traditional antidepressant medications.

Optum now joins a broad and expanding list of insurers covering Deep TMS for adolescent depression, including Evernorth Health Services, CVS/Aetna, Medi-Cal, PacificSource Health Plans, TRICARE, and several Blue Cross and Blue Shield organizations such as Health Care Service Corporation, Highmark, Regence, Florida Blue, Blue Cross Blue Shield of Michigan and Blue Cross Blue Shield of North Carolina.

Collectively, these payers cover roughly 180 million lives. The expansion is especially notable given the estimated 5 million adolescents aged 15-21 in the United States affected by major depression, a population with limited effective treatment options.

Per a report by Grand View Research, the global neuromodulation devices market size was estimated at $5.80 billion in 2024 and is projected to reach $10.39 billion by 2030, registering a CAGR of 8.51% from 2025 to 2030.

The increasing incidence of chronic pain, neurological disorders and mental health conditions is expected to drive the demand for effective and innovative treatment solutions.

In November, BWAY announced the launch of a multicenter clinical trial evaluating its next-generation Deep TMS 360 system for the treatment of Alcohol Use Disorder (AUD), a condition marked by high relapse rates despite existing therapies. The study represents the first multicenter trial using BrainsWay’s new multichannel TMS platform, underscoring a key milestone in expanding its clinical footprint and advancing its innovation pipeline beyond depression.

Currently, BWAY carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are Intuitive Surgical ISRG, Medpace Holdings MEDP and Boston Scientific BSX.

Intuitive Surgical, sporting a Zacks Rank #1 (Strong Buy) at present, posted a third-quarter 2025 adjusted EPS of $2.40, beating the Zacks Consensus Estimate by 20.6%. Revenues of $2.51 billion topped the Zacks Consensus Estimate by 3.9%. You can see the complete list of today’s Zacks #1 Rank stocks here.

ISRG has an estimated long-term earnings growth rate of 15.7% compared with the industry’s 11.9% growth. The company’s earnings outpaced estimates in each of the trailing four quarters, the average surprise being 16.34%.

Medpace, currently carrying a Zacks Rank #2 (Buy), reported a third-quarter 2025 EPS of $3.86, which surpassed the Zacks Consensus Estimate by 10.29%. Revenues of $659.9 million beat the Zacks Consensus Estimate by 3.04%.

MEDP has an estimated earnings growth rate of 17.1% for 2025 compared with the industry’s 16.6% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 14.28%.

Boston Scientific, currently carrying a Zacks Rank #2, reported a third-quarter 2025 adjusted EPS of 75 cents, which surpassed the Zacks Consensus Estimate by 5.6%. Revenues of $5.07 billion topped the Zacks Consensus Estimate by 1.9%.

BSX has an estimated long-term earnings growth rate of 16.4% compared with the industry’s 13.5% growth. The company’s earnings beat estimates in each of the trailing four quarters, the average surprise being 7.36%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite